A triple shot of central bank news has confirmed one thing if nothing else; accelerating economic growth is at hand. The FOMC, the ECB and the BoE have issued statements in the last 24 hours indicating global economic growth is expanding faster than predicted and expected to continue expanding at this rate or faster over the next 12 months. What the news also confirms, to the disappointment of many traders, is that inflation within the respective countries will continue to expand toward the 2% target but remain low over the long term.

Thursday’s news includes data from the EU and UK along with the ECB’s quarterly Economic Bulletin and a policy statement from the BoE. The BoE held rates steady at 0.5% in a vote that split 7/2 in favor of the decision. The 2 dissenters voted in favor of an immediate rate hike confirming market expectation a policy change could come in May. The bank confirms that inflation cooled in the last quarter but remains high and above target at 2.7%. The reason they did not hike at this meeting is low wage inflation. Wages are rising but not at a pace fast enough to satisfy all members of the committee.

The ECB, in their quarterly Bulletin, see global growth expanding above expectation and accelerating into the summer months. Inflation is expected to hit their target 2.0% in the next 12-24 months but remain low long term despite broad growth within the EU economy. The bank raised its GDP target for 2018 in accordance with above average growth, up by a tenth, but left estimates for 2019 and 2020 unchanged.

New data from the EU supports the idea of continued growth but not acceleration, leaving markets mixed on outlook. The Markit Composite PMI, a broad-based gauge of economic activity, fell to 55.3 in March. The index was expected to decline but by a much smaller amount. The decline shows deceleration in the economy and at a greater rate than expected, the caveat is the reading remains positive. At 55.3 we can expect to see continued expansion within the EU that could easily accelerate as the spring season unfolds.

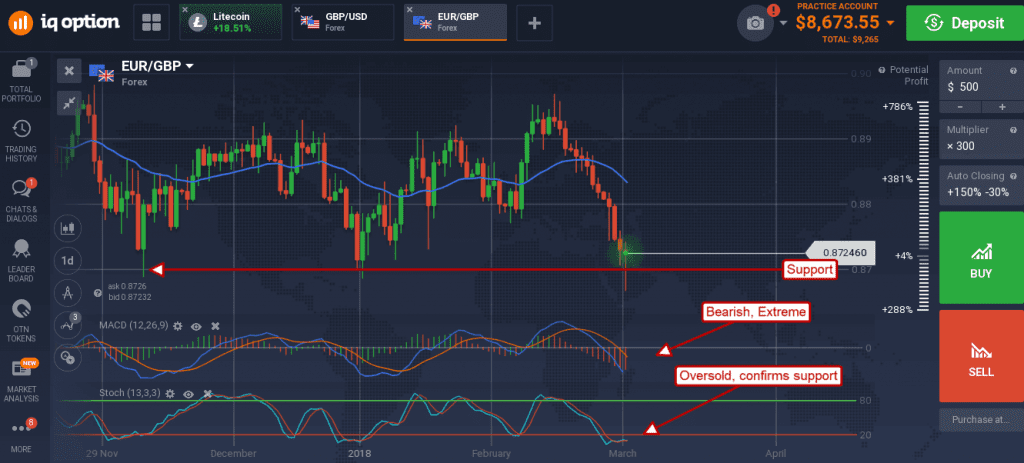

The EUR/GBP fell hard on weakness in EU data and hawkish outlook for the BoE. The move took the pair down to test a key support level at the bottom of a long-term trading range. This level is near 0.8700 and has been tested many times. Hawkish outlook within the ECB Bulletin and no change to the BoE’s long-term outlook provided support once again.

The pair bounced, forming a wicked looking hammer in early Thursday trading that indicates a reversal or swing within the range can be expected. The indicators show prices are at an extreme, oversold and at peak momentum, consistent with reversal within a trading range. A move up will confirm this outlook, the first target for resistance is 0.87750.

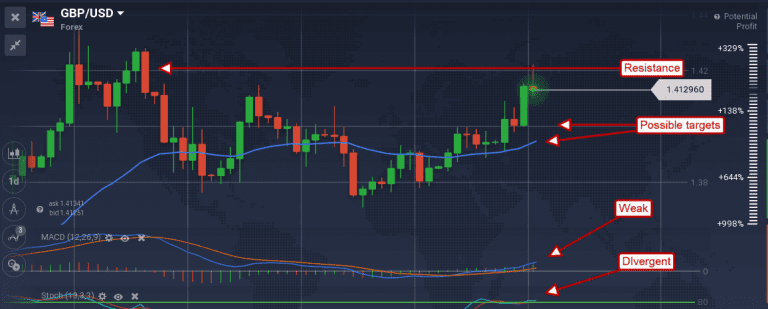

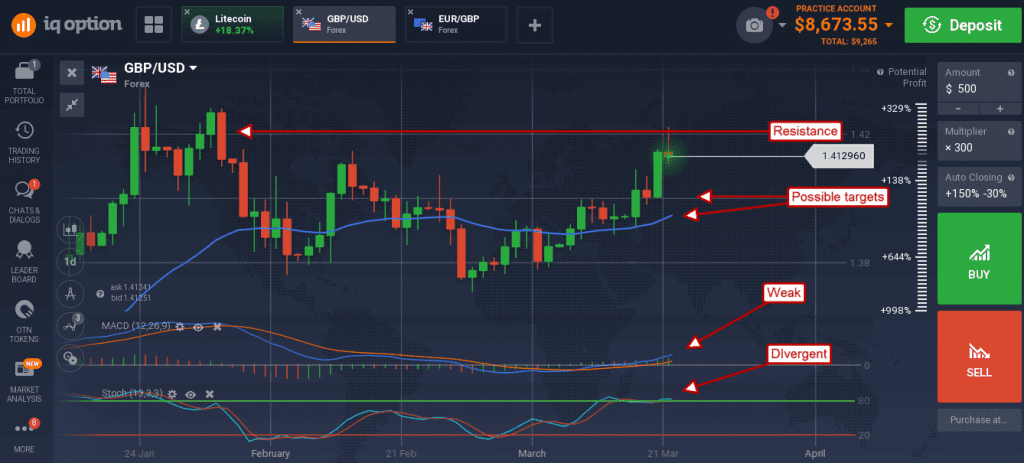

The pound spiked versus the dollar, but gains were capped by FOMC outlook and data from the US. The FOMC remains cool on the topic of inflation but also sees growth accelerating. Yesterday’s data was a mixed bag but confirms growth and positive forward outlook. Composite PMI figures were a bit below expectations but remains expansionary near 55. Likewise, the Conference Board’s Index of Leading Indicators was weaker than expected but still indicative of robust growth at 0.6%.

The GBP/USD is indicating resistance near 1.420, just below recent highs, and a possible consolidation or pull back to support targets at 1.4000 and just below at the short term moving average.