The release of the US GDP Growth Rate for the second quarter is the key economic event for today, which may move the US Dollar as the expectations are set high and any economic surprise either positive or negative may add increased volatility for the US Dollar. There are also the releases of the US Core Personal Consumption Expenditures for the second quarter, the Michigan Consumer Sentiment Index, whereas in the European Session important economic data is expected starting with the French GDP Growth Rate, the UK Nationwide Housing Prices and the Interest Rate Decision by the Central Bank of Russia.

Lately the forex market responds not only to the fundamental releases but also to risk sentiment factors which support either the safe haven currencies or the riskier ones. An example is the US-EU trade deal on the tariffs and the potential trade war aversion between the US and the Eurozone.

Key economic events for today in the forex market:

European Session

- France: GDP Growth Rate QoQ 1st Est, UK: Nationwide Housing Prices (YoY, MoM), Russia: Interest Rate Decision

Time: 05:30 GMT, 06:00 GMT, 10:30 GMT

The Gross Domestic Product Growth Rate is the most important measurement of economic performance for any given country, taking into consideration multiple economic indicators such as employment, productivity, economic activity in various business sectors. An increase for the GDP Growth Rate is considered positive and supportive for the French economy and the Euro, as France is one of the biggest countries in the Eurozone.

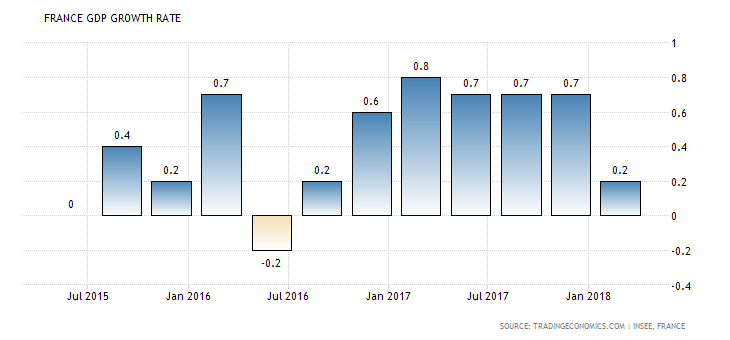

“The French economy advanced 0.2 percent on quarter in the three months to March of 2018, unrevised from the second estimate and after a 0.7 percent growth in the previous period, final figure showed. It is the weakest pace of expansion since the September quarter 2016. Year-on-year, the economy expanded 2.2 percent in the first quarter, matching the second estimates and following a 2.8 percent growth in the previous quarter.”

As seen from the above chart the French economy had the weakest pace of expansion since the September quarter 2016, and in 2018 the economic growth is much lower compared to 2017, an economic slowdown is evident. The forecast for the French quarterly GDP Growth Rate is for an unchanged figure of 0.3%.

In UK the Nationwide Housing Price Index (HPI) measures the change in the selling price of homes with mortgages backed by Nationwide, one of UK’s largest mortgage providers, providing information on housing inflation. Higher than expected readings are considered positive for the British Pound reflecting a robust housing market and inflationary pressures in the overall economy. The forecast is for a decline for the monthly Nationwide Housing Prices Index at 0.1%, lower than the previous figure of 0.5% and a decline for the yearly figure as well at 1.9%, lower than the previous reading of 2.0%.

The Central Bank of Russia is expected to keep the key interest rate unchanged at 7.25%, which should have a neutral effect on the Russian Ruble. Any economic surprise though may add increased volatility for the currency.

American Session

- US: GDP Price Index QoQ, PCE Prices QoQ, Core PCE Prices QoQ, GDP Growth Rate QoQ, Michigan Consumer Sentiment Final

Time: 12:30 GMT, 14:00 GMT

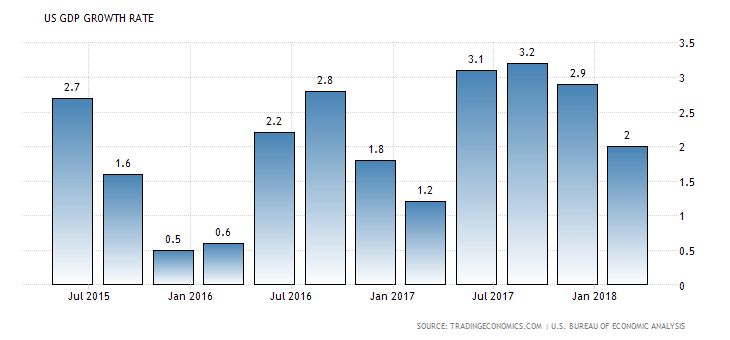

GDP Growth Rate annualized is a measure of market activity, reflecting the pace at which a country’s economy is growing or decreasing and measuring the economic performance over time. Higher than expected readings are considered positive and supportive for the US Dollar. The key economic event for today which could set a new trend for the US Dollar is the annualized GDP Growth Rate annualized for the second quarter, with high expectations set and the potential volatility increase to be evident in the market upon its release, especially in the event of any economic surprise, positive or negative. The forecast is for an annualized GDP Growth Rate for the second quarter of 4.1%, double the figure compared to the previous one of 2.0%. The Core Personal Consumption Expenditures are an important indicator of inflation, measuring the changes in durable goods, consumer products, and services. Higher readings for the PCE prices are also considered positive for the US Dollar, implying inflationary pressures, increasing the odds of a tighter monetary policy by the Fed. The forecast is for a marginal lower reading of the Core PCE Prices at 2.2%, compared to the previous reading of 2.3%.

“The US economy expanded an annualized 2 percent on quarter in the first quarter of 2018, below 2.2 percent in the second estimate and market expectations of 2.2 percent. Private inventory investment and personal consumption expenditures (PCE) were revised down, the final estimate showed.”

A large increase is expected which should move the US Dollar. But the persistence of this increase or not is more important than just a one-time large increase. In 2018 the annualized GDP Growth Rate is lower compared with 2017, and this large increase should be examined and monitored as it may be attributed to seasonality factors.

The Michigan Consumer Sentiment Index is a survey of personal consumer confidence in economic activity. Again, higher than expected or rising figures are considered positive for the US Dollar, reflecting the willingness of consumers to spend money and stimulate economic growth. The forecast is for a reading of 97.1, lower compared to the previous reading of 98.2.