Eurozone and EU trade balance data came in better than expected on a surprise jump in exports. The news helped to strengthen the euro despite year-to-date declines in the broader Eurozone economy.

The headline Eurozone balance of trade came in at 26.4B euros, up 8.3B euros from the previous year. This gain is due to a better than expected read on exports, up 5.6%, offset by a smaller than expected gain in imports, only 5.1%. While positive the YTD data shows evidence of lingering weakness in trade, down -12.6% at the headline and well below expectations. This is due to a 7.4% gain in exports offset by a 10.4% gain in imports.

Looking to the core EU the numbers are a little better. Headline YOY trade balance came in at a positive 3.1B euros, reversing a trade deficit of -1.6B euros for the same period last year. This is driven by an increase in exports of 6.3% offset by a 3.2% gain in imports. The YTD numbers are similar; the headline balance more than doubled from last year’s 3.1B euros to 7.4B euros on strength in exports.

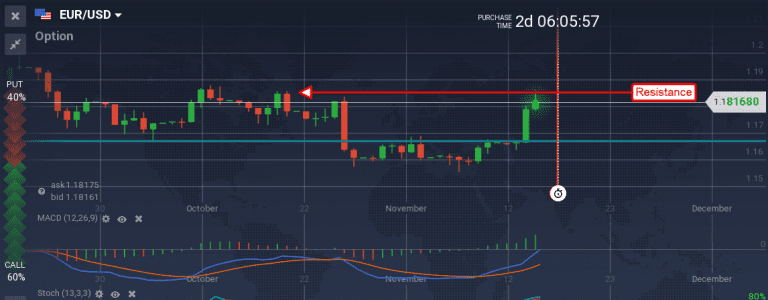

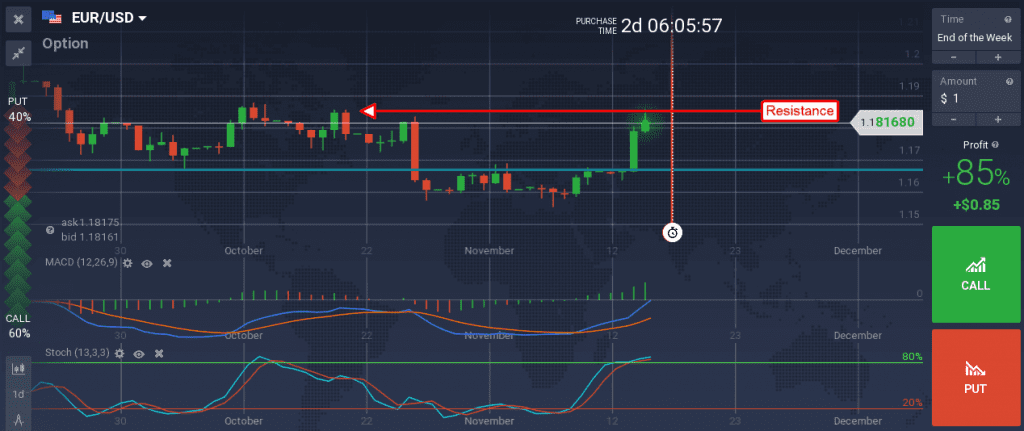

The EUR/USD began its move well before the release of data. The pair moved up to test the 1.1850 level where it held steady up to and through the news. Gains were capped by stronger than expected US data which could leave the pair moving lower into tomorrow’s EU CPI release. This move also confirms resistance at last month’s highs and the possibility of range bound trading into the next round of central bank meetings. The indicators are both bullish and suggest resistance will be tested again, a break above 1.1850 would be bullish for the pair.

Today’s US data included CPI and retail sales which both show strength in the economy and support current FOMC expectations. CPI came in at 0.1% headline and 0.2% at the core, both above expectations, while retail sales gained 0.2% versus an expected 0.00%.

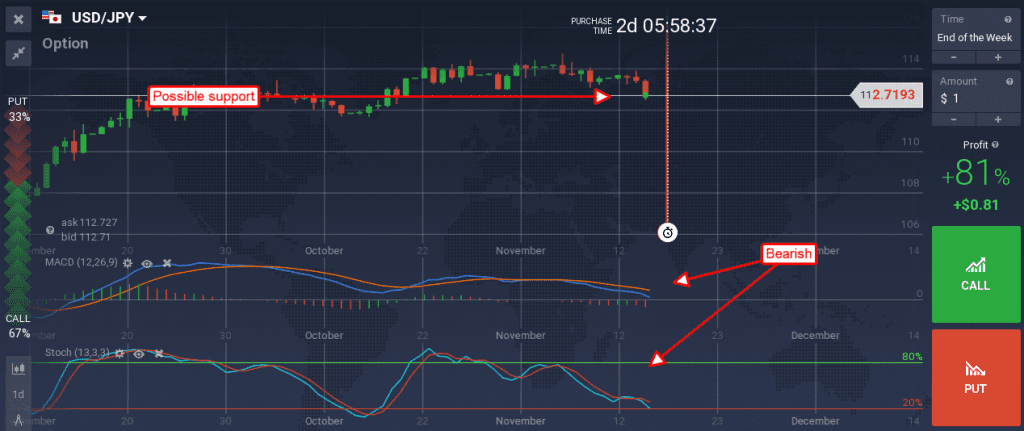

The USD/JPY had been moving lower in early trading but found support soon after the release of today’s data. The caveat is that the indicators remain bearish and suggest support will be tested again. Support is near the 112.50 level, a break of which would be bearish for the pair.

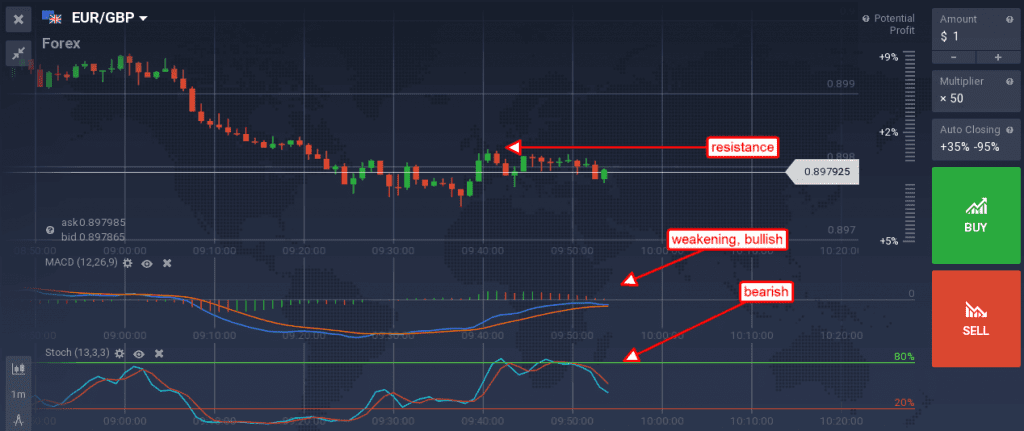

Trading was mixed in the EUR/GBP. The pair had been moving higher on expected weakness in the UK but met resistance near 0.9010 and the two-month high. The reason, UK labor data came in much better than expected. Average hourly earnings x-bonus jumped 2.2% over the past month, as expected, coupled with a 2.2% gain in earnings with bonus, better than expected.

This news was good and bolstered by a surprise drop in jobless claims that suggest not only improving but improving employment conditions overall. Today’s move in this pair confirms resistance at the top of a two-month trading range and will likely keep it range bound into the near term. Downside targets for support are 0.8950 and 0.8000.

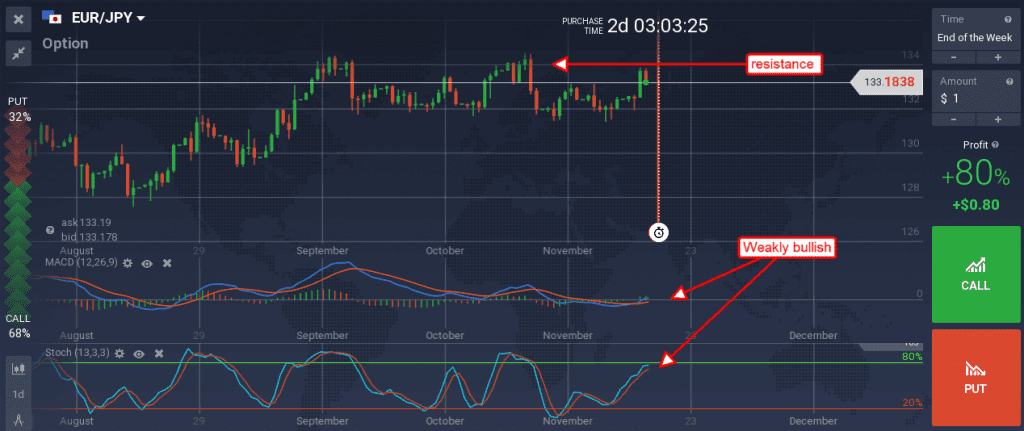

The EUR/JPY also met resistance despite strength in the EU trade data. This is due to better than expected data from Japan which strengthened the yen and offset gains in the euro. The pair hit resistance below 134.00 and well below the top of a two-month trading range.

The move leaves the pair range bound where it is likely to remain into the near term. Downside target for support is near 132.00, a break of which would be bearish.