The first weekly trading session for April 2018 is ending today with a focus on important economic data related to the economies of US and Canada. The key economic event for today is the US Non-Farm Payrolls and the Unemployment Rate in Canada. High volatility and price actions is expected for the US Dollar and especially for the USD/CAD currency pair.

Key economic events in the forex market for today:

European Session

- Germany Industrial Production, France Balance of Trade, Germany Construction PMI, ECB Coeure Speech, Russia Inflation Rate and Foreign Exchange Reserves, BoE Carney Speech

Time: 06:00 GMT, 06:45 GMT, 07:30 GMT, 07:45 GMT, 13:00 GMT, 15:15 GMT

Higher than expected or increasing figures for the Industrial Production and Construction PMI in Germany, and a trade surplus for the Balance of Trade in France are considered positive for the Euro.

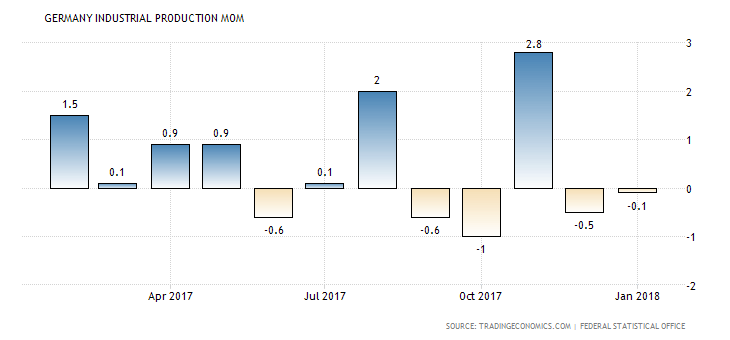

The forecast is for an increase for the monthly figure of Industrial Production in Germany with a reading of 0.2%, higher than the previous reading of -0.1% and a trade deficit for the Balance of Trade in France, which is expected to narrow to a reading of -5.3 Billion Euros, less than the previous reading of -5.6 Billion Euros. The following chart shows that Industrial production in Germany is volatile, with an inconsistent trend over the past 12 months.

The Inflation Rate in Russia is expected to increase on an annual basis, with a figure of 2.4%, higher than the previous reading of 2.2%. This reading is considered positive and supportive for the Russian Ruble, signaling the existence of increased inflationary pressures in the economy, which if sustained over time may weigh on the decision of the Central Bank of Russia to increase the key interest rate to fight the inflation.

American Session

- Canada Unemployment Rate and Employment Change, US Non-Farm Payrolls, US Unemployment Rate, US Average Hourly Earnings, Canada Ivey PMI

Time: 12:30 GMT, 14:00 GMT

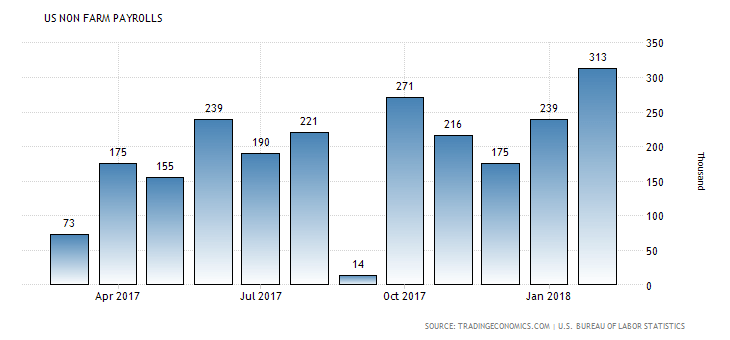

The main economic event for today is the release of monthly US Non-Farm Payrolls, which will indicate the state of the labor market in the US, and can move significantly the US Dollar. Higher than expected or rising figures for the US Non-Farm Payrolls are positive for the US Dollar, reflecting a robust labor market and potential higher economic growth measures by consumers spending and the GDP Growth Rate.

Non-Farm payrolls in the United States increased by 313K in February of 2018, following an upwardly revised 239K in January and beating market expectations of 200K. It is the highest increase in payrolls since July of 2016. The forecast is for a figure of 201K, less than the previous figure of 313K. Also increased Average Hourly Earnings will be positive for The US Dollar reflecting higher consumer spending and consumption, with the forecast being for an increase and a figure of 0.2%, higher than the previous figure of 0.1%. Lower than expected or declining figures for the Unemployment Rate in Canada, higher figures for the Employment Change and the Ivey Purchasing Managers Index (PMI) will be positive for the Canadian Dollar.

The forecast is for an unchanged Unemployment Rate of 4.1% in the US and an unchanged Unemployment Rate of 5.8% in Canada. The expectation for the economy of Canada is for an increase in the Employment Change with a reading of 17K, higher than the previous reading of 15.4K, and a marginal decline for the Ivey Purchasing Managers Index (PMI) figure at 59.4, lower than the previous figure of 59.6. The Ivey Purchasing Managers’ Index (PMI) measures the activity level of purchasing managers in Canada, with figures above the 50 level indicating expansion and potential higher future overall economic performance.

Asian Session

- Japan Leading Economic Index and Coincident Index

Time: 05:00 GMT

Higher than expected or rising figures for the Leading Economic Index and Coincident Index are positive for the Japanese Yen as they provide useful insights and information on the future direction of the economy, measuring current economic conditions. The forecast is for an increase of both Indexes, which should provide support for the Japanese Yen.