Today, Friday, May 18, 2018 the last trading session for the week May 14-18, the forex market economic calendar is very thin, with economic data focused mainly on the economy of Canada, and the economies of Germany and the Eurozone. With no major events during the Pacific or Asian Session, the expected volatility in the forex market should be moderate, and mainly for the Canadian Dollar versus other currencies.

Key economic events for today:

European Session

- Germany: PPI MoM, Eurozone: Balance of Trade

Time: 06:00 GMT, 09:00 GMT

The Producer Price Index (PPI) measures the change in the price of goods sold by manufacturers, providing insights on the existence of inflationary pressures in the economy. Increasing figures for the PPI most probably mean that the increased prices will be transferred from producers to consumers, therefore increasing the inflationary pressures in the economy, which is considered positive for the Euro, as the German economy is the largest economy in the Eurozone. The forecast is for an increase for the monthly PPI in Germany with a figure of 0.3%, higher than the previous figure of 0.1%.

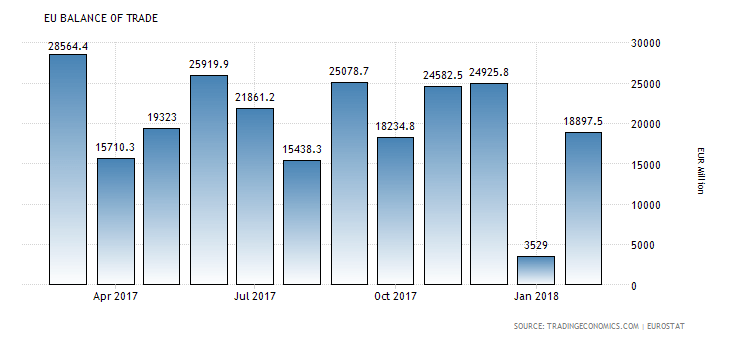

The Balance of Trade in the Eurozone has the potential to move the Euro, with trade balance surpluses considered positive for the local economy and currency, indicating capital inflows and increased demand for goods and services denominated in Euros, which may lead to the appreciation of the Euro. As seen from the chart there was a large increase for the trade surplus in the Eurozone during past month, after the large decline in January.

The forecast is for an increase of the trade surplus at 27.9Billion Euros, significantly higher than the previous reading of 18.9Billion Euros, which should be supportive for the Euro. There is often a strong negative correlation between the price of the Euro and the trade surplus in the Eurozone, with a weak Euro increasing the trade surplus, making the exports more competitive, but at the same time the imports more expensive.

American Session

- US: Fed Mester Speech, Fed Brainard Speech, Fed Kaplan Speech, Canada: Inflation Rate, Core Inflation Rate, Retail Sales

Time: 07:00 GMT, 12:30 GMT, 13:15 GMT

The main economic event for the day is probably the release of the Inflation Rate in Canada.

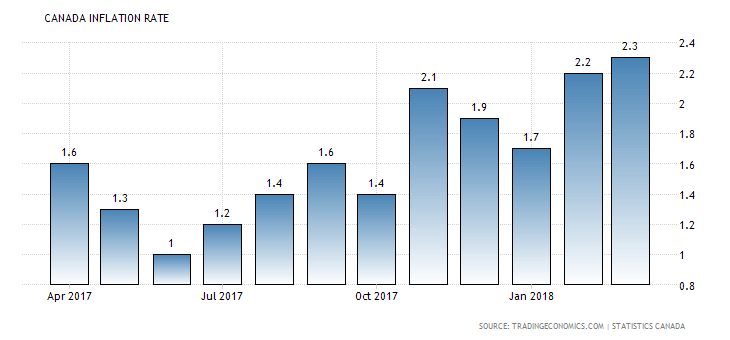

“Consumer prices in Canada increased 2.3 percent year-on-year in March of 2018, above 2.2 percent in February and compared to market expectations of 2.4 percent. It is the highest inflation rate since October of 2014, as prices in seven of the eight major components rose, mainly gasoline.”, Source: Trading Economics.

As seen from the chart the Inflation Rate in Canada has been trending up in the past 12-months, increasing the probabilities of further monetary policy tightening and future interest rate increases by the Bank of Canada, which is positive for the Canadian Dollar. The forecast is for an unchanged yearly Inflation Rate of 2.3%, and a decline for the monthly Inflation Rate at 0.2%, lower than the previous figure of 0.3%.

There is also the important release of the monthly Retail Sales in Canada, with higher than expected figure or rising ones considered positive for the local currency as higher consumer spending most probably will lead to higher economic growth measured by the GDP level.

The forecast is for a figure of 0.3%, marginally lower than the lower figure of 0.4%. The Canadian Dollar may also move if thee is any significant price change in oil prices, as they remain at high levels, any correction may influence negatively the Canadian Dollar, which has a high and positive correlation with oil prices.