It may come as a shock to many of you, but Facebook collects your data. They do it for a reason, because you are valuable to them. Not as a friend or as a treasured resource to be protected, but as a business resource to be exploited. Yes, exploited. Facebook may say they value your privacy, but it is your very privacy they are selling when they allow third parties access to your feed. How else do you think they serve those adds which, in my case, are targeted at 40-something-mountain-bike-riding-stock-market-trading-first-time-fathers.

The Russia/US election scandal brought this issue into the public spotlight. For the first-time people realized that yes, Facebook isn’t their friend and that it can be used to deeply impact personal and public opinion. The issue came into sharp focus two weeks ago when a whistleblower revealed widespread misuse of personal data. The scandal, involving Cambridge Analytica and use of personal data to sway election results, has not only called Facebook’s privacy policy into question, it’s called the company’s very business model into question. Just how do they make money? Who is paying them for those ads and what are they doing to stop misuse?

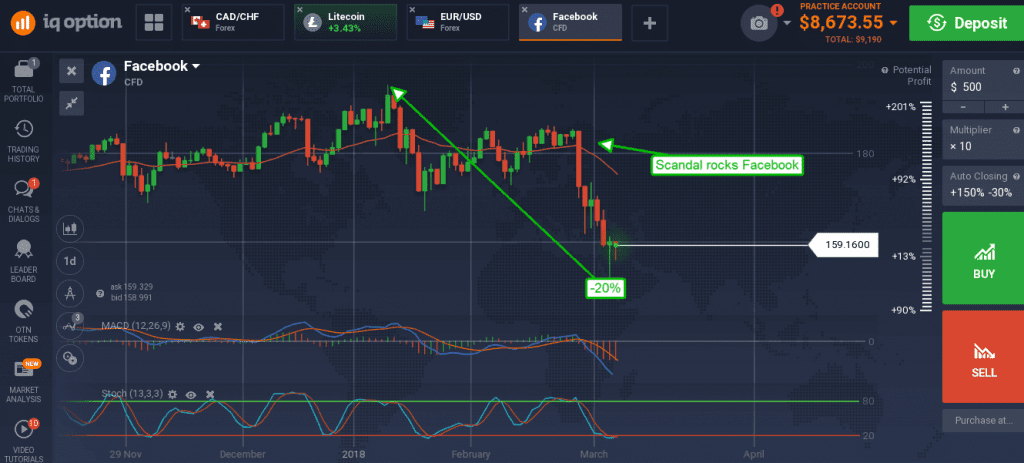

Apologies from Zuckerberg and Sandberg ring hollow. Sure, they’re sorry the data was misused but only because it’s going to hurt their business. Facebook makes money by selling your data, they aren’t going to stop and if they do they don’t make money. At the very least the company will face a major change that will curtail its operations. At worst it will crumble under the pressure and cease to exist. Shares have already fallen close to 20% and the decline has only just begun.

CEO Mark Zuckerberg has been called to testify before the UK parliament and declined. The FTC is opening an investigation into the company’s collection, use and handling of data. A coalition of US State Attorney’s General are opening their own investigation into the scandal and more actions are likely. Even if the company survives, which I think it won’t, it will be a long time before it is making anything near the money it is now.

IQ Option traders can take advantage of this situation using the Facebook CFD to short. Price action on Monday brought the stock down to the $150 level and a target for support. The shares bounced from that support level but not look like they are reversing the recent fall from grace. If anything, they are setting the stock up for another fall as the scandal widens and investors run for the exits.

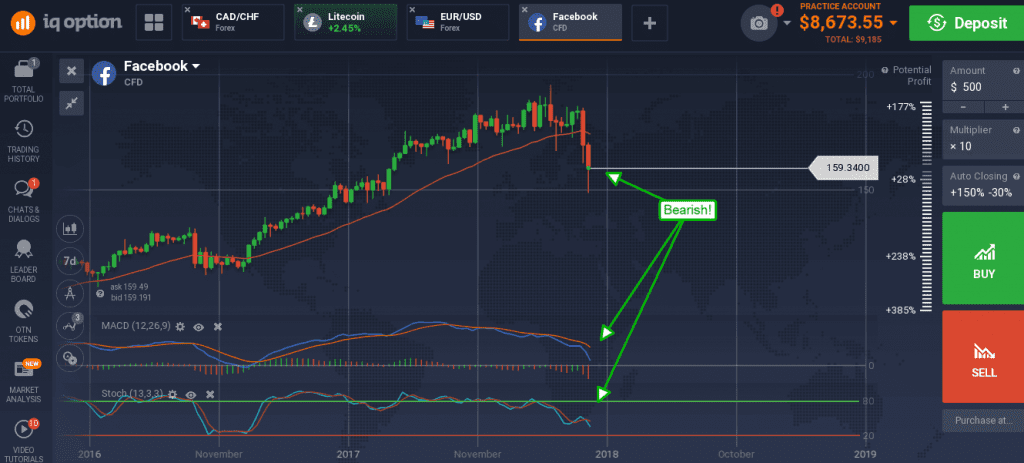

The indicators are a bit mixed on the daily charts, stochastic is indicative of support, but momentum is strongly bearish, so I would expect to see it Facebook continue to move lower. The stock will easily move back to retest support at $150 in the near term or over the next week or two.

I would expect to see prices bounce from this level again before moving lower. Looking to the weekly charts the longer-term targets, like over the next month to 6 months, are well below $150, closer to $115.