The last trading session of the week today has only a few but still very important economic data releases, with the potential to move the forex market and especially the British Pound and the US Dollar. There are not any significant economic events during the Pacific or the Asian Session, so moderate to high volatility is expected only during the European and American Session.

The US Dollar after the release of the inflation figures initially strengthened but very soon the trend reversed and weakened against the major currencies. It is the third month that US inflation rate is above the 2.0% target rate set by the Fed, and this in theory should act as supportive for the US Dollar as the probabilities of an interest rate increase in March are now higher, but the forex market is trying to predict the actual number of future interest rate increases by the Fed in 2018, which is very hard to estimate, based on current economic conditions.

These are the main economic events for today in the forex market to focus on:

European Session

- UK Retail Sales

Time: 09:30 GMT

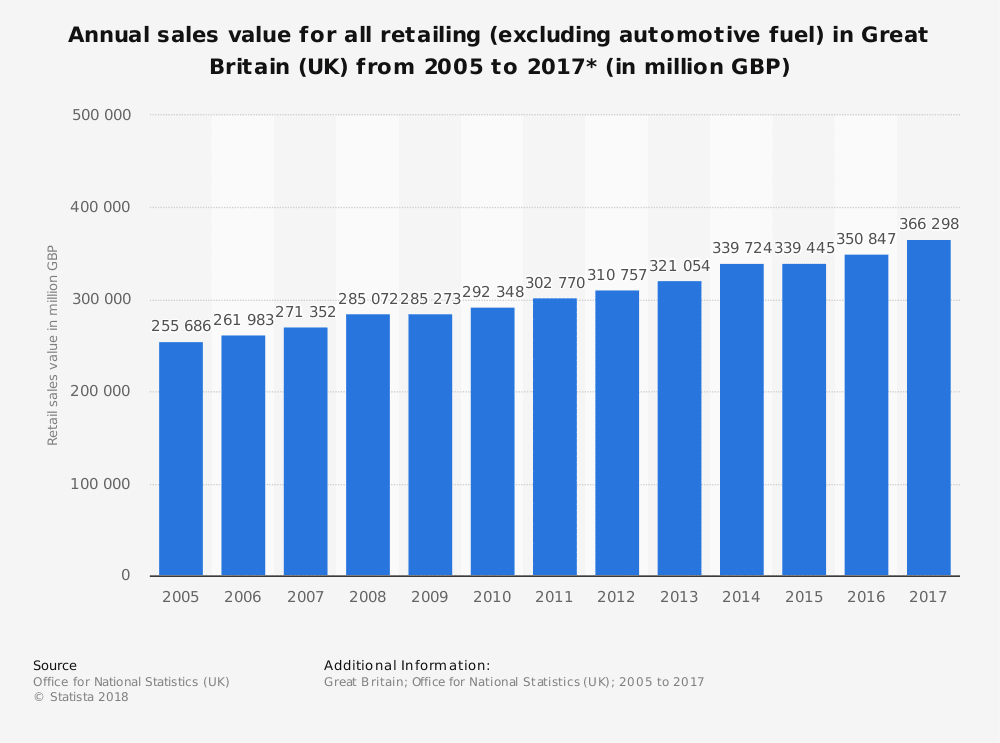

Higher than expected or rising figures for the retail sales in UK will be supportive and positive for the British Pound, indicating increased consumer confidence about economic conditions and consumer spending leading to higher economic growth measured by the GDP figures. The forecasts are for an increase of the retail sales in UK both on a yearly and a monthly basis. For the yearly basis the forecast is for a reading of 2.6%, higher than the previous reading of 1.4%, and for the monthly basis the forecast is for a reading of 0.5%, higher than the previous reading of -1.5%. As seen from the following graph the UK economy amid the negotiations and economic turbulence of Brexit developments is resilient and the uptrend for the retail sales is strong.

This statistic shows the total value of retail sales (excluding automotive fuel) in Great Britain annually from 2005 to 2017. Over the period, the amount spent in the retail industry has increased gradually, indicative of a robust economy and strong consumer spending. It will be interesting to monitor this uptrend until March 2019 and beyond, when the Brexit should officially be a reality rather than just negotiation talks and programming for time being.

American Session

- US Export and Import Prices, Housing Starts and Building Permits, Michigan Consumer Sentiment Index

Time: 13:30 GMT, 15:00 GMT

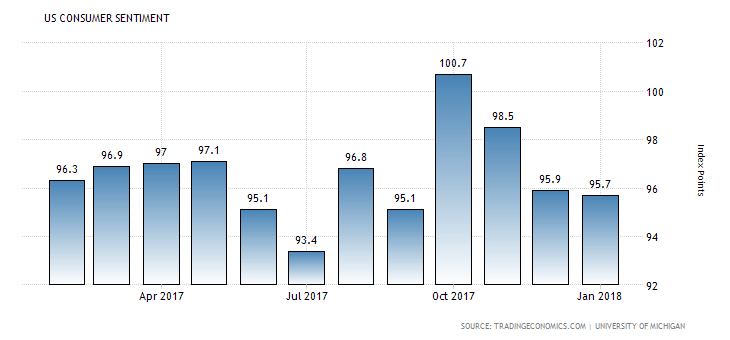

The University of Michigan Sentiment Index has the potential to move significantly the US Dollar with rising figures being supportive for the US Dollar reflecting improved economic conditions and consumer confidence. As seen from the chart the University of Michigan Sentiment Index has been declining for three consecutive times, so it is interesting from a fundamental analysis to monitor how the tax reforms and tax cuts announced will influence and at what degree the consumer sentiment in the US. The recent intense stock market sell-off was short-lived and consumers anticipate a slightly higher inflation rate but also growth in jobs and personal income. The forecast is for a reading of 95.6, slightly lower than the previous reading of 95.7.Any positive or negative economic surprise has the potential to add increase volatility for the US Dollar upon their release.

Higher than expected or rising figures for the Import and Export Prices will be positive for the US Dollar indicating the presence of sustainable inflationary pressures in the economy and increasing the odds of more than anticipated interest rate increases by the Fed, while the forecasts for the building permits and housing starts are for an unchanged reading of 1.3 Million for the building permits and an increase for the housing starts with a reading of 1.25 Million, higher than the previous reading of 1.192 Million. These numbers in the event they are actual will signal a robust housing market, which plays a pivotal role in the US economy as it is considered a leading indicator of the economy.