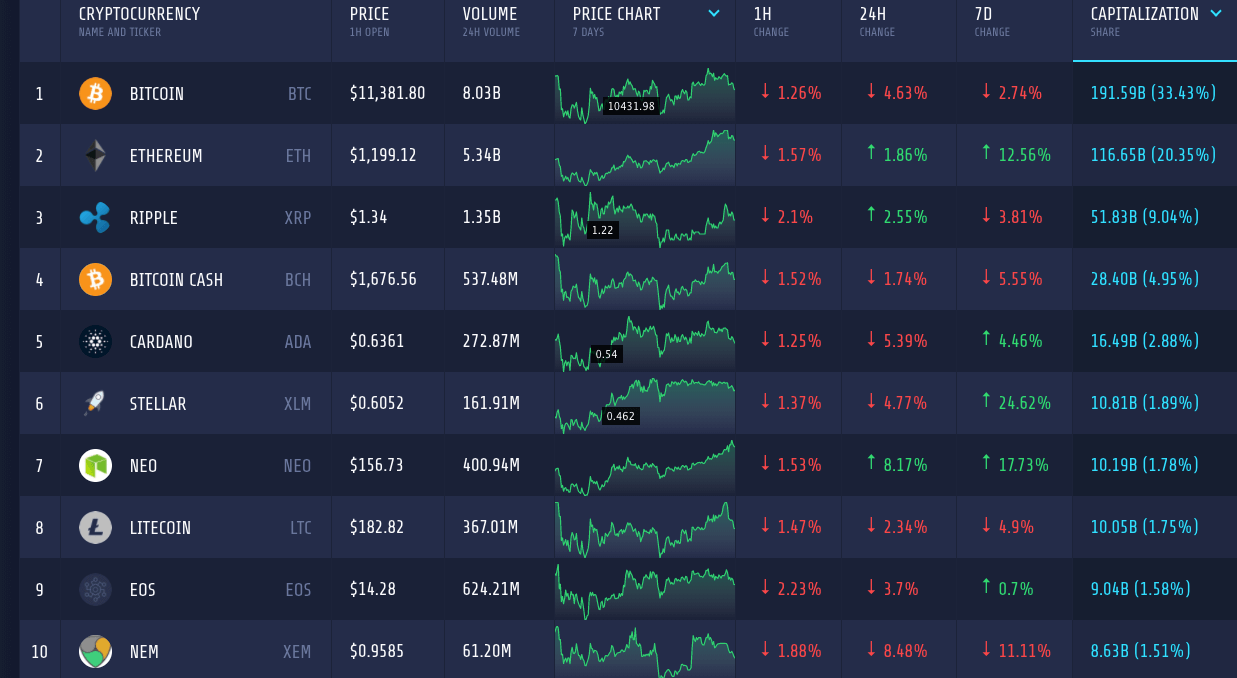

The cryptocurrency market is up again, and many coins gained significantly in this weekend. The total market cap of the market has now reached $573 billion. And now, the listed blockchain projects are little shy to reach 1500. This is a huge advancement in the blockchain space.

Ethereum

Ethereum has quite a good week, as the crypto market regained its upward pace. The coin gained over 12 percent in the last 7 days, but the gain percentage dropped to mere 1.8 percent in the last 24 hours due to the pullback from the peak. Ethereum still holds a market cap of above $116 billion. The coin is also attracting a lot of traders lately, as the trading volume on the last 24 hours is over $5.3 billion.

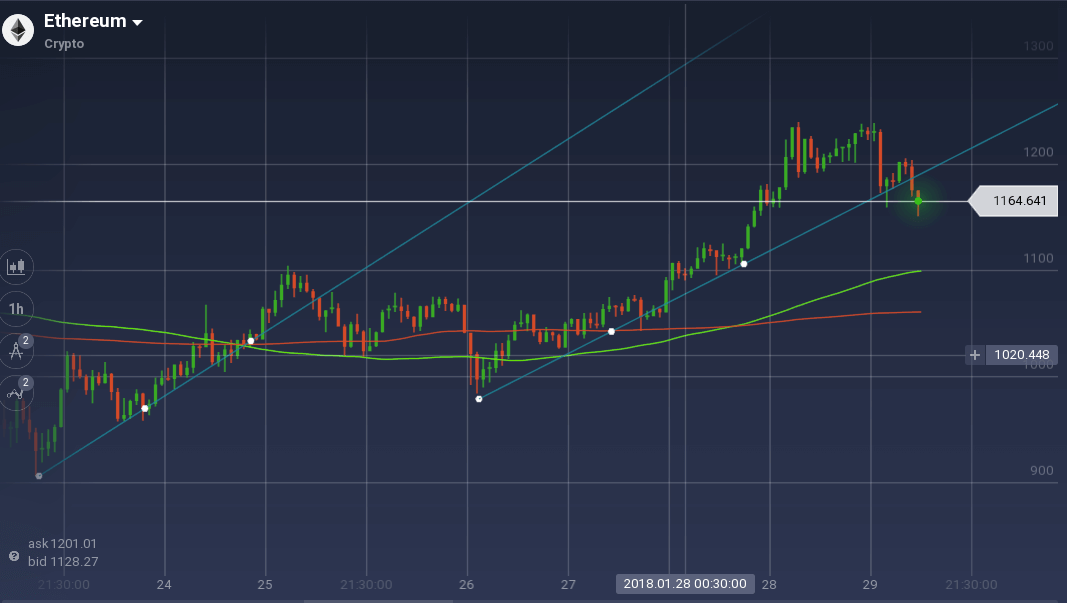

On the weekly chart, Ethereum had two major upward running trends. In the early week, the coin paced to $1100 from $918. But then the peak resistance resulted in a pullback, and further resistance at $1070 pushed the coin to take a dip. After diving to below $980, the coin pivoted and thus a gradual upward rise began.

ETH/USD continued its bullish climb for the next 48 hours until the peak resistance at $1240 ceased the climb. With a support at $1193, the pair also tested the peak resistance a couple of times, but could not breach the strong resistance barrier. The pair is now pulling a classic pullback and dropped to $1168.

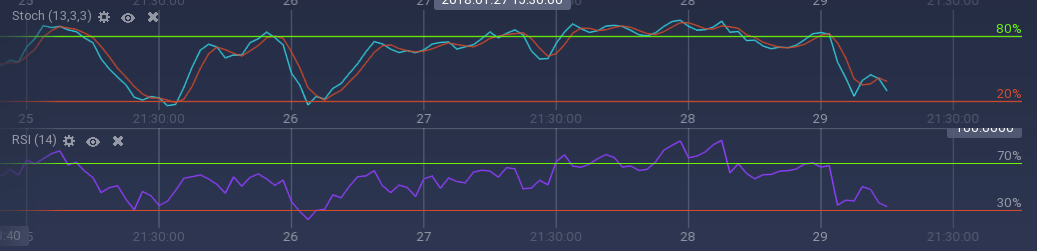

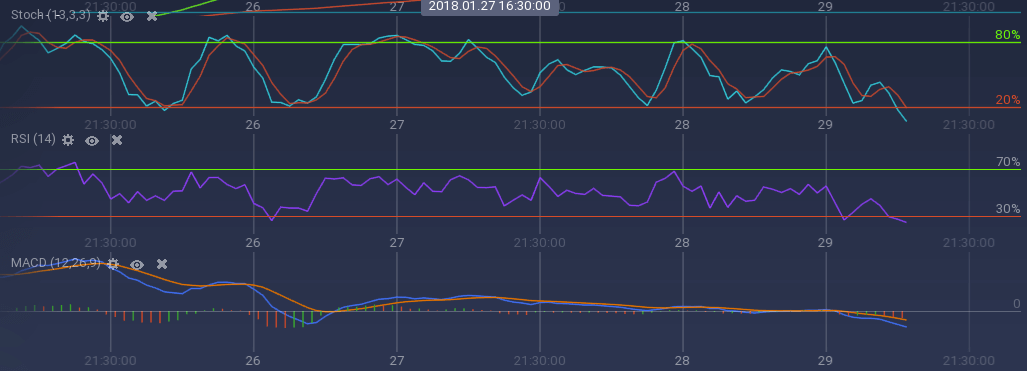

The pullback in the prices is clearly reflected in the oscillators’ run. Stoch and RSI both are going down after a significantly long bullish run. RSI has reached to 31 percent, without any sign of recovery. The price curve has also dipped below 23.6 percent Fibonacci level and is on its way to 38.2 percent.

Against Bitcoin, ETH depreciated above 9 percent over the week as the prices of ETH/BTC pair dropped from 0.000125 BTC to 0.000113 BTC.

Stellar

Stellar has become a very popular coin recently because of its huge gains. It is competing against some of the major coins on the market, but still has become the 6th largest coin on the market with a market cap of $10.81 billion.

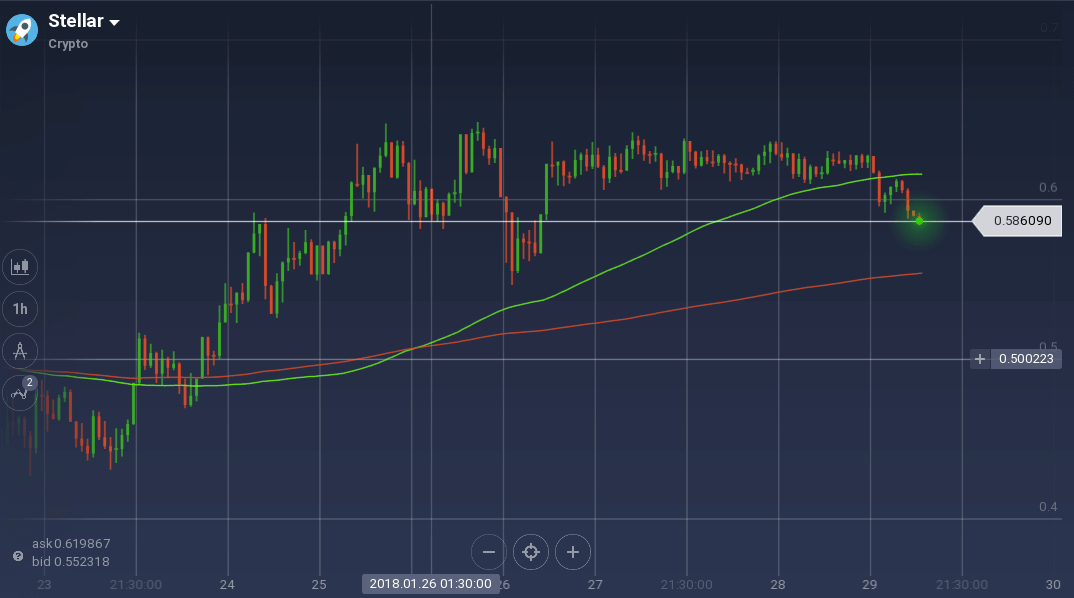

Over the week, the coin gained over 24 percent, highest among the top 20 coins. The coin had its bullish run in the early week, as it went up from $0.43 to $0.64. Though the peak resistance ceased the bull, the coin maintained its peak value throughout the week. At times, sudden dips caused the price to go down, but support at $0.58 and $0.55 resulted in a rebound. $0.61 also acted as a supported for most of the week.

Recently, the coin is taking a downturn as the price curve breached the support level and dropped to $0.58. This resulted in a drop below 23.6 percent Fibonacci retracement level.

Due to the bullish prices, 100 SMA remained above the 200 SMA, indicating the dominance of the upward run.

Though because of the recent dip the technical indicators are running bearish, the oscillators have reached the overselling zone, which indicates exhaustion among the buyers. Stoch is below the 20 percent overselling mark and the current value of RSI is 27 percent. RSI is slowly stabilizing. MACD is also indicating a bearish movement.

XLM/BTC performed very well in the past week. The pair is up by 17 percent and is currently trading at 0.000052 BTC.

Market Update

The biggest news of the week is the hacking of the Japanese largest cryptocurrency exchange Coincheck. Nearly $600m worth of NEM, as well as a shift of a $123m Ripple payment, has shut down the exchange. Later, the exchange also assured the victims that it will refund their stolen crypto assets.

The Russian government is also in the process of finalizing the federal law for the regulation of cryptocurrencies and initial coin offerings. The draft law has now been officially published. It regulates the creation, issuance, storage, and circulation of cryptocurrencies.

Conclusion

After a huge setback in the prices last week, the crypto market is back at its usual pace. Though many coins are gaining significantly, most of them are still recovering. In a short-term, we can expect a surge in the crypto prices.