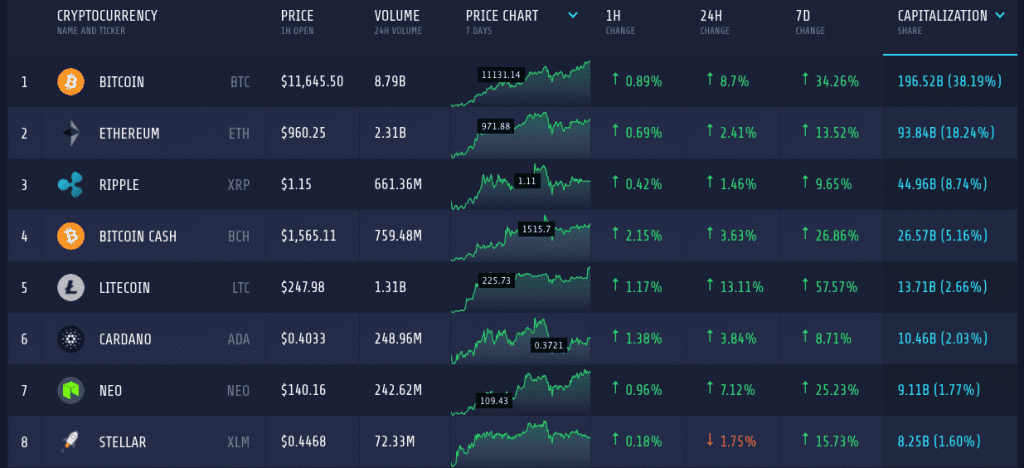

Cryptocurrencies are strongly maintaining their bullish dominance once again. Almost all the coins are adding to their values amid the crash. The total market cap has reached $514 billion.

Ethereum

Ethereum had a decent run the past week. The coin added 13.5 percent to its value over the week and is still maintaining its gradual bull, gaining around 2.5 percent on the daily chart. It is also one of the favorite coins among the traders as the trading volume in the last 24 hours was $2.3 billion. The market cap of this coin is $93.8 billion.

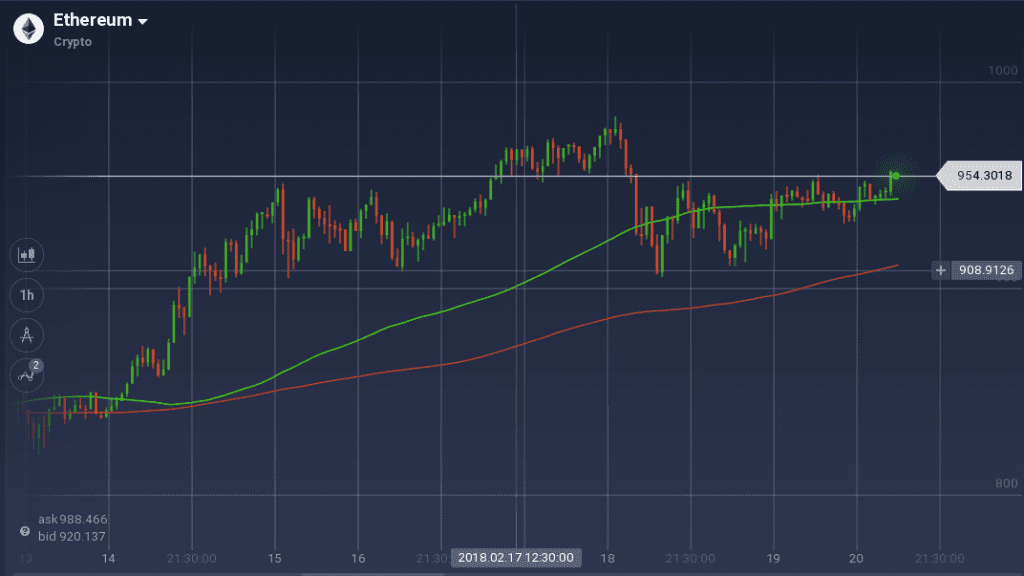

ETH gained significantly in the early week with a jump from $838 to $950. However, the coin faced a stiff resistance there. But with support at $911, the coin continuously tested the resistance level. Ultimately, ETH breached the resistance level, but only to face another resistance level between $972 to $981. This also resulted in a pullback, until support at $907 acted as a pivot. Though the coin is pushing to recover is apex value, another resistance around $950 is ceasing it from gaining further. The coin is continuously testing this resistance level and is currently trading around $954.

As the coin is on the brink of breaching the resistance, all technical indicators are soaring. MACD is signaling a bull after running stable for a while. Stoch is also soaring but is about to cross the overbuying mark. However, RSI is retreating from its bullish pace and going down with value at 66 percent.

NEO

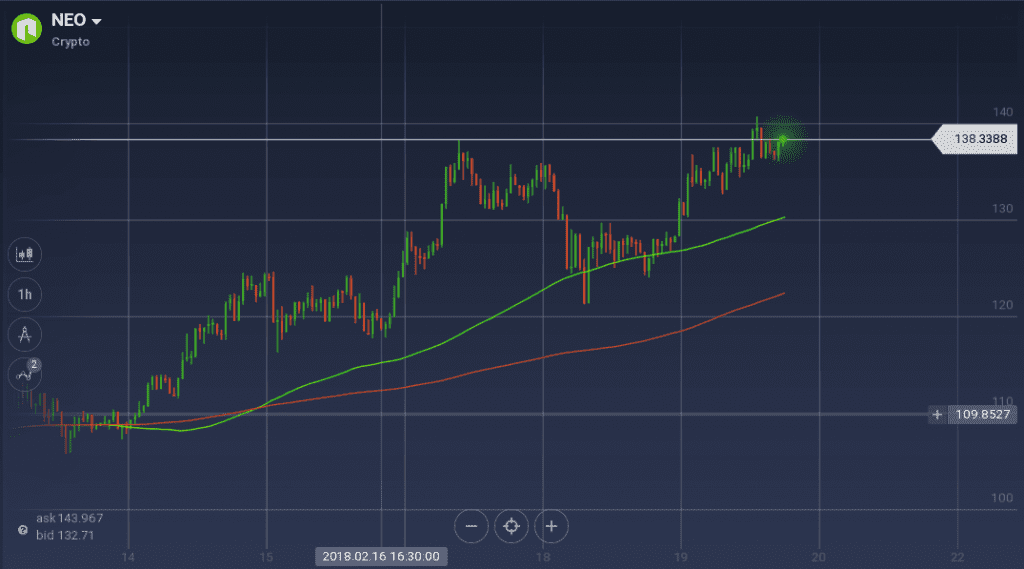

NEO, better known as “Ethereum of China,” is also on a bullish ride. It has made it position firm in the top 10 coins’ list by holding more than $9 billion in market cap. On the weekly chart, NEO gained a whopping 25 percent and on the daily, it appreciated by 7 percent. It is one of the favorite coins to the Asian traders as more than 20 percent of the trading is done against KRW. The total trading volume in the last 24 hours was $242 million.

NEO was dominated by steep bull all along the weekly chart, however, there were dips on the way. After the early week jump from $108 to $124, NEO faced a strong resistance level but a support level quickly formed at $117, which prevented any dives. Soon with a rage among the buyers, the coin jumped to $138. With another support forming at $131, NEO tested the resistance for a while, but it could not breach the resistance and ultimately took a downturn. The support around $124 held the value for a while and ultimately acted as a pivot to initiate another bull.

NEO is again facing the resistance around $138, but this time it is very determined and testing the level very aggressively.

Even though the coin is on an aggressive run, due to the resistance, the technical indicators are running dull. None of the oscillators are signaling anything significant. MACD is also running bearish. RSI is currently around 55 percent.

Market Update

In a statement to CNBC last Friday, White House cybersecurity coordinator and special assistant to the president Rob Joyce said the U.S. does not intend to regulate cryptocurrency anytime soon.

Messaging platform Telegram broke all records as it raised $850 million in an ICO pre-sale. The popularity of the platform has helped this token sale tremendously.

The National Bank of Poland (NBP), the country’s central bank, has reportedly admitted to paying for social media campaigns that attacked cryptocurrencies.

Conclusion

As the cryptocurrency market is back on track, the FUD is turning down. Also, it might be a good time for adding some new tokens in the portfolio while they are still on some discount.