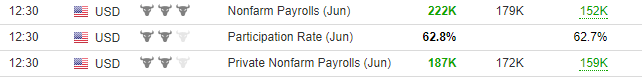

US non-farm payrolls beat expectations by a wide margin on Friday 7th July 2017, strengthening the US Dollar against the majority of its counterparts, with the exception of Australian and Canadian Dollar. This strong number from US non-farm payrolls has the potential to set the tone for this new trading week.

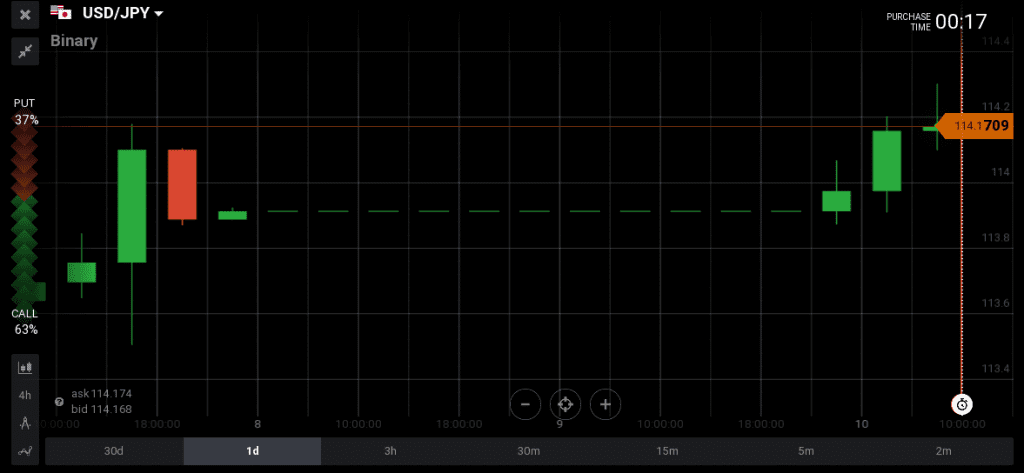

Japanese Yen

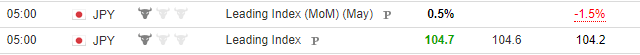

Labor Cash Earnings for the month of May 2017 were higher than expected, with a reading of 0.7% compared to the forecast of 0.4%, while the Leading Index for May was a bit higher than the expectation as it came in 104.7 and the forecast was 104.6.

Labor Cash Earnings for the month of May 2017 were higher than expected, with a reading of 0.7% compared to the forecast of 0.4%, while the Leading Index for May was a bit higher than the expectation as it came in 104.7 and the forecast was 104.6.

These both positive readings are supportive for the Yen, showing increased domestic spending ability and that most economic indicators are positive for the economy. But the Yen depreciated against the US Dollar due to the strong US non-farm payrolls and the USD/JPY moved up 0.59% from 113.07 to 114.19. The weekly gains for USD/JPY were 1.34%, moving from 111.92 to 114.19.

Euro

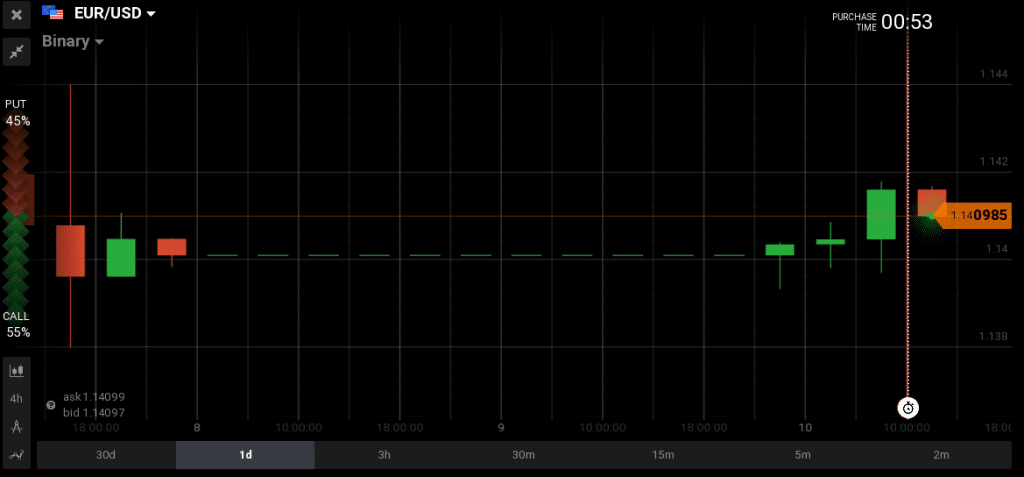

The German Industrial Production reading was higher than expected both on a monthly and yearly basis for the month of May, with readings of 1.2% and 5.0% respectively, while their forecasts were 0.2% and 4.0% accordingly. This rising Industrial Production is positive for further economic expansion of Germany and supportive for the Euro. But the forex market was waiting for the main event of the US non-farm payrolls and in this respect the EUR/USD moved down 0.19% from 1.1440 to 1.1378.

The German Industrial Production reading was higher than expected both on a monthly and yearly basis for the month of May, with readings of 1.2% and 5.0% respectively, while their forecasts were 0.2% and 4.0% accordingly. This rising Industrial Production is positive for further economic expansion of Germany and supportive for the Euro. But the forex market was waiting for the main event of the US non-farm payrolls and in this respect the EUR/USD moved down 0.19% from 1.1440 to 1.1378.

On weekly basis the EUR/USD fell 0.22% from 1.11440 to 1.1311.

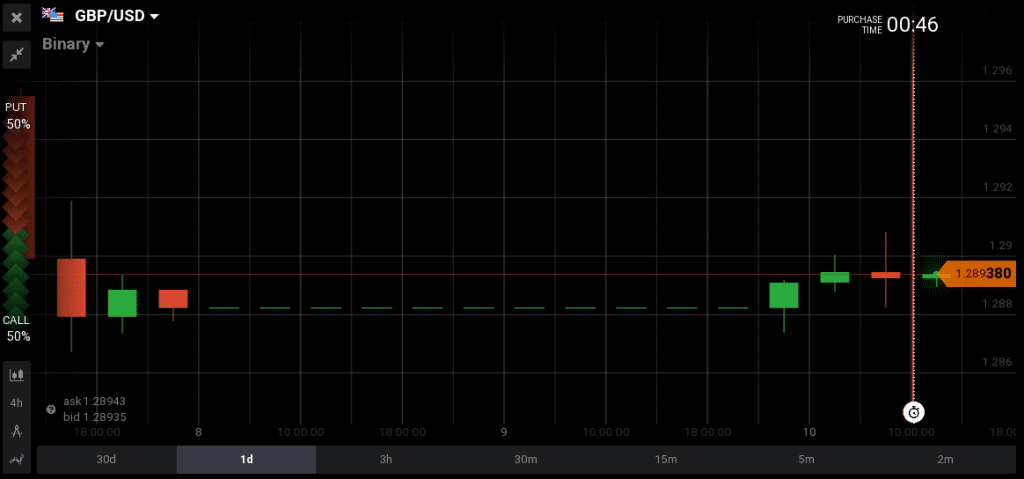

British Pound

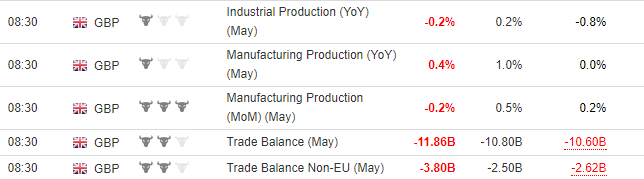

A series of disappointing economic readings for the UK Industrial Production, Manufacturing Production and Construction Output for the month of May, plus a higher than expected Visible Trade Balance deficit were all negative for the British Pound and as a result the Pound depreciated significantly against the US Dollar. These week economic readings must be closely monitored and analyzed on a monthly basis as they can provide important information about the Brexit effects on the UK economy in terms of economic growth, inflation and the possibility of an interest rate change.

A series of disappointing economic readings for the UK Industrial Production, Manufacturing Production and Construction Output for the month of May, plus a higher than expected Visible Trade Balance deficit were all negative for the British Pound and as a result the Pound depreciated significantly against the US Dollar. These week economic readings must be closely monitored and analyzed on a monthly basis as they can provide important information about the Brexit effects on the UK economy in terms of economic growth, inflation and the possibility of an interest rate change.

The GBP/USD moved down 0.61% from 1.2977 to 1.2864. On weekly basis there were losses for the pair as well of about 1.04% as the pair moved down from 1.3026 to 1.2864.

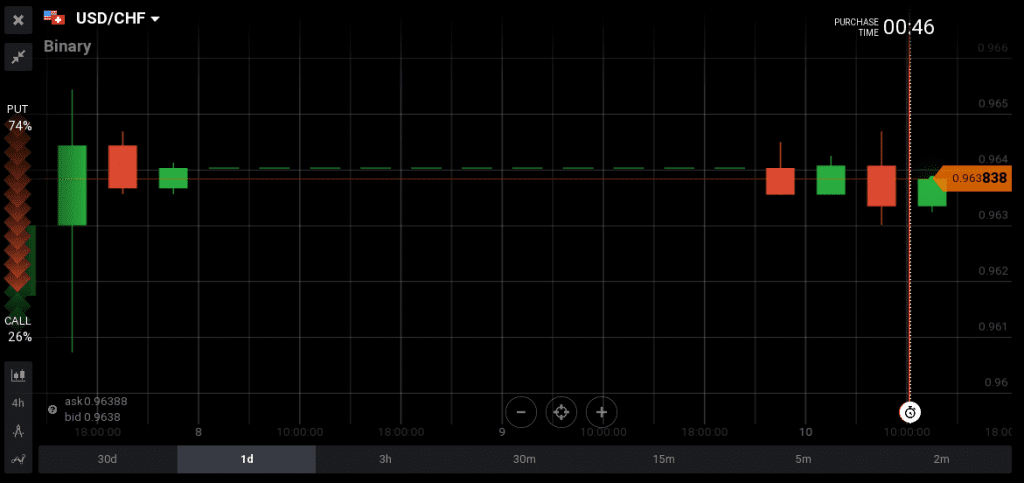

Swiss Franc

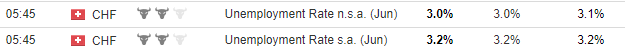

The Swiss Unemployment reading came in exactly as the forecast at 3.0% for the month of June, a neutral reading. But due to the strong US non-farm payrolls the gold prices fell almost 1.11%, and in turn the Swiss Franc depreciated against the US Dollar.

The Swiss Unemployment reading came in exactly as the forecast at 3.0% for the month of June, a neutral reading. But due to the strong US non-farm payrolls the gold prices fell almost 1.11%, and in turn the Swiss Franc depreciated against the US Dollar.

The USD/CHF moved up moderately, with gains of 0.35%, from 0.9599 to 0.9656. On weekly basis the gains for USD/CHF were 0.59% as the pair from 0.9579 to 0.9689.

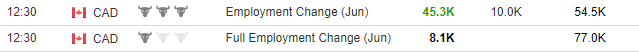

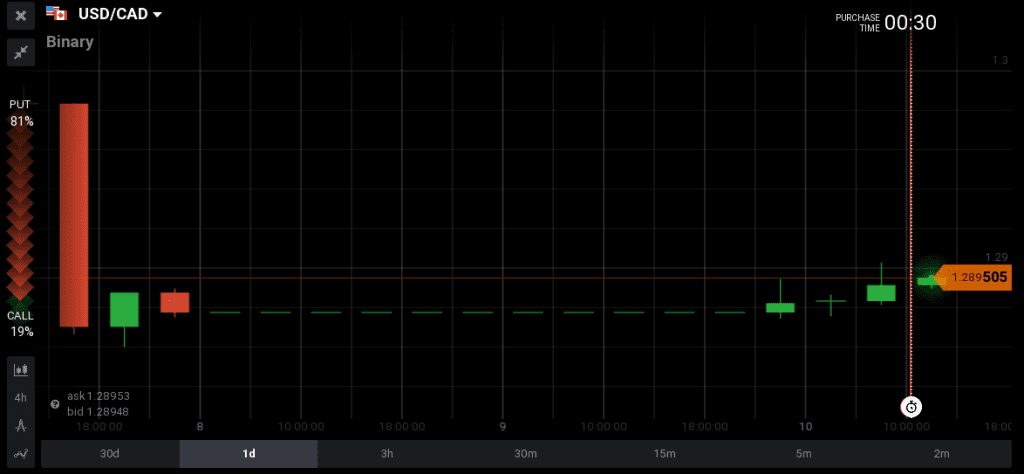

Canadian Dollar

A very strong Net Change in Employment for the Canadian economy with a reading of 45.3k against the forecast of 10.0k for the month of June and a small decline in the Unemployment Rate with a reading of 6.5%, lower than the forecast of 6.6%, were both very positive for the Canadian Dollar. The Canadian Dollar had strong gains against the US Dollar, as the USD/CAD moved lower 0.79% from 1.2995 to 1.2857.

A very strong Net Change in Employment for the Canadian economy with a reading of 45.3k against the forecast of 10.0k for the month of June and a small decline in the Unemployment Rate with a reading of 6.5%, lower than the forecast of 6.6%, were both very positive for the Canadian Dollar. The Canadian Dollar had strong gains against the US Dollar, as the USD/CAD moved lower 0.79% from 1.2995 to 1.2857.

There was also a strong selloff for the oil prices, about 2.83% which did not have any negative impact for the USD/CAD. The forex market now may focus on the possibility of an interest rate hike on Wednesday 12th July 2017 from the Bank of Canada. On weekly basis the Canadian Dollar appreciated against the US Dollar as the USD/CAD moved down 0.69% from 1.3016 to 1.2857.

US Dollar

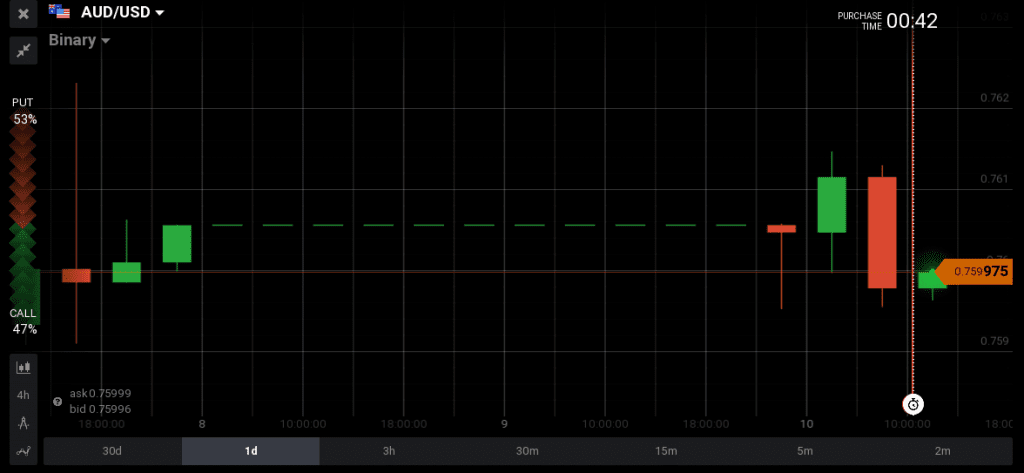

A very strong Change in Non-farm Payrolls for the month of June with a reading of 222k, higher than the forecast of 178k was very supportive for the US Dollar showing a healthy and strong labor market.

The Unemployment Rate reading came in at 4.4%, higher than the forecast of 4.3% and Average Hourly Earnings were also lower than their expectations, both on a monthly and yearly basis, a neutral to slightly negative readings. The Australian Dollar completely ignored the strong US non-farm payrolls reading and appreciated against the US Dollar as the AUD/USD moved up 0.26% from 0.7569 to 0.7624.

But on a weekly basis the Australian Dollar had losses against the US Dollar as the AUD/USD moved down 1.11% from 0.7696 to 0.7567.

This very strong US non-farm payrolls reading is generally very positive for the US Dollar, and it can form new trends this month, but it is important to highlight the fact that later in the summer liquidity may decrease in the forex market due to the summer holidays, especially in August.

Economic events for Monday 10th July 2017

Today there is a light economic calendar with main events a speech from the Governor of the Bank of Japan, and German Exports and Imports. The forex market will continue to weigh on the outcome of the US non-farm payrolls as the key economic data for today, and this could result in the continuation of the US Dollar strengthening.