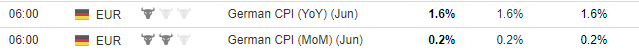

The Australian Dollar continued to have strong gains against the US Dollar and the trend in AUD/USD was the strongest one for Thursday 13th July 2017. The GBP/USD currency pair also had another nice trend as the British Pound appreciated against the US Dollar, while other pairs were little changed.

Australian Dollar

The Consumer Inflation Expectation reading for the month of July 2017 came in at 4.4%, much higher than the previous reading of 3.6%, an indication that inflation may be rising at a fast pace for the Australian economy.

The Consumer Inflation Expectation reading for the month of July 2017 came in at 4.4%, much higher than the previous reading of 3.6%, an indication that inflation may be rising at a fast pace for the Australian economy.

The Australian Dollar continued to appreciate against the US Dollar as the AUD/USD moved up 0.82% from 0.7675 to 0.7743.

Euro

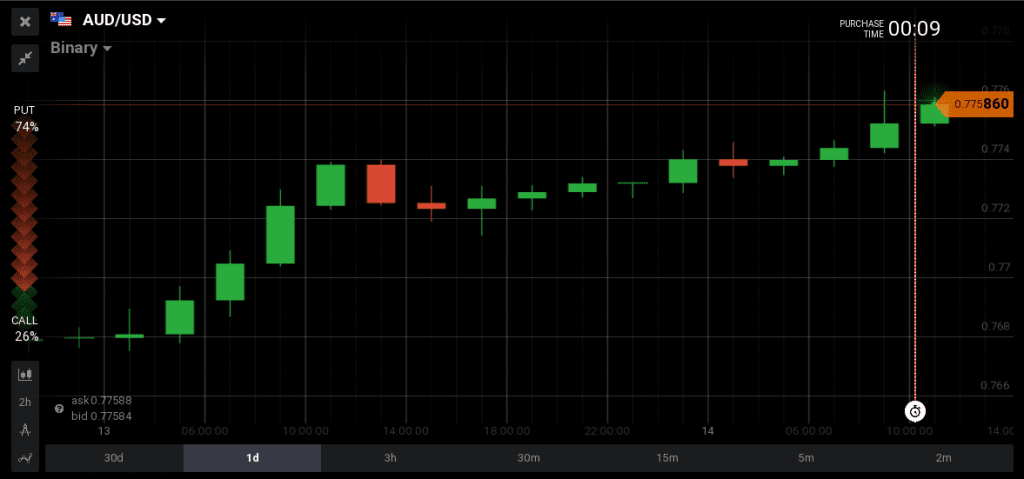

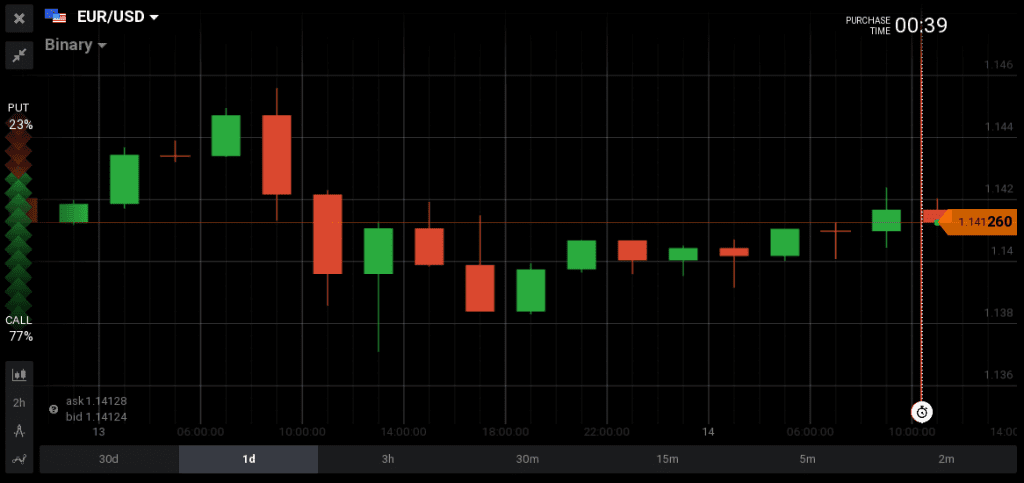

The German Consumer Price Index reading for the month of June 2016 came in at 1.6% and 0.2% for the yearly and monthly basis respectively, and exactly at the same readings with the expectations. This stability in low inflation prices for the German economy does not add much inflationary pressures to the Eurozone economy, and is considered neutral for the Euro. The EUR/USD was little changed down 0.07% from 1.1456 to 1.1371.

The German Consumer Price Index reading for the month of June 2016 came in at 1.6% and 0.2% for the yearly and monthly basis respectively, and exactly at the same readings with the expectations. This stability in low inflation prices for the German economy does not add much inflationary pressures to the Eurozone economy, and is considered neutral for the Euro. The EUR/USD was little changed down 0.07% from 1.1456 to 1.1371.

Canadian Dollar

After a day with very strong gains due to the interest rate increase by the Bank of Canada, the Canadian Dollar continued to have gains, but at a more moderate pace against the US Dollar.

After a day with very strong gains due to the interest rate increase by the Bank of Canada, the Canadian Dollar continued to have gains, but at a more moderate pace against the US Dollar.

![]()

The Canadian New Housing Price Index reading for the month of May 2017 came in at 3.8% and 0.7% for the yearly and monthly basis accordingly, higher than the estimates of 3.5% and 0.3%. Although both readings were lower than their previous readings, they suggest growth for the housing market and inflationary pressures, which are positive for the Canadian Dollar. The US oil prices were also higher for the fifth consecutive day. The USD/CAD moved down 0.17% from 1.2770 to 1.2721.

US Dollar

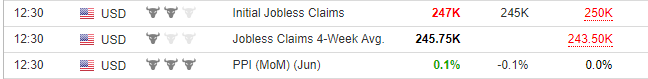

The US Initial Jobless Claims reading was 247k, a bit higher than the forecast of 245k, but the Continuing Claims reading fell to 1945k, lower than the forecast of 1950k. There was a series of economic readings about the Producer Price Index, which shows change in prices from the producer perspective, and all almost came in line with expectations, showing not significant inflationary pressures.

Mrs Janet Yellen made a testimony for the second day to the Congress, making comments about the improvement of the US economy and that there are plans for increasing the interest rates. The reaction for the US Dollar was mixed.

Economic events for Friday 14th July 2017

The forex market today will focus on several economic data. There is the Japanese Industrial Production for the month of May, the Euro-Zone Trade Balance for May, but the main events are related to the US economy. At 12:30 PM GMT time there is the important announcement of Consumer Price Index, reflecting inflation, and also at the same time there is the release of Advance Retail Sales, while later on at 14:00 PM GMT time there is the announcement of University of Michigan confidence. These macroeconomic data can either support the US Dollar or not, depending on the outcomes.