The economic calendar for today has important economic data about the economies of Switzerland, Canada, Japan, Eurozone, Australia, and US. In the European Session the release of the figures for the Unemployment Rate and the Inflation Rate in the Eurozone most probably will move the Euro, which is trying to recover after the steep decline in the pas days, a result of political turmoil in Italy. Moderate to high volatility is expected today in the forex market, mainly for the Euro, US Dollar, Canadian Dollar and the Swiss Franc.

These are the main economic events to focus on today in the forex market:

European Session

- Switzerland: GDP Growth Rate QoQ, GDP Growth Rate YoY, Retail Sales YoY, UK: Nationwide Housing Prices YoY, Nationwide Housing Prices MoM, Mortgage Lending, Mortgage Approvals, BoE Consumer Credit, France: Inflation Rate YoY Prel, Spain: GDP Growth Rate YoY Final, GDP Growth Rate QoQ Final, Eurozone: Inflation Rate YoY Flash, Core Inflation Rate YoY Flash, Unemployment Rate, Italy: Inflation Rate YoY Prel, Inflation Rate MoM Prel

Time: 05:45 GMT, 06:00 GMT, 06:45 GMT, 07:00 GMT, 07:15 GMT, 08:30 GMT, 09:00 GMT

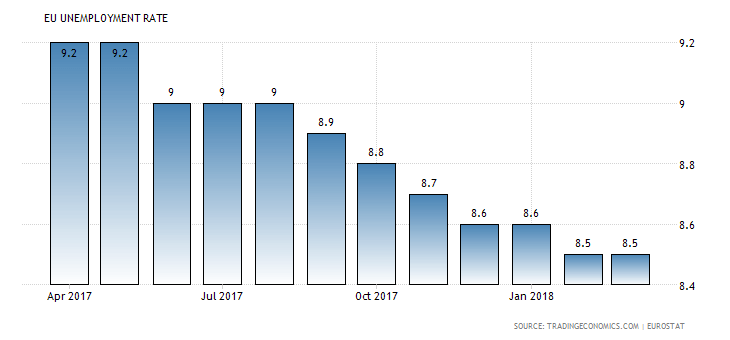

The Euro can move today significantly as there is important economic data related to the Eurozone and specific countries such as Italy, France and Spain. Higher than expected or rising figures for the Inflation Rate in France, the GDP Growth Rate in Spain, the Inflation Rate in Italy are considered positive for the Euro. The main event though for the Euro will be the release of the Inflation Rate and the Unemployment Rate in the Eurozone. Higher than expected figures for the Inflation Rate, especially the Core Inflation Rate and lower than expected for the Unemployment Rate are considered positive and supportive for the Euro, reflecting inflationary pressures in the economy, which may shift the monetary policy, if these inflationary pressures are sustained in the future. A lower Unemployment Rate is positive for economic expansion. The forecast is for an increase of the Core Inflation Rate YoY Flash at 1%, higher than the previous rate of 0.7%, and a decline for the Unemployment Rate at 8.4%, lower than the previous rate of 8.5%.

As seen from the chart “The unemployment rate in the Euro Area was unchanged at 8.5 percent in March of 2018, the same as in February and in line with market expectations. It remains the lowest jobless rate since December of 2008, well below 9.4 percent a year earlier.”, Source: Trading Economics. We notice a downtrend for the Unemployment Rate in the Eurozone for the past 12-months, with the latest reading of 8.5% being at the very low of the range, a positive macroeconomic and fundamental effect for the Euro.

For the Swiss Franc and the British Pound, higher than expected figures for the GDP Growth Rate and the Mortgage Approvals and Mortgage Lending accordingly should be supportive and positive, reflecting a robust economy in an expansion phase and a strong housing market. The forecast is for an increase for the yearly GDP Growth Rate in Switzerland at 2.3%, higher than the previous figure of 1.9%, and an increase for the Mortgage Approvals and yearly Nationwide Housing Prices in UK, but a decline for the Mortgage Lending in UK, with some mixed economic data expected overall.

American Session

- Canada: GDP Growth Rate Q1 Annualized, GDP Growth Rate QoQ Q1, GDP MoM, BoC Leduc Speech, US: Personal Income MoM, Personal Spending MoM, Chicago PMI, PCE Price Index MoM, PCE Price Index YoY, Pending Home Sales YoY, Pending Home Sales MoM, EiA Crude Oil Stocks Change, Fed Bostic Speech, Fed Brainard Speech, Initial Jobless Claims, Continuing Jobless Claims

Time: 12:30 GMT, 13:45 GMT, 14:00 GMT, 15:00 GMT, 16;30 GMT, 16:35 GMT, 17:00 GMT

The Canadian Dollar can move with the release of the Canada GDP Growth Rate Annualized, and if there are any economic surprises, beating or missing the estimates. As seen from the chart “The Canadian economy expanded an annualized 1.7 percent on quarter in the last three months of 2017, higher than 1.5 percent in Q3 but below expectations of a 2 percent growth. Considering full 2017, the economy advanced 3 percent, following a 1.4 percent growth in 2016.”, Source: Trading Economics.

As of summer, 2017, the economic growth in Canada has not been advancing in the same pace as before and seems to have been at least moderate compared to the previous quarters.

The forecast for the Canada GDP Growth Rate Annualized QoQ and the Q1 is for an increase having a figure of 1.8%, higher than the previous figure of 1.7%. The GDP Growth Rate MoM Is expected to decline at 0.2%, lower than the previous reading of 0.4%.

Important economic data for the US economy can move the US Dollar, with higher than expected readings for the Personal Income, Personal Spending, Pending Home Sales, PCE Price Index and Chicago PMI considered positive and supportive. All these readings reflect an indicator of inflation, the level of consumer spending, and business conditions in the region of Chicago. The forecasts are for unchanged readings of the Personal Spending and Personal Spending, and monthly Pending Home Sales, and for an increase of the Chicago PMI figure at 58.0, higher than the previous reading of 57.6.

The USD/CAD currency pair is expected to witness further volatility with the release of the US Crude Oil Stocks Change. If the increase in crude inventories is more than expected, this implies a weaker than expected demand and is considered negative for crude oil prices.

Pacific Session

- Australia: Private Capital Expenditure, Private Sector Credit, AIG Manufacturing Index

Time: 01:30 GMT, 22:30 GMT

Higher than expected readings for the AIG Manufacturing Index, the Private Sector Credit and Capital Expenditure are considered positive for the Australian Dollar, reflecting increased business conditions in the Australian manufacturing sector, and providing information on the business and economic conditions, which can support economic growth.

Asian Session

- Japan: Housing Starts

Time: 05:00 GMT

Higher than expected figures for Housing Starts are considered positive for the Japanese Yen, as It shows the strength of the Japanese housing market. The forecast is for a figure of -8.9%, lower than the previous figure of -8.3%, which may influence negatively the Yen.