Officials at the ECB have indicated their intent to begin discussing publicly the end of quantitative easing in the EU. The news comes just a day after Bloomberg reported a similar story based on undisclosed sources within the bank. Wednesday’s comments come from ECB Chief Economist Peter Praet and ECB policy maker Jens Wideman and confirm that the bank will assess when to begin winding down its massive bond buying program.

This news came as a shock to the market which was expecting the bank to remain relatively discreet considering ongoing political uncertainty in Italy, Spain and Greece. The ECB is scheduled to hold a policy meeting next week and now expected to begin discussing plans, an event that amounts to major policy change for market participants.

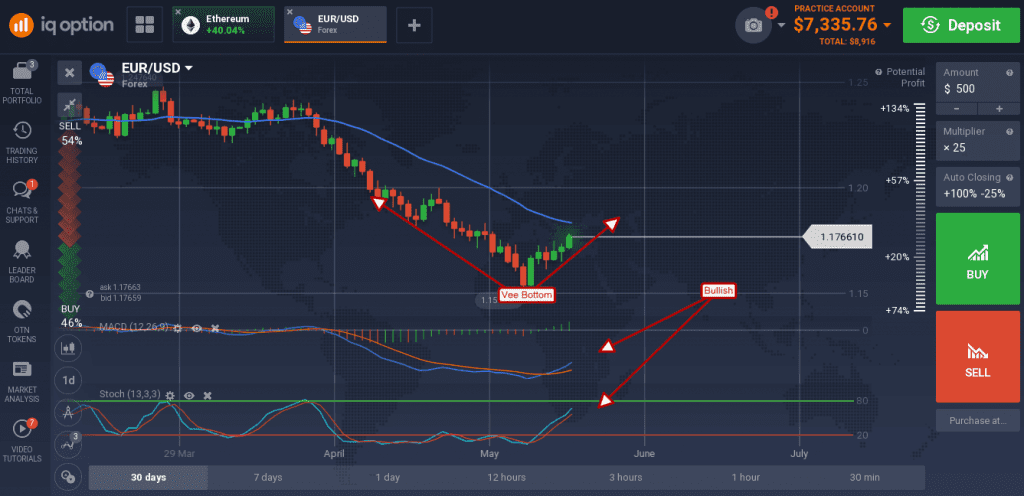

The news sent the euro shooting higher adding momentum to a reversal begun last week. The EUR/USD pair had been at an extreme low driven by FOMC expectations (now diminished) and political unrest centered in Italy (also diminished). The reversal was set up by declining expectation for future rate hikes beyond the June FOMC meeting (also next week) and sparked by stronger than expected data from the EU. Now, with the ECB turned hawkish, reversal in the pair is all but assured.

The EUR/USD created a medium sized green candle moving up from support in what looks like a near text-book Vee bottom. The move is supported by both MACD and stochastic which are pointing higher, gaining strength and have room to move higher. There may be resistance at the 1.1800 level and/or the short term moving average but, once broken, an extended move higher is likely.

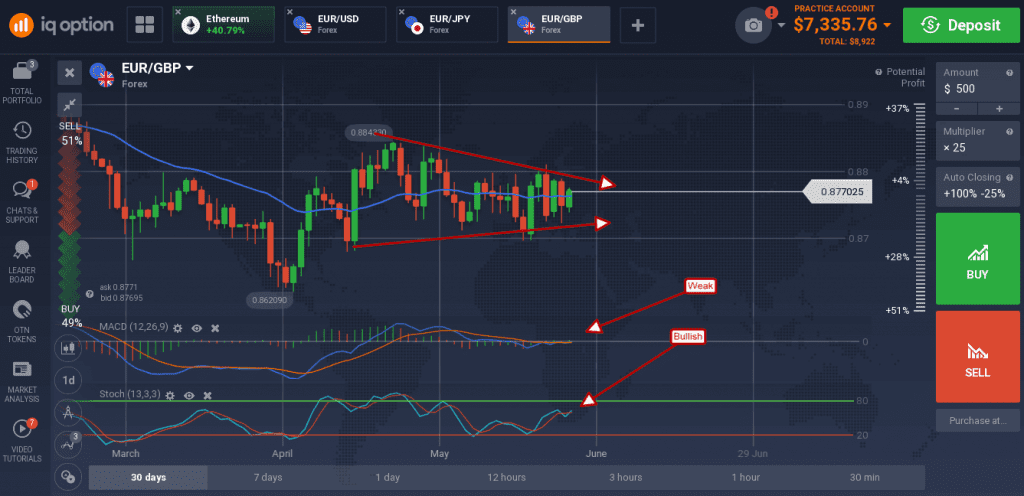

The single currency was able to gain versus the pound but did not make a significant move. The EUR/GBP created a medium sized green candle but exactly in the middle of a narrowing consolidation range and to the side of several weeks’ worth of range bound trading. This is due to increasingly hawkish expectation for the ECB couple with the same for the BOE who will be meeting the week after next. Until then look for resistance at the top of the range, near 0.8800, and support near the bottom at 0.8700.

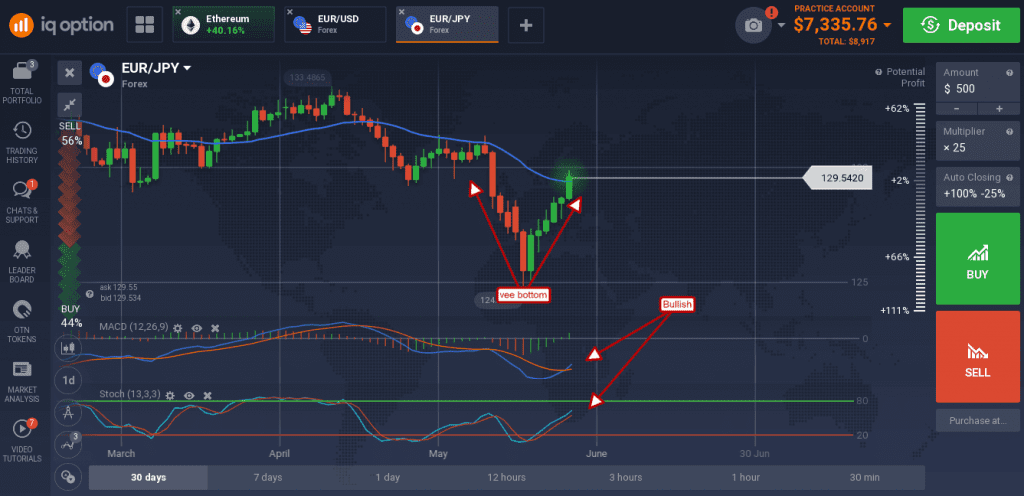

The EUR/JPY has also completed a Vee Bottom, bouncing from lows set in late May to regain nearly all the Italy induced losses. The pair is now moving higher, accompanied by bullish indications in MACD and stochastic, and fast approaching the 130.00 level.

This level may provide some resistance to higher prices but a move to 132.00 looks likely as ECB officials begin tightening and risk-on sentiment returns to the market.