The times are changing, and it’s important to keep up with them if you want to stay ahead of the game. IQ Option broker is here to help you polish up on the basics of Forex and find out what fundamentals will matter for traders in 2018. Read on to learn what it takes to increase your chances of success this year.

Fundamentals drive the Market

Fundamentals are the very foundation upon which the market functions. They are the underlying conditions set up by the central bankers, economic activity, and government policy. These are the conditions under which traders like you and me most operate. Having a sound grasp of what fundamentals are and how they are changing is of utmost importance for successful traders. A small note to beginners: you want to make sure you don’t trade against the fundamentals; otherwise, you’ll be in for an unpleasant surprise.

The year 2018 will be a different game and, when compared to some years, may be even more important because fundamentals are shifting. The global economy has been in an era of fiscal stimulus, quantitative easing and loose central bank policy intended to spur economic growth. Now that growth is beginning to accelerate, those policies are changing and altering the investment landscape with it. So, what fundamental factors will be important in 2018?

Economic data will be important in 2018

The year 2018 will see a precarious balance between growth and policy tightening. This means that economic data will continue to sway sentiment and possibly drive volatility. So long as global growth remains in the forecast risk-on currencies like the euro, the pound and Australian dollar will continue to draw support from as traders look seek market beating returns. Regarding the US and its data, well, positive US data may turn out to be contra indicative for the USD as the US is a leading economy.

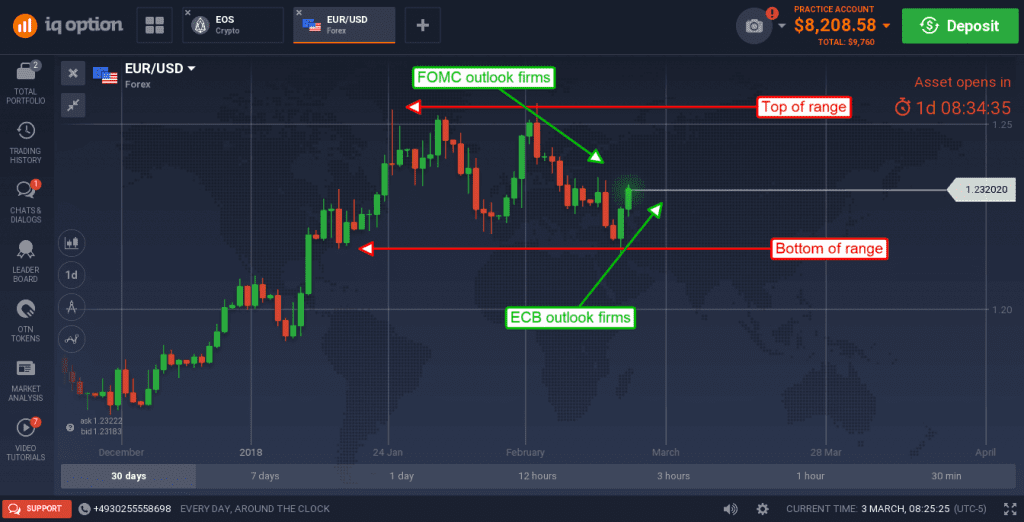

What this means is strong data in the US will lead to improved global economics which in turn will help strengthen foreign currencies. This is already being see in the EUR/USD pair. The dollar is set to rally on firming FOMC rate hike outlook but can’t make headway versus the euro.

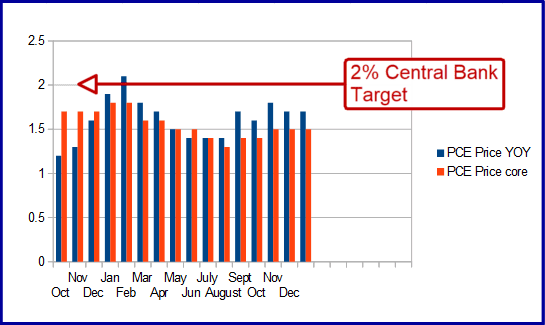

The most important data points will be the inflation reads. Things like PPI, CPI and PCE prices will dominate. Traders will look to this data for signs of acceleration as inflation rises toward the 2% target favored by central bankers. If they see this, it will help strengthen the respective currency as it will lead to policy tightening. For example, if US PCE prices jump to 2% you could expect a surprise FOMC rate hike and a jump in the dollar.

Central Bankers will be important in 2018

Central bankers will be the most important thing for traders to watch in 2018. The data will show changes in fundamental conditions that central bankers will act on through policy changes. As economies expand and growth gains traction, we can expect to see rate hikes from the FOMC, the ECB, the BOE and now the BOJ as well.

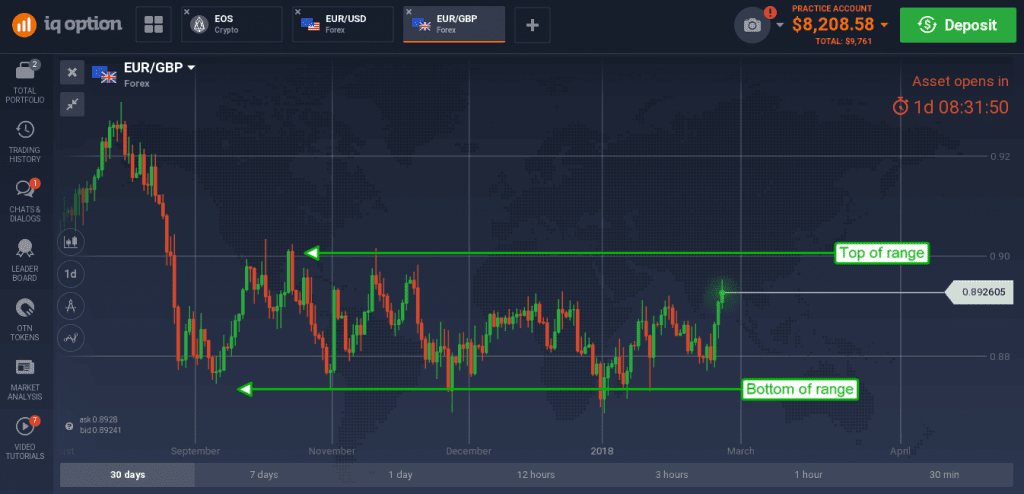

The FOMC is already on a path of tightening that began two years ago. The ECB was thought to be the next in line to begin tightening but was beat by the BOE. The BOE raised rates once last year and began this year with a policy statement to the effect they would be raising rates sooner than expected and at a rate faster than expected. The ECB has begun to taper their bond purchases with an expectation for policy action sometime this year, a move that will firm the euro. The BOJ was not expected to tighten this year but surprised the market by stating a policy change was on the horizon.

Forex market outlook for 2018

On the whole, the outlook for 2018 is good. It appears there is going to be volatility and price movement for traders to take advantage of. What they need to remember is that long-term support and resistance targets are likely areas of price reversal. Why? Because fundamentals are going to keep most major currency pairs range bound. News that may strengthen one currency will be offset by news that strengthens another, resulting in an ebb and flow of exchange rates driven by daily news releases and central bank policy. Keeping on top of the fundamentals can be part of your leverage as you trade throughout the year.