The EUR/USD pair moved significantly up, retesting the highs of 2017 after the European Central Bank released the minutes from its June monetary policy statement. The text of the document revealed that policymakers are showing more willingness to move from the monetary easing cycle, a major shift in the monetary policy.

Euro

The minutes of the ECB June monetary policy pushed EUR/USD significantly higher, with gains of 0.60% moving from the low price of 1.1330 to the high price of 1.1425.

The minutes of the ECB June monetary policy pushed EUR/USD significantly higher, with gains of 0.60% moving from the low price of 1.1330 to the high price of 1.1425.

The German Factory Orders came weaker than expected for the month of May with a reading of 1.0% compared to the forecast of 1.9% on monthly basis, the Markit Germany Construction PMI and Markit Germany Retail PMI were both a bit softer than their previous readings, but the main event that caused the rally for the EUR/USD were the statements about a potential monetary policy shift, the willingness of the ECB to gradually reduce its purchases of bonds.

This is a major event and the traders reacted positively to it. It is also important to mention that a few days before there were also positive comments from the chair of the ECB Mario Draghi about the European economy.

Australian Dollar

![]()

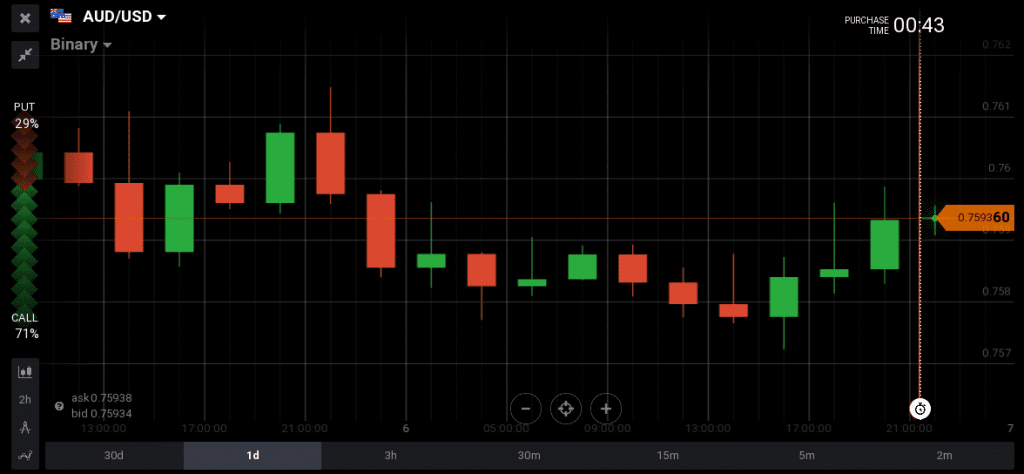

The Australian Trade Balance for the month of May showed a larger than expected trade surplus, which is positive for the Australian Dollar, showing more exports than imports for the Australian economy.

The Australian Trade Balance for the month of May showed a larger than expected trade surplus, which is positive for the Australian Dollar, showing more exports than imports for the Australian economy.

The AUD/USD however did not move up as in theory, but moved down 0.30% from 0.7615 to 0.7578.

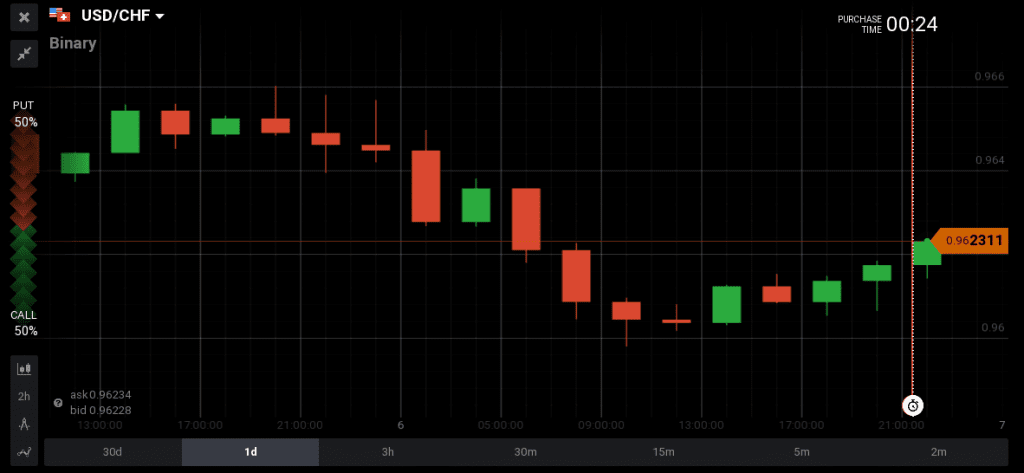

Swiss Franc

The Swiss Consumer Price Index for the month of June fell to 0.2% compared to its previous reading of 0.5%, so this falling CPI is not supportive for the Swiss Franc as the Swiss National Bank should not worry about raising interest rates any time soon.

The Swiss Consumer Price Index for the month of June fell to 0.2% compared to its previous reading of 0.5%, so this falling CPI is not supportive for the Swiss Franc as the Swiss National Bank should not worry about raising interest rates any time soon.

The gold prices were modestly up, and the USD/CHF moved down 0.37% from 0.9690 to 0.9601, probably as there is a high correlation between the price action of EUR/USD and USD/CHF, an inverse price movement in many times.

Canadian Dollar

The Canadian Building Permits showed great gains for the months of May with a reading of 8.9% compared to the forecast of only 1.0%. The large growth in the construction sector can act as a leading indicator for the economy in general and is positive for the Canadian Dollar. However this strong reading was not enough for the Canadian Dollar to show some gains as recently.

The Canadian Building Permits showed great gains for the months of May with a reading of 8.9% compared to the forecast of only 1.0%. The large growth in the construction sector can act as a leading indicator for the economy in general and is positive for the Canadian Dollar. However this strong reading was not enough for the Canadian Dollar to show some gains as recently.

The USD/CAD moved up 0.17% from 1.2924 to 1.2984, while the oil prices had a rally which faded soon.

US Dollar

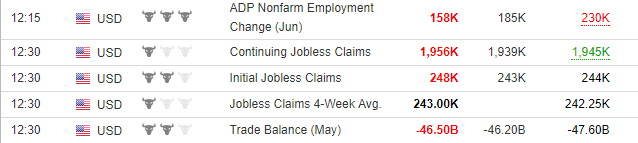

The US Trade Balance deficit showed an improvement for the month of May as the deficit narrowed to $-46.5 billion form -$47.6 Billion in the previous month, a supportive reading for the US Dollar. But the US ADP Employment Change of 158K jobs was less than the expectation of 188K jobs, and weekly Initial Jobless Claims and Continuing Claims were both higher than the forecasts, reflecting weakness for the labor market and being negative for the US Dollar. On the other hand the ISM Services/Non-Manufacturing Composite for the month of June was stronger than expected, being positive for the US Dollar. With all this mixed data, the US Dollar had a mixed day.

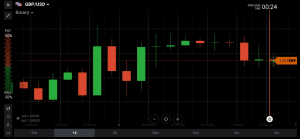

The GBP/USD was higher 0.26% from 1.2920 to 1.2984, and USD/JPY was down 0.10% from 113.47 to 112.90.

Economic calendar for Friday 7th July 2017

Today the economic calendar is full of very important data so there should be high volatility in the forex market. The main event is the US Non-farm Payrolls at 12:30 PM GMT time.

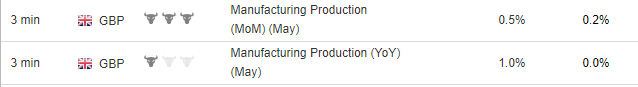

But there are also important economic news related to the Japanese economy early in the morning, a lot of economic data about the UK and its economy such as the Manufacturing Production for the month of May, the German Industrial Production, and the Canadian Unemployment Rate for the month of June. The US Non-farm Payrolls depending on the outcome could set a new trend change for the US Dollar.