The release of the next monetary policy account is expected to occur on Thursday 6th July 2017.

Market participants are predominantly expecting that the ECB (European Central Bank) meeting minutes will indicate firmer plans to further tighten monetary policy. The minutes released on July 6th 2017 will present the discussions and forecasts set out during the June 2017 ECB meeting. It is expected that the major focus will be on the extent to which the governing council of the ECB discussed reducing quantitative easing – how much ‘tapering’ of the bond buying monetary stimulus programme can we expect in the short to medium term.

In comments made towards the end of June at the ECB Forum on Central Banking in Sintra ECB President Mario Draghi suggested he was looking at measures to tighten monetary policy – suggesting stimulus may not need to be as substantial and sizeable as it had been as we move forward through 2017. He made suggestions that the cutting of interest rates and bond buying phases executed previously may be on the reverse.

Inflation is the dominant a concern. The latest released estimates of inflation from the European Commission have demonstrated a rise in consumer prices, gaining by 1.3 per cent in June and falling lower from the level of 1.4 per cent that was reported in May of this year. Although inflation fell in June – driven by energy prices, specifically oil – core inflation (which strips out volatile oil pricing) continued to rise.

Draghi has furthermore made comments saying that “reflationary” forces had replaced those of deflation and this has been the trigger to raising market expectations of the likelihood of tightening of monetary policy. This one comment almost immediately sent the German bond markets higher – alongside other European bond segments. However, President Draghi soon commented that this was an overreaction from the market. Further to this, ECB members including President Draghi, have maintained their stance that they require inflation to rise sustainably towards its 2% target before taking any monetary policy tightening actions.

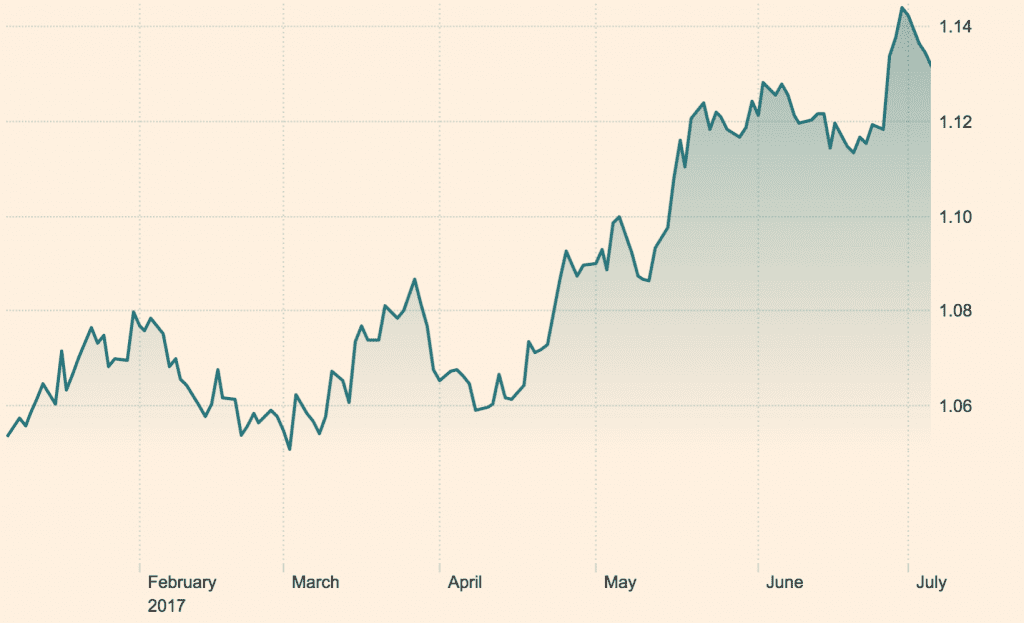

If the minutes do in fact indicate increased confidence and tightening of monetary policy we can expect to see moderately increased volatility in the Euro as well as a continuation of the steady increase the currency has been experiencing since the start of the year.

Image source: Source: https://markets.ft.com/

Investors as well as bond market traders are watching closely for further hints of the next steps from the ECB for European monetary policy – with some theorising that the ECB has reached a period where they have run out of reasons not to tighten monetary policy. The 60 EUR billion bond buying monthly programme is outlined to continue through to the end of 2017. Mr Draghi has indicated some moderate confidence in the European economy – and should this be reflected in monetary policy we may see a reduction in the monthly 60 EUR billion programme of bond buying.

Further to this, the ECB committee will meet on July 20th to officially decide on the level of interest rates and this week’s policy meeting minutes will be crucial to that decision as well as the financial market behaviour in the days between.

Will you be trading the EUR currency pairs in the wake of the news?

Sources:

https://www.ecb.europa.eu/press/accounts/2017/html/index.en.html

https://www.ft.com/content/56408542-5fef-11e7-8814-0ac7eb84e5f1

https://markets.ft.com/data/currencies/tearsheet/summary?s=eurusd&mhq5j=e3

https://www.reuters.com/article/diary-top-econ-idUSL3N1JU4OL

http://markets.businessinsider.com