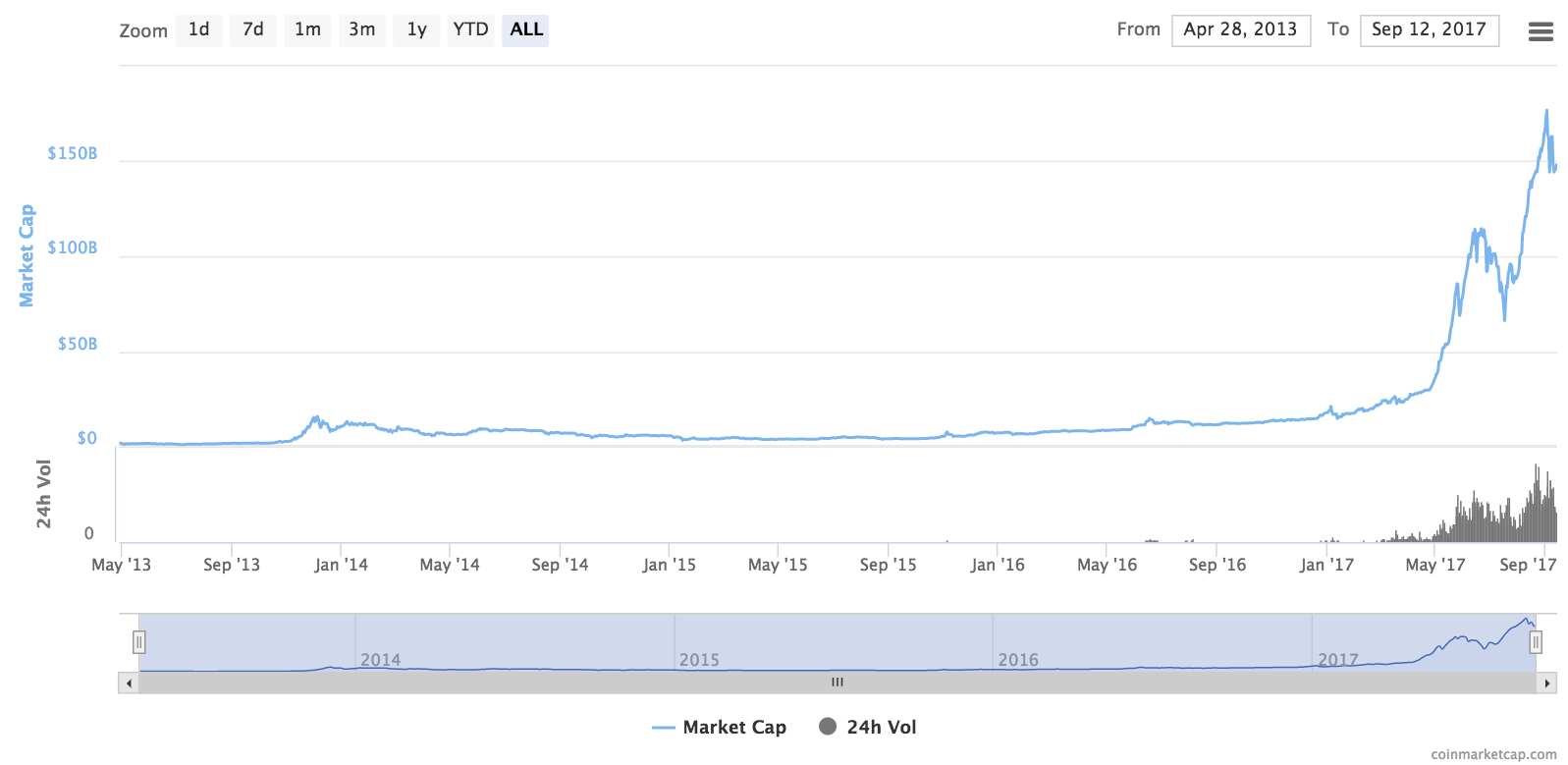

The applications of cryptocurrencies and blockchain technology are growing at an accelerating pace. The popularity of digital currencies and transactions is at an all-time high – and similarly the user base numbers, trading volumes and market capitalization of the cryptocurrency market have exploded in 2017. One of the logistic hurdles of cryptocurrencies reaching a larger number of people and applications is the level of accessibility for every day transactions. This access has been blocked in part because of regulatory hurdles, which vary from country to country across the globe.

However, another key factor to achieving higher adoption rates is to increase the amount of merchant acceptance.

Why do we need a Crypto Debit Card?

The easier it is to spend cryptocurrency with an everyday vendor the more likely these digital currencies will be used in everyday, consumer based living and beyond. Cryptocurrency debit cards provide one answer to this conundrum. Numerous tech companies are currently, aggressively attempting to make the first significant mark in this area of cryptocurrency transactions – the first one to create a robust, popular, secure and effective system has a chance to become the gold standard, and monopolise the market, or at least gain significant market share.

Who are the Providers?

Cryptocurrency debit card development has been underway for over two years– but 2017 has created a spectacular surge in demand and volume of cryptocurrency transactions, spurring on development in the fintech companies providing these debit card platforms as demand driven investment pours in.

As of 2017 over thirty cryptocurrency debit cards are in circulation – with a moderate amount of differentiation between them. For example, they have differing fee structures, process transactions between different cryptocurrencies and fiat currencies and add on various levels of maintenance charges.

Coinbase

Coinbase launched the first ever Bitcoin debit card in 2015 and has furthermore recently received 100USD million in Series D funding.

TenX

Another big name in this space is Singapore based TenX, who are attempting to integrate Bitcoin, Ethereum and Dash cryptocurrencies for payments across both the Visa and MasterCard network.

Monaco

Monaco is an increasingly popular name is this space – supporting Bitcoin and Ethereum spending and offering interbank exchange rates without additional mark-up fees. This feature is especially attractive when you consider that users save approximately £30-£40 on every £500 spent when compared against traditional banking transaction charges.

OCASH

The latest cryptocurrency debit card comes from OCASH – which will allow the use of a number of different crypto-tokens through a system known as Stablecoins. This is a SmartCoin based system that allows processing of tokens based on the most popular currencies – such as bitUSD, bitEUR, bitGBP, Bitcoin, and Ethereum – for any general purchases.

Additional providers that are growing in popularity include Xapo, BitPay, Cryptopay, Wirex, CoinsBank.

How does it work?

Cryptocurrency debit cards work as simply and effectively as traditional debit cards. They are able to operate within the existing infrastructure – with Visa and MasterCard providing a payment network between vendor and cryptocurrency spender in much the same way that they currently do.

Customers pay with cryptocurrency such as Bitcoin and the merchant receives fiat currency such as US dollars. Companies like TenX provide the link and technology in between that converts the currency flows so that neither the payment network or merchant is inconvenienced and customers are able to spend their tokens freely across the globe.

What are the Benefits?

Specifically, the biggest benefit is freedom. Cryptocurrency debit cards give users the option to spend their virtual currency with simplicity in everyday transactions – such as in restaurants and shops. By making this type of crypto spending so much more accessible we may see even more innovation and adoption of virtual currencies in wider areas of society and industry.

Sources:

- https://cointelegraph.com/

- http://www.ibtimes.com/

- http://www.pymnts.com/