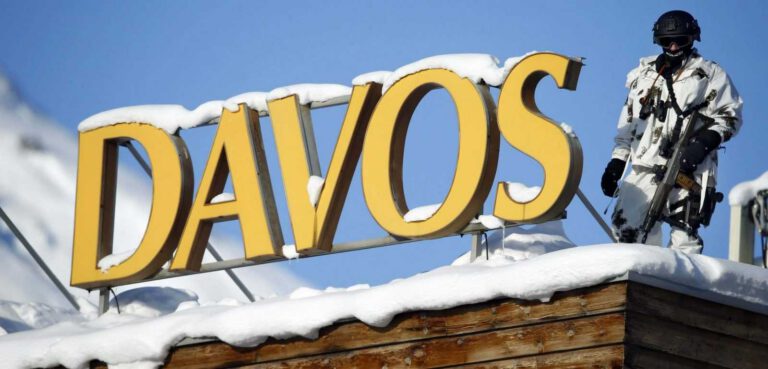

The new trading session and week for the forex market starts with the focus on fundamental economic events but also on the final thoughts about the statements of the US Government officials at Davos, during the World Annual Economic Forum. There were completely opposite statements from the US Secretary of Treasury who favorited a weak US Dollar as means of boosting the US exports, and possibly reducing the US trade deficit, and later on the statements from US President that over time a strong US Dollar is the desired outcome.

In the long run the fundamentals are the key drivers of the value of any currency, although the perception and momentum trading of the forex market participants play also a pivotal role. This week the US non-farm payrolls and the unemployment rate, plus the FOMC interest rate decision, can influence significantly the US Dollar and possibly pause its weakness against major other currencies. There are also important economic events this week related to the Eurozone, Australia and Canada.

These are the main economic events for today in the forex market to focus on:

American Session

- US Personal Income, Personal Spending, PCE Core, Dallas Fed Manufacturing Activity

Time: 13:30 GMT

PCE Core, is a measure of inflation based on changes in personal consumption, measuring the personal consumption expenditures, but excluding the volatile price changes of food and energy. It differs from the CPI, which is based on a fixed basket of goods, as the Personal Consumption Expenditures (PCE) Deflator finds the average increase in prices for all domestic personal consumption, with rising or higher than expected readings signaling inflationary pressures in the economy.

It is important to monitor these trend changes as sustainable inflationary pressures and figures near the 2.0% target rate set by the Fed will increase the probabilities of future interest rate increases, being positive for the US Dollar. The forecast is for an unchanged reading of 1.5% on a yearly basis, which can be considered neutral for the US Dollar. Also higher than expected figures for the personal income and personal spending will be supportive for the US Dollar, due to the correlation of consumer spending with economic growth measured by the GDP growth rate.

The Dallas Fed Manufacturing Activity Index tracks the business and manufacturing activity at the district of Texas, with increasing readings signaling increased economic activity being positive for the US Dollar. The forecast is for a decline of the index.

Pacific Session

- New Zealand Trade Balance

Time: 21:45 GMT

The trade balance deficit for the New Zealand is expected to decline significantly to -125 Million New Zealand Dollars from the previous figure of -1193 Million New Zealand Dollars. This large decline should be considered positive and supportive for the New Zealand Dollar, indicating increased exports than imports, and a narrowing trade deficit, thus increased demand for goods and services denominated in New Zealand Dollars. This in theory should lead to the appreciation of the local currency over time.

Asian Session

- Japan Unemployment Rate, Overall Household Spending, Retail Trade, Large Retailers Sales

Time: 23:30 GMT, 23:50 GMT

Declining or lower than expected figures for the unemployment rate are positive for the economy of Japan, indicating a robust economy, and higher economic growth as more people are active in the labor force, therefore increased consumer spending is a key factor of total economic activity. Same applies to readings of household spending and retail trade and sales. Increased readings are positive for the Japanese economy because they translate to higher consumer spending, and imply higher consumer confidence as well.

Consumer spending leads to higher figures of GDP growth. The forecasts are for an unchanged unemployment rate of 2.7% and declines for the household spending and retail sales growth, which may have a neutral to negative influence on the Japanese Yen and may pause or even possibly reverse the recent strong appreciation against the US Dollar.