Many new traders get overwhelmed by the sheer number of assets in the market. Where do you even start if you don’t have a clear idea of which ones are worth trading?

One solution is an instrument that allows you to trade a basket of assets at once, instead of choosing just a single stock or commodity. This instrument is called an ETF.

So, how IQ Option ETF trading works and is it a good way to begin? Check out this guide.

What Is an ETF?

An ETF stands for Exchange-Traded Fund. Think of it like a shopping basket at the supermarket: instead of buying just one item (a single stock), you get a basket filled with different products that work well together.

In trading terms:

- An ETF represents a group of assets — it can be stocks, bonds, commodities, or even currencies.

- You don’t pick just one single stock or commodity — you trade the basket.

- ETFs are listed and traded on exchanges just like regular stocks.

For example:

- The SPDR S&P 500 ETF (SPY) follows the 500 biggest US companies.

- The Gold ETF (GLD) reflects the price of gold.

- There are ETFs for technology, clean energy, emerging markets — almost anything you can imagine.

But remember: when you trade an ETF IQ Option, you’re not buying those assets themselves. You’re trading CFDs (Contracts for Difference). That means you only speculate on whether the ETF’s price will rise or fall — without owning the fund or its components.

How Are ETF Baskets Formed?

At this point, many traders ask: “If ETFs are just baskets, how do I know the basket isn’t full of random assets? And why not just pick the assets myself?”

Here’s how it works:

- ETFs follow strict rules

Each ETF is designed to track something specific — like an index, a sector, or a commodity.

Example: the S&P 500 ETF must hold the 500 biggest US companies. A Gold ETF must reflect gold prices — so its basket is linked to physical gold or futures contracts.

So the basket isn’t random. It’s carefully built to mirror a market or sector.

- Transparency and management

- ETFs are usually managed by large financial institutions (like BlackRock or Vanguard).

- Their job is not to gamble but to track the chosen index/sector as accurately as possible.

- Most ETFs publish their holdings daily, so anyone can see what’s inside.

- Risk balancing

If you buy one stock, you win or lose based on that company alone. With an ETF, losses in one asset can be balanced by gains in another, smoothing out extreme swings.

- When stock picking may be better

If you’re confident in your analysis of specific companies, picking your own stocks might give you higher potential returns. But for most beginners, ETFs provide a safer, more balanced entry point into trading.

Why Trade ETFs on IQ Option?

IQ Option ETF trading stands out for beginners because of:

- Simple interface — the platform is clean, visual, and beginner-friendly.

- Easy entry with just $10 — you don’t need huge capital to start CFD trading on ETFs.

- Leverage available — you can use leverage to boost your position size (but be careful — it increases risk too).

- Wide choice — from gold to tech, from indices to energy — IQ Option offers plenty of ETF CFDs.

- $10K practice account — test IQ Option ETF trading with a demo account before risking real money.

Pros and Cons of IQ Option ETF Trading

Like any instrument, ETFs have upsides and downsides.

✅ Pros

- Diversification — one CFD trade covers multiple assets.

- No stock-picking stress — you trade a whole sector, not just one risky stock.

- Flexibility — exist for nearly every industry or theme.

- Liquidity — ETFs are popular, so prices move actively.

- Transparency — you know exactly what the fund tracks.

❌ Cons

- Still risky — diversification reduces risk but doesn’t eliminate it.

- Leverage danger — using high leverage can multiply losses.

- Market hours apply — IQ Option ETF trading happens during exchange hours, not 24/7 like crypto.

How to Trade ETF CFDs on IQ Option

If you want to try ETF IQ Option trading, here’s the roadmap:

- Open an account

- Sign up and start with a demo account.

- Sign up and start with a demo account.

- Choose an asset

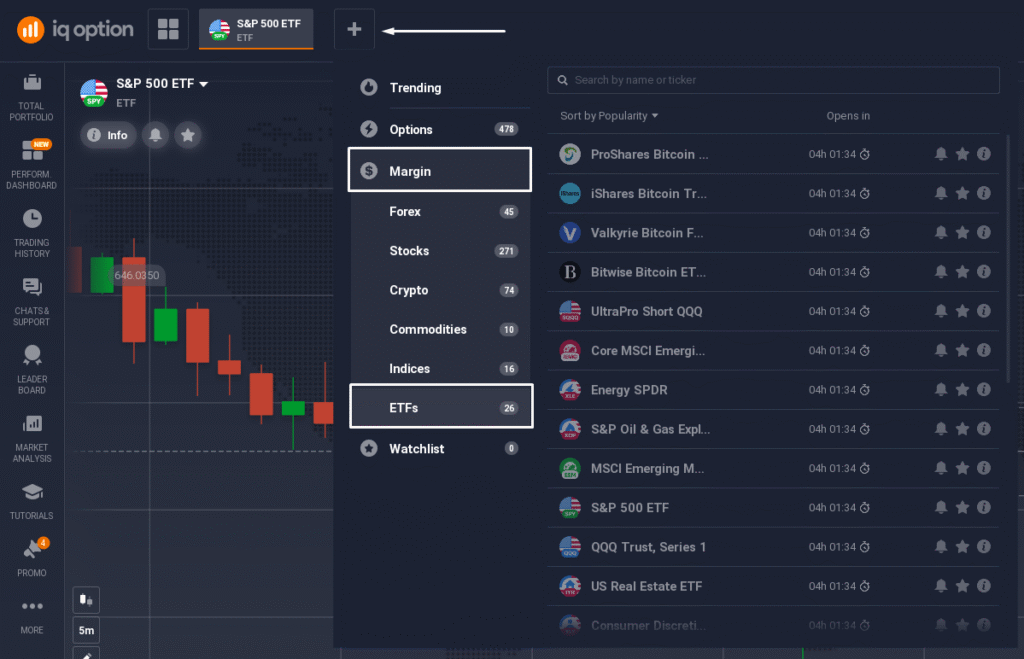

- Click the “+” button → Margin → ETFs.

- Pick one you’re interested in (e.g., tech, gold, or S&P 500).

3) Read the chart

- Use built-in charts and indicators.

- Check the overall trend and key levels.

4) Set trade size

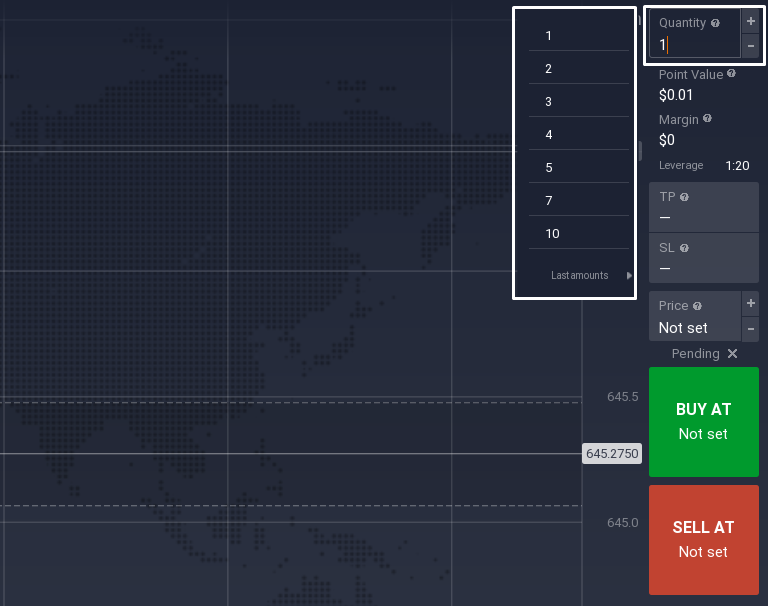

IQ Option ETFs are traded on the margin engine (with leverage). In this case, you set the trade amount in pips — which represent the minimum unit of price movement for the asset.

Example: if an ETF moves from 100.00 to 100.01, that’s 1 pip. The number of pips you choose determines how much your profit or loss changes when the price moves.

👉 Read more about margin trading in this article.

5) Know your leverage

To see the available leverage for the chosen asset, open the asset’s Info panel and tap Trading conditions.

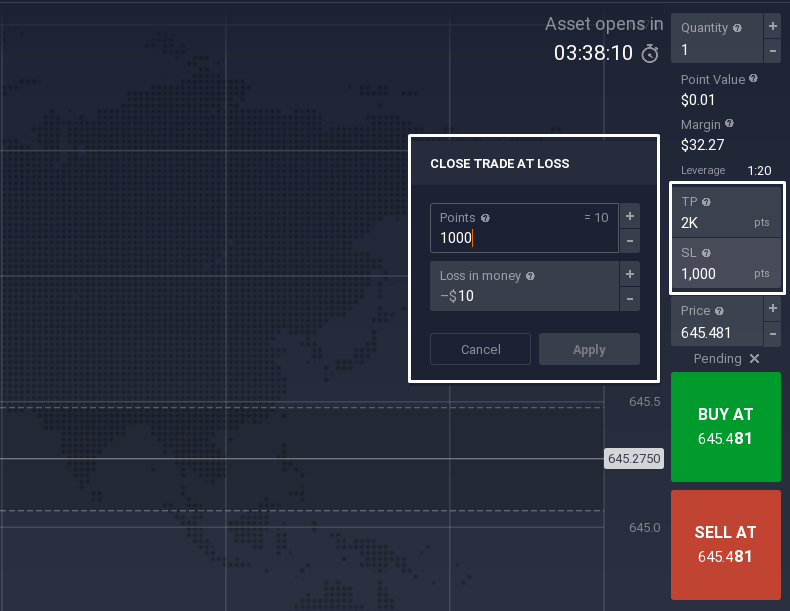

The platform will calculate the required margin for the trade automatically.

6) Manage risk

- Place a Stop-Loss to limit potential losses.

- Optionally set a Take-Profit to lock in gains.

4) Choose direction

- Expect a rise? Click Buy.

- Expect a drop? Click Sell.

7) Monitor & close

- Track your position on the platform.

- Exit manually, or let Stop-Loss/Take-Profit close it automatically.

Popular ETFs You Can Trade on IQ Option

Here are some ETFs commonly traded as CFDs on IQ Option:

| ETF Name | What It Tracks |

| Crypto ETFs | |

| ProShares Bitcoin ETF | Bitcoin price movements |

| iShares Bitcoin Trust | Bitcoin exposure through institutional ETF |

| Valkyrie Bitcoin Fund | Bitcoin performance |

| Bitwise Bitcoin ETF | Broad-based Bitcoin exposure |

| Broad Market & Indices | |

| S&P 500 ETF | 500 largest U.S. companies |

| QQQ Trust, Series 1 | Nasdaq-100 index (tech-heavy) |

| Dow Jones Industrial Avg. | 30 leading U.S. companies |

| iShares Russell 2000 ETF | Small-cap U.S. companies |

| Regional & Emerging Markets | |

| Core MSCI Emerging Markets | Stocks from developing countries |

| MSCI Emerging Markets | Broad emerging markets index |

| China Large-Cap ETF | Largest Chinese companies |

| MSCI Japan ETF | Large and mid-sized Japanese companies |

| MSCI Mexico ETF | Mexican equity market |

| Sector ETFs | |

| Energy SPDR | U.S. energy sector |

| S&P Oil & Gas Exploration | U.S. oil & gas exploration and production |

| Technology SPDR | U.S. tech sector |

| Consumer Discretionary SPDR | U.S. consumer discretionary sector |

| Utilities SPDR | U.S. utilities sector |

| Materials Select Sector SPDR | U.S. materials sector (chemicals, metals) |

| S&P Metals & Mining ETF | U.S. metals and mining companies |

| US Real Estate ETF | U.S. real estate market |

| Commodities & Gold | |

| Gold Miners ETF | Companies involved in gold mining |

| Daily Junior Gold Miners | Smaller gold-mining companies |

| Bonds | |

| 20+ Year Treasury Bond ETF | Long-term U.S. Treasury bonds |

| Thematic / Alternative | |

| ETFMG Alternative Harvest ETF | Cannabis industry |

| UltraPro Short QQQ | Inverse 3x exposure to Nasdaq |

👉 Pro tip: Start with big, well-known ETFs before exploring niche ones.

Beginner-Friendly ETF Trading Strategies

Here are three simple strategies to test:

1. Trend Following

- Indicators to use: Moving Averages (MA-50 and MA-200), MACD.

- How it works:

- Moving averages help spot the overall trend (price above MA = uptrend, below = downtrend).

- MACD confirms momentum and potential entry points.

- Strategy: Trade with the trend — buy during uptrends, sell during downtrends.

2. Breakout Trading

- Indicators to use: Support/Resistance lines, Bollinger Bands, RSI.

- How it works:

- Mark strong support and resistance zones.

- Bollinger Bands show when price is squeezing (low volatility) — often before a breakout.

- RSI helps filter false breakouts (avoid buying if RSI is overbought).

- Strategy: Enter when the price breaks above resistance or below support with strong volume/momentum.

3. News & Event-Based Trading

- What to use: Economic Calendar, Newsfeed, Volume indicator, ATR (Average True Range).

- How it works:

- Strategy: Combine fundamentals with indicators — e.g., if oil prices spike and Energy ETFs break resistance on high volume, it may be a strong buy signal.

Risk Management Tips For ETF Traders

- Never risk more than a small part of your balance on one trade.

- Always set Stop-Loss orders.

- Don’t trade on emotions.

- Practice with a demo account before going live.

ETFs vs. Stocks vs. Forex

For most beginners, ETFs provide a smoother entry than forex or stock picking. Let’s compare them:

| Feature | ETFs | Stocks | Forex |

| Diversification | Basket of assets | Single stock | Pair only |

| Risk Level | Medium | Higher | High |

| Complexity | Easy for beginners | Medium | High |

| Volatility | Moderate | High | Very high |

| Best For | Beginners, mid-term | Stock pickers | Advanced traders |

Common Questions About IQ Option ETF Trading

1. Do I own the ETF when trading on IQ Option?

No. You trade CFDs, which means you speculate on price changes. You don’t own the underlying assets.

2. Is ETF CFD trading safer than stocks?

Yes, generally — because ETFs are diversified. But it’s still risky.

3. Can I trade ETFs on weekends?

No. ETFs follow stock market hours.

4. How much money do I need to start?

From $10 — this is the minimum deposit amount at IQ Option. The minimum cost of one trade is just $1.

5. Which ETFs are the most popular and best for beginners?

For beginners, broad-market ETFs are usually the best starting points. They are diversified, highly liquid, and less volatile than niche sector ETFs. Some of the most popular ETFs on IQ Option are:

- S&P 500 ETF (SPY)

- QQQ Trust (QQQ)

- MSCI Emerging Markets ETF

- SPDR Gold Shares (GLD)

Final Thoughts

If you’re new to trading and want a balanced, beginner-friendly instrument, ETFs are a smart option. They combine diversification, simplicity, and flexibility — and on IQ Option, you can trade them as CFDs with small amounts of capital.

With patience, ETF CFD trading on IQ Option can become your stepping stone into the financial markets.