New data suggest business expansion within the EU and UK is cooling. The data is contrary to information from the US which suggest economic activity in that nation is still accelerating. The combination has set the central banks at odds, creating a divergence in the forex markets that is driving market action.

In Germany the Business Expectations index came in at 98.5, below the expected 99.5 and down from the previous months 98.7%. The reading shows that expectations for future activity have fallen, indicative of cooling within the economy. In Britain Business Investment shrank by -0.2% in the first quarter, a concrete sign of cooling activity, contrary to expectations of increase. The YOY figure is still 2.0% above last year but below expectations.

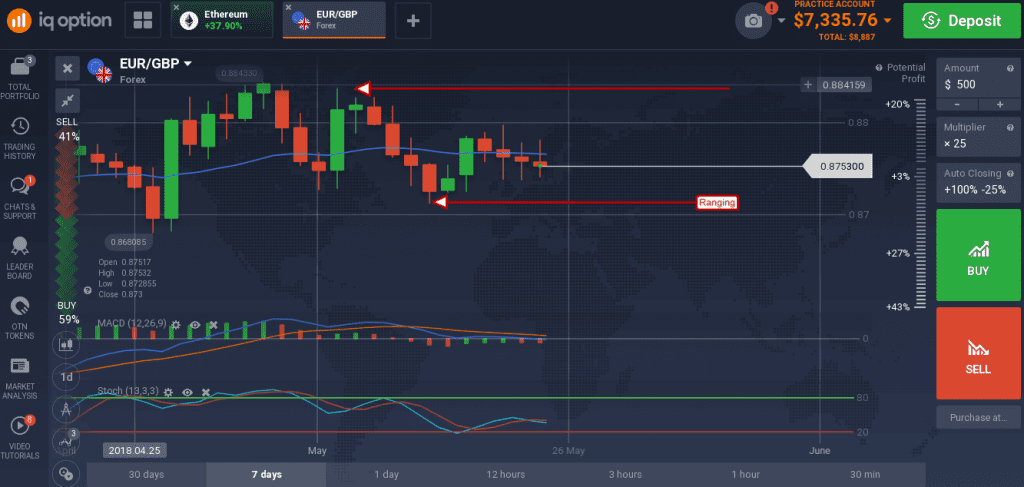

The EUR/GBP moved sideways on the news in a day of volatile trading. The candle formation in early Thursday trading was bearish with a long upper shadow confirming resistance at the short term moving average. Although bearish the candle is to the side of the previous five and well within near and short-term trading ranges. The indicators are mildly bearish but consistent with range bound trading more than downward motion.

The pair may fall from this level, but support is likely to be found near 0.87250. I move below that could take the pair down to 0.8700 but I would expect the range to hold until fundamental factors within either nation have changed.

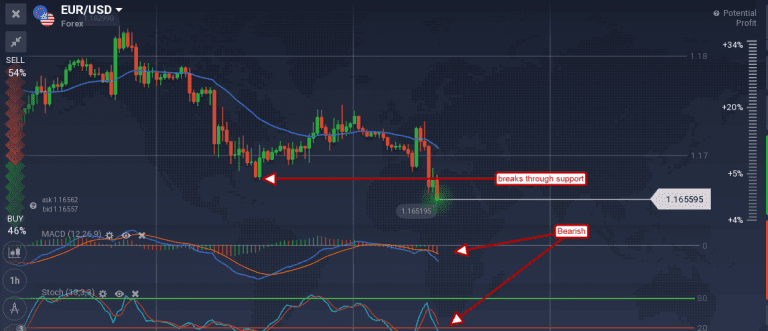

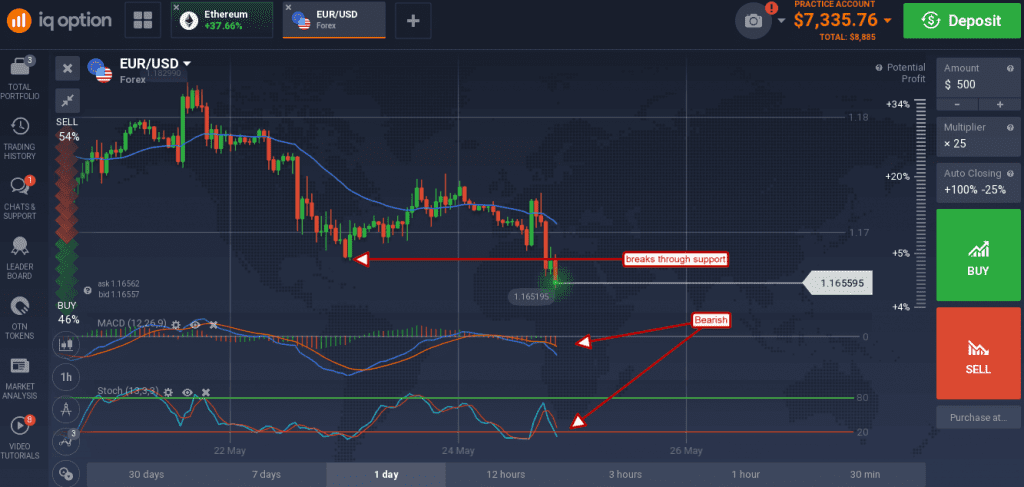

In the US Durable Goods Orders fell a bit more than expected with the caveat core Durable Goods Orders was hotter than expected at 0.9%, nearly double the estimate. While the data is mixed, it shows strength in the US economy at the core level that is underpinning inflation and interest outlook. The news helped the USD to strengthen against the EUR and move the EUR/USD down to a long-term support target, where it broke through to a new seven month low. The indicators are bearish and pointing lower, consistent with lower prices, but also showing divergence from the low so caution is due.

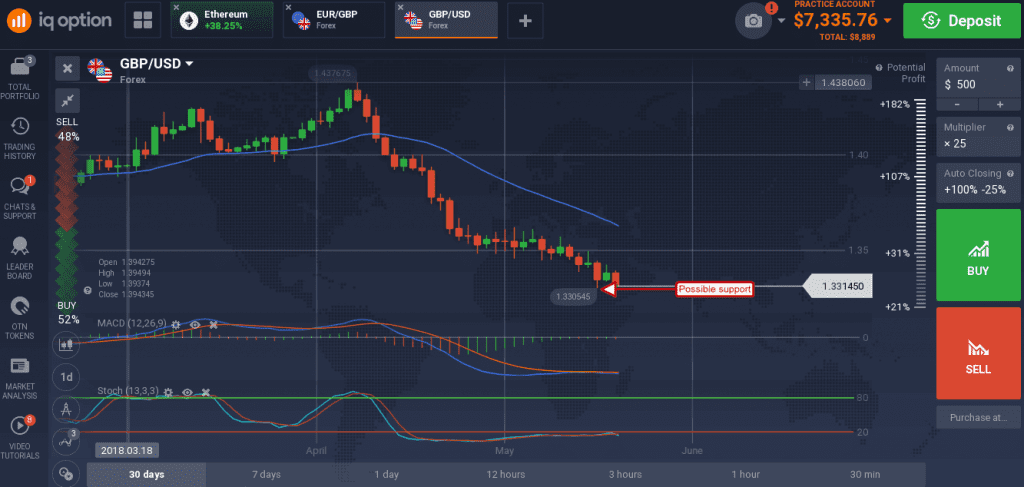

The dollar also strengthened against the pound, moving below Thursday’s open, to approach the long term low set earlier this week. The indicators are bearish in support of lower prices but show divergences that should not be ignored.

Divergence does not mean reversal is 100% but it is a sign of weakness within the downtrend, a weakness that can lead to sharp price movements and unnecessary losses.