Today the economic calendar is full of several very high importance economic events, which can move the forex market. These are the top ones to focus on during the trading session on 20th July 2017.

Australian Employment Change and Unemployment Rate (June)

Time: 01:30 GMT

![]()

Higher readings for the employment and lower reading for the unemployment rate are positive for the Australian Dollar and the Australian economy, reflecting higher consumer spending, which can lead to higher economic growth and higher readings of GDP. The expectations are for the unemployment rate to remain unchanged at 5.6% and the employment change to be 15.0k, lower than the previous reading of 38.0k.

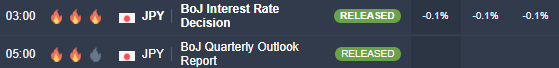

Bank of Japan Monetary Policy Rate and Outlook Report

Time: 03:10 GMT

The expectations are for the Bank of Japan to keep its monetary policy steady, and make no change to the interest rates, but any monetary policy from any central bank is of top economic importance as it provides insights and comments about inflation expectations and general economic outlook. Even with no change in interest rated the statements made by the Bank of Japan may cause significant volatility for the USD/JPY, with a focus on the inflation and the GDP growth.

Japanese All Industry Activity Index (May)

Time: 04:30 GMT

An economic index which measures changes in several industries, such as service, manufacturing and construction and provides information about the state of the Japanese economy and its growth. Higher readings are positive and the outlook is for a reading of -0.8%, lower than the previous reading of 2.3%.

Bank of Japan Governor Haruhiko Kuroda speech

Time: 06:30 GMT

After the initial reaction of the forex market to the Bank of Japan monetary policy, there is the important speech from the Bank of Japan Governor, which can also provide crucial fundamental news and comments to move the Japanese Yen.

European Central Bank Rate Decision

Time: 11:45 GMT

While the expectations are for the ECB to keep interest rates unchanged at 0.00%, the forex market will focus on news about the ECB’s bond buying program, inflation and economic growth.

US Initial Jobless Claims and Continuing Jobless Claims

Time: 12:30 GMT

Lower than expected readings for the Initial and Continuing Jobless Claims are positive for the US Dollar indicating a stronger labor market.

ECB President Mario Draghi Press Conference

Time: 13:30GMT

A second speech from a central bank, this time from the ECB can move the EUR/USD on any comments about the bond buying program, and the rate of inflation which can reveal fundamental information about the future of any interest rate hikes.