The weekly trading session for September 10-14, 2018 is ending today with a plethora of US economic events such as the Retail Sales and the University of Michigan Consumer Sentiment Index. Other market-moving economic news are the Eurozone’s Balance of Trade, the Japanese Industrial Production and the Bank of Russia Interest Rate Decision. Moderate to high volatility should be expected for the US Dollar and the Euro.

These are the main economic events ns reports in the forex market today, time is GMT:

European Session

Sweden: CPIF YoY, Inflation Rate MoM, Eurozone: Balance of Trade, UK: BoE Governor Carney Speech, Russia: Interest Rate Decision, Monetary Policy Report

Time: 07:30, 09:00, 10:00, 10:30, 12:00

As of September 2017, the Riksbank uses the CPIF, the consumer price index with a fixed interest rate, as target variable for the inflation target. According to the central bank, “From a monetary policy perspective, one disadvantage of the CPI is that it is directly affected by changes in the policy rate. These adjustments have, through their impact on mortgage rates, large and direct effects on the CPI which are not connected to underlying inflationary pressures.”, Source: Trading Economics. Consumer Price Index with a Fixed Interest Rate in Sweden has been in an uptrend as of January 2018, reflecting inflationary pressures in the Swedish economy which may weigh on the Riksbank, the central bank in Sweden to raise the key interest rate. Higher than expected readings for the CPIF and the monthly Inflation Rate are considered positive for the Swedish Krona, but an unchanged reading of 2.2% for the yearly CPIF and a decrease for the monthly Inflation Rate to -0.1% from 0.5% are expected.

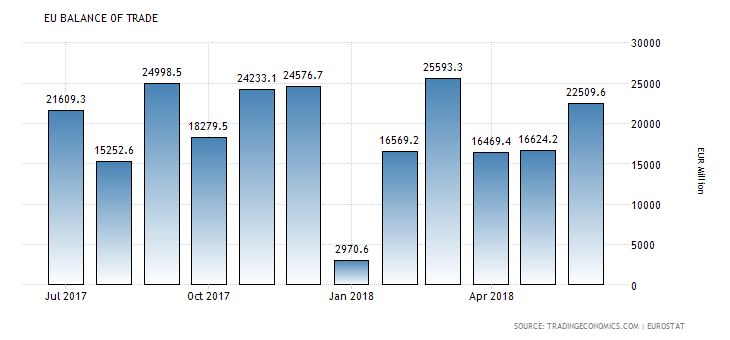

The Eurozone’s Trade Balance is the difference between exports and imports of Euro-zone goods and services. When exports are greater than imports, the Euro-zone experiences a trade surplus, which indicate that funds are coming into Europe in exchange for exported goods and services. These capital inflows may lead to a natural appreciation of the Euro as in general a trade surplus is considered positive for the Euro.

“The Euro Area trade surplus narrowed to EUR 22.5 billion in June 2018 from EUR 25.7 billion in the same month a year earlier, well above market expectations of EUR 18 billion. Imports rose 8.6 percent and exports increased 5.7 percent.”, Source: Trading Economics.

For the past 12-months the Euro area Balance of Trade has witnessed a trade surplus, but with significant volatility. The Euro Area trade surplus is expected to narrow to 18B Euros from 22.5B Euros.

The BoE Governor Speech after the recent Interest Rate Decision in UK may or may not move the British Pound, depending on whether any new updated statements are made about economic projections and Brexit. For the economy of Russia and the recent financial turmoil related to emerging markets an Interest Rate increase by the central bank of Russia will probably be supportive and positive for the Russian Ruble, but the expectations are for an unchanged key Interest Rate set at 7.25%. The statements made in the Monetary Policy Report soon after the announcement of the Interest Rate Decision will be monitored by the forex market participants, and traders whether the central bank appears to be optimistic or pessimistic on the Inflation Rate and economic growth which can be a market-moving catalyst for the Russian Ruble.

American Session

US: Retail Sales MoM, Export Prices MoM, Import Prices MoM, Retail Sales Ex Autos MoM, Fed Evans Speech, Industrial Production (YoY, MoM), Business Inventories MoM, Michigan Consumer Sentiment Prel, Michigan Current Conditions Prel, Michigan Inflation Expectations Prel, Michigan Consumer Expectations Prel, Michigan 5 Year Inflation Expectations Prel

Time: 12:30, 13:00, 13:15, 14:00

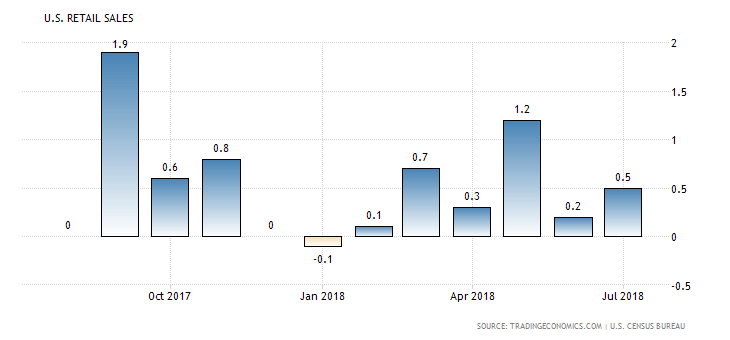

There are many economic reports to be released today related to the US economy, but the two market-moving news are the monthly Retail Sales and the Michigan Consumer Sentiment Index. The Michigan Consumer Sentiment Index is a survey of personal consumer confidence in economic activity, indicating whether or not consumers are willing to spend money. The Retail Sales measure the change in the total value of sales at the retail level and are an important indicator of consumer spending, a key driver for the performance of overall economic activity. Higher than expected readings for both the Michigan Consumer Sentiment Index and the monthly Retail Sales are positive for the US Dollar. The forecasts are for an increase of the Michigan Consumer Sentiment Index to 96.6 from 96.2 and a small decline for the monthly Retail Sales to 0.4% from 0.5%.

“US retail trade rose by 0.5 percent month-over-month in July 2018, following a downwardly revised 0.2 percent advance in June. The sales beat market expectations of a 0.1 percent gain boosted by purchases of motor vehicles and clothing. “, Source: Trading Economics.

As seen from the above chart the monthly US Retail Sales exhibit significant volatility. Higher than expected figures for the Industrial Production, Michigan Inflation, Consumer Expectations, and Current Conditions, and lower than expected figures for the Business Inventories are positive for the US Dollar, indicating expansion in the industrial sector, a strong demand for goods and services from manufacturers, retailers, and wholesalers and the level of consumers economic sentiment.

Asian Session

Japan: Industrial Production (YoY, MoM)

Time: 04:30

The Industrial Production measures the outputs of the Japanese factories and mines. The Industrial Production monthly and yearly changes are a major indicator of strength in the manufacturing sector, a key business sector for the economy of Japan. Higher than expected figures are considered positive for the Japanese Yen. Some mixed economic data is expected, with an increase for the yearly Industrial Production to 3.1% from 2.3% and an unchanged monthly figure of -0.1%.