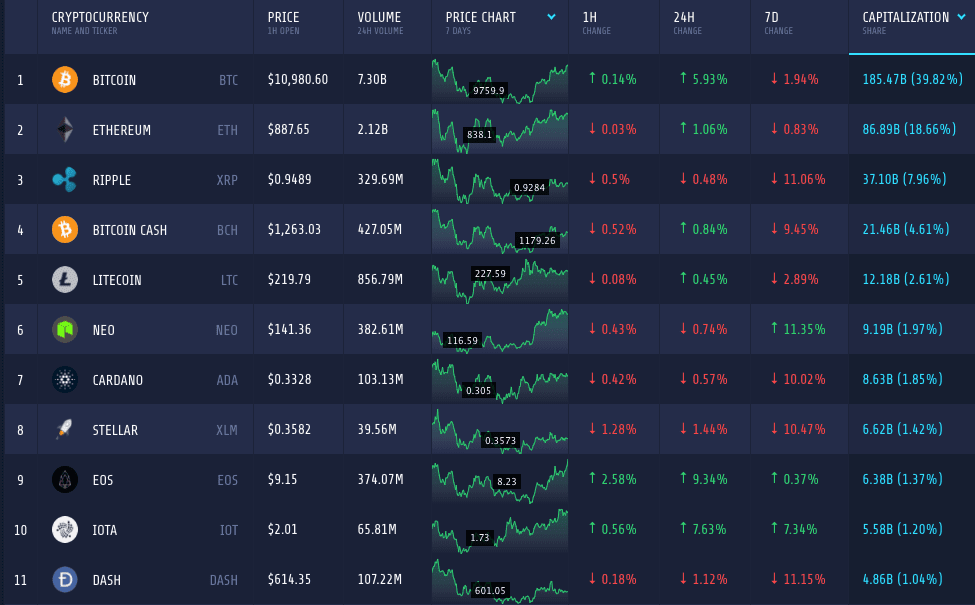

The cryptocurrency market is in a stabilized mode right now. While some coins are gaining, others are losing their values. The market cap of 1523 listed coins has now reached to $465 billion – though it is almost half of the apex market cap above $800 billion.

Bitcoin

Bitcoin is dominating the market with almost 40 percent of the market share. It is holding market cap of above $185 billion. The coin is showing some bullish trend lately, as it appreciated 6 percent on the daily chart, but incurred a loss of 2 percent on the weekly.

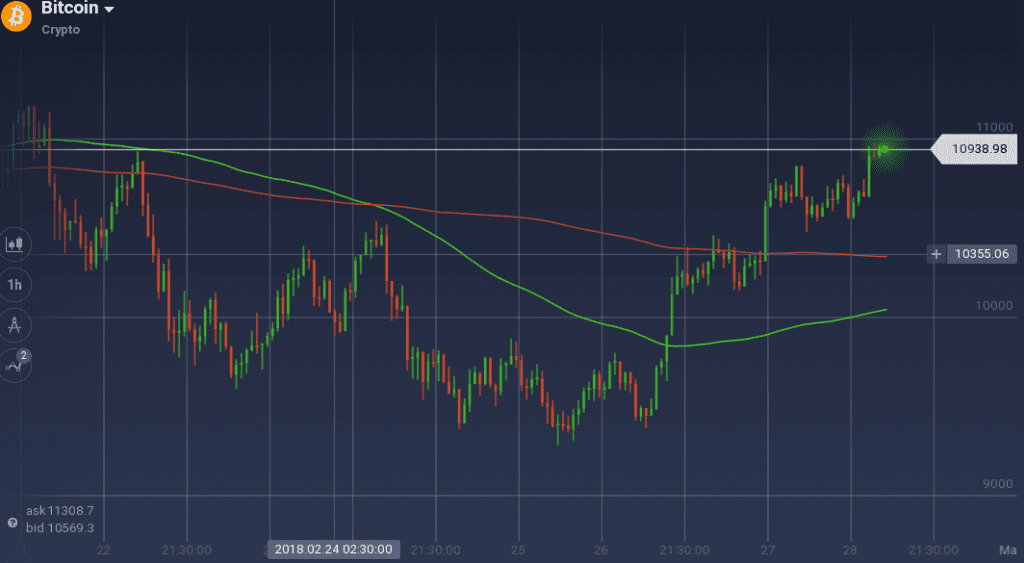

On the weekly chart, Bitcoin had a roller-coaster ride. With eventual spikes, the coin maintained a downward trend in the early trading sessions. Multiple resistance levels – $10400 and $10530 – acted upon the coin to check any further growth. After dipping below $9400, the coin found some support, but a strong resistance level was also there at $9800. With two consecutive buying rages, the coin took a leap to reach $10,900 from $9400 in the last 48 hours.

Currently, BTC is trading above $10,900 and is trying to breach the $11,000 mark.

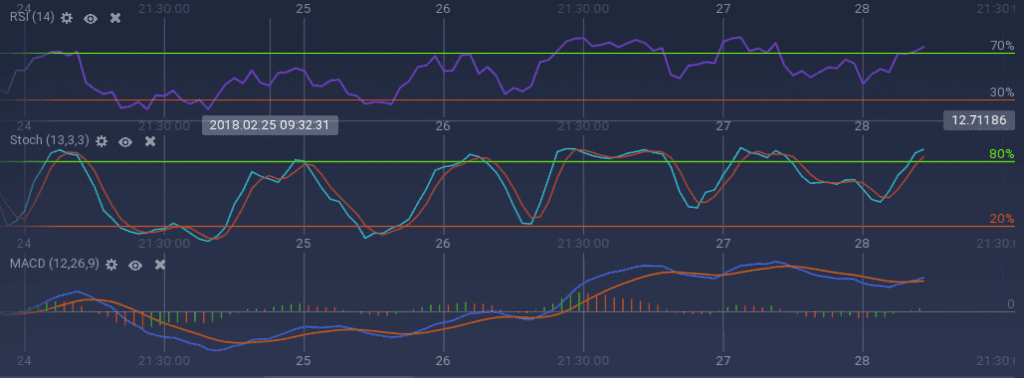

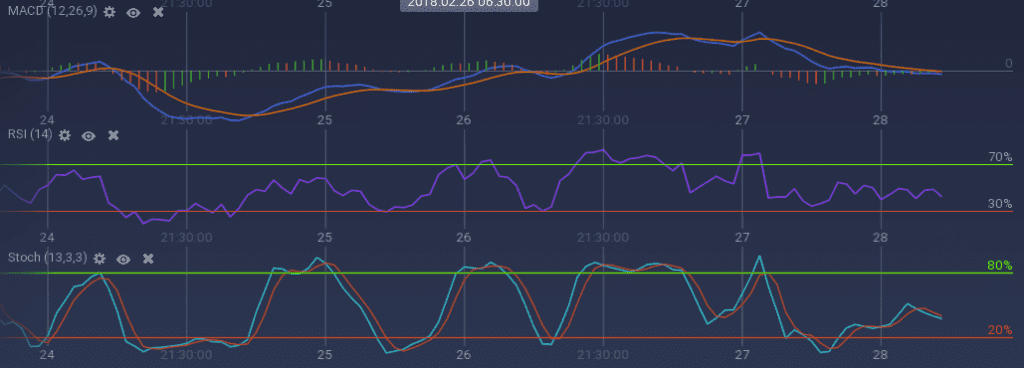

As the coin is running bullish, the technical indicators are showing strong positive sign. Stoch and RSI, both, are soaring and have breached the overbuying mark. MACD curves are also indicating a bullish trend. The current value RSI is at 72 percent. With the regained bull, the gap between 100 SMA and 200 SMA is shrinking, but the former is still running below the later.

DASH

While many coins are soaring, DASH is one of the coins which lost a significant amount over the week. The coin depreciated by 11 percent over the week and has maintained its loss on the daily chart with 1.1 percent depreciation. DASH currently holds a market cap of above $4.8 billion and has registered trading volume above $107 million in the last 24 hours.

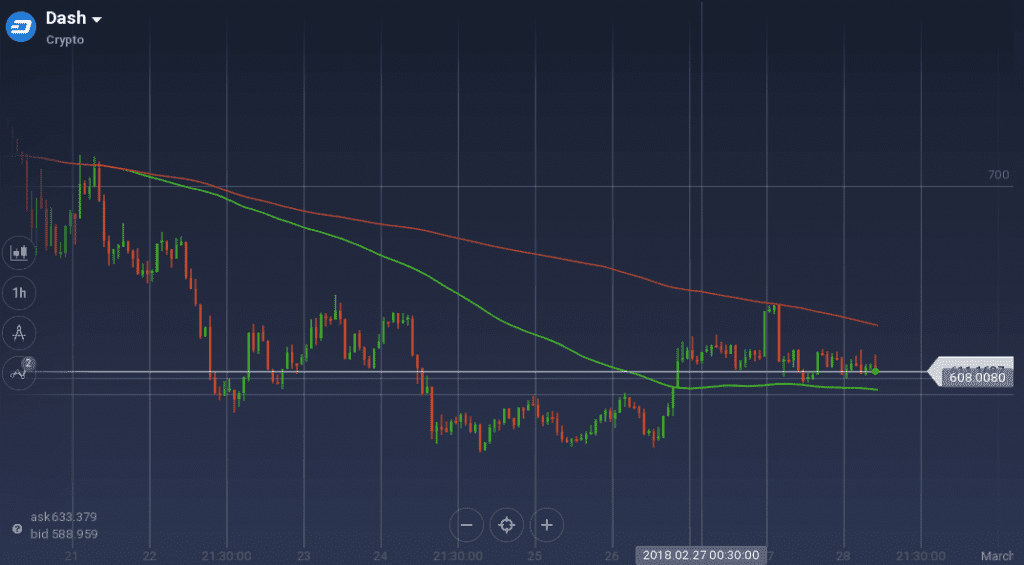

DASH dived from above $700 to below $500 in the early of the trading session. Though the coin tried to rebound, it faced a stiff resistance at $640. The coin tested the resistance multiple times, but could not breach it. Along the week, the coin fell further, until $576 provided some support. However, a new resistance level formed at $600. After testing the resistance for a couple of times, the coin shot up to $623, where a strong resistance level checked its growth. Though the coin found support around $610, it is trading within the narrow resistance-support band.

Because of the presence of the resistance, the technical indicators are running at a dull pace. Both the oscillators – Stoch and RSI – are going down, while MACD is stabilizing along the axis.

Against Bitcoin, DASH was running bearish all round the week. The pair incurred a loss of 16 percent over the week as it went down from 0.06BTC to 0.05BTC.

Market Update

Another major Thai bank is reportedly terminating transactions involving cryptocurrencies through the bank accounts of a local crypto exchange. This decision follows a similar move by another major Thai bank, Bangkok Bank, to terminate the same exchange’s bank accounts.

The European Union’s financial chief has said that if issues related to cryptocurrencies aren’t addressed it will take steps to regulate the market.

Conclusion

The cryptocurrency market is running in a mixed fashion recently. Picking coins for trading can be very crucial at this point, as the right can hoard a ton of profit in the short term.