A scathing article published in TechCrunch claims that ETH, the native cryptocurrency of the Ethereum network, is going to plummet if no changes are made. In the article cryptocurrency entrepreneur Jeremy Rubin says a concept called economic abstraction will render ETH worthless. Economic abstraction refers to the ability to pay for Ethereum transactions in a non-native currency, specifically the very ERC-20 tokens the Ethereum network powers.

If users can pay gas and other transaction fees using the token native to the service (OMG/Omisego is one example) the ETH tokens will become redundant and valueless. The scariest part of this assertion is that Ethereum co-founder Vitalik Buterin agrees. Of course, he goes on to explain that yes, Ethereum could fall prey to economic abstraction if no changes are made, and there are many changes for Ethereum on the horizon.

Buterin responded in a Reddit post that addressed the claims made by Rubin and refuted several. He also assured the community that there were two proposals in the works that would fix ETH place as the native token to the ETH network. Other concerns expressed by Rubin include Ethereum’s issues with scaling and smart-contract security, both addressed in the upcoming Constantinople hardfork and the sharing and Plasma upgrades.

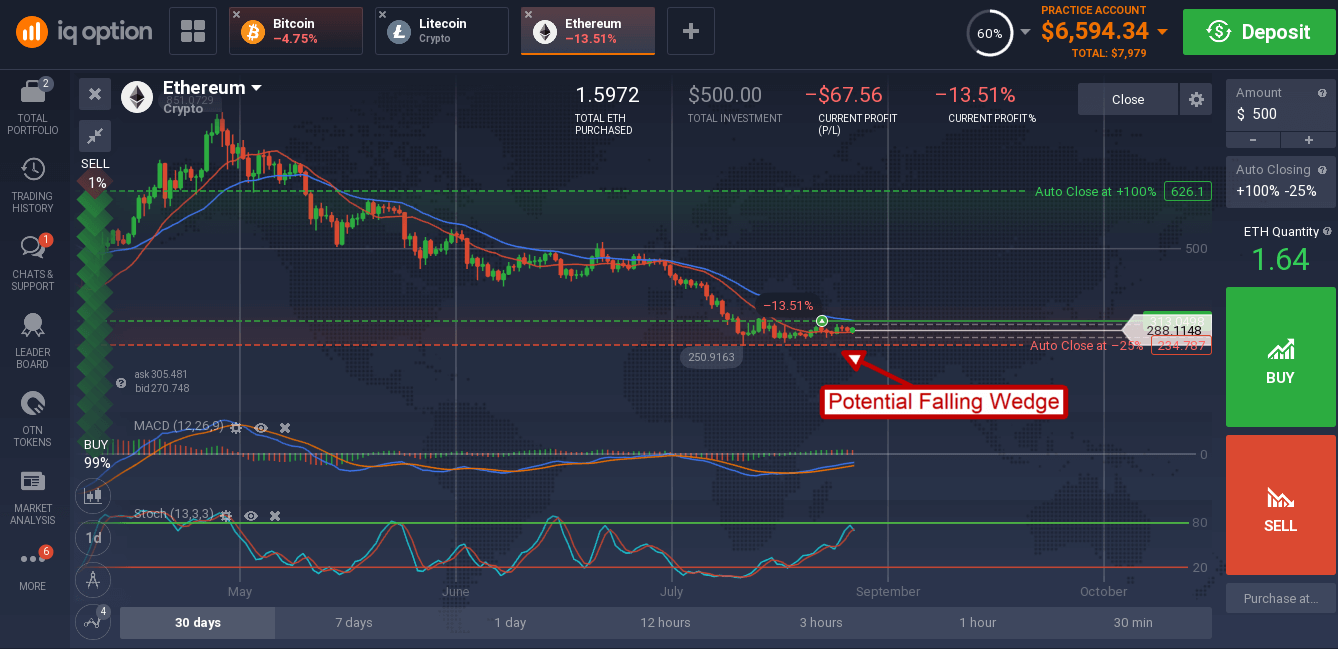

ETH was able to hold steady despite concerns raised by Rubin. The token remains below the $300 resistance target and does appear as if it may move lower. Price action over the past month has lagged the broader cryptocurrency market and is forming a wedge pattern. The wedge is often a sign of continuation which in this case could lead to another 50% in drop in prices. The caveat is of course the planned hardfork and upgrades scheduled for this fall.

A move above $300 would be bullish, a move above the short term 30 day moving average would signal a reversal in sentiment.

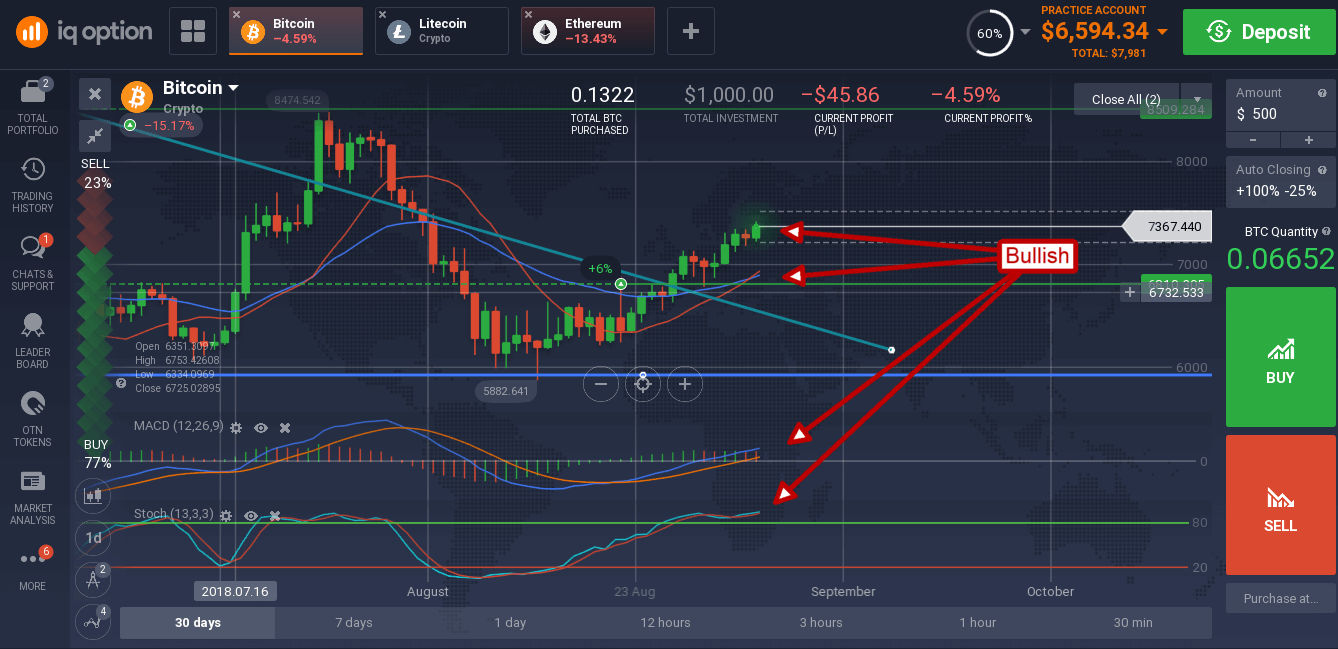

Meanwhile Bitcoin, the world’s leading cryptocurrency, has been making big gains over the past three weeks. The token has risen to a one month high over $7,300 and is indicated higher.

Projections for the near-term remain tame at $10,000 but BTC bulls like Tom Lee still see the worlds reserve cryptocurrency trading above $20,000 by the end of 2018.