The September read on CPI came in weaker than expected and sent the dollar crashing versus the basket of world currencies. The EUR/USD, USD/JPY and GBP/USD have all made significant moves in the wake of the report and now testing respective support and resistance levels.

The headline figure is 0.5%, a tenth shy of expectations but still strong and supportive of forward FOMC rate hike outlook. On an annualized basis headline consumer prices are up 2.2% and above the Fed’s 2% target. The reports takes note that headline inflation has been accelerating since June when it was a cool 1.6%. Much of the gains are due to rising energy prices, the gas index is up 13.1% in the past month alone, and likely to persist in the short to long term. Stripping out the volatile food and energy prices CPI rose 0.1% MOM at the core level and is up 1.7% YOY for the 5th month in a row.

Retail Sales were released simultaneous to the CPI and was also weaker than expected. The caveat is that 1.6% is still a solid number and consistent with ongoing improvement in the US economy. On a year over year basis sales are up 4.5% and for the quarter up 3.9% from the same period a year ago. Gasoline is a big drive of sales increases, up 11.4%, but not the only one. Building materials, likely attributable to post-hurricane reconstruction, are up 10.7%. Bottom line, the data may have been weak but it still shows strength in the consumer and the slow advance of inflation.

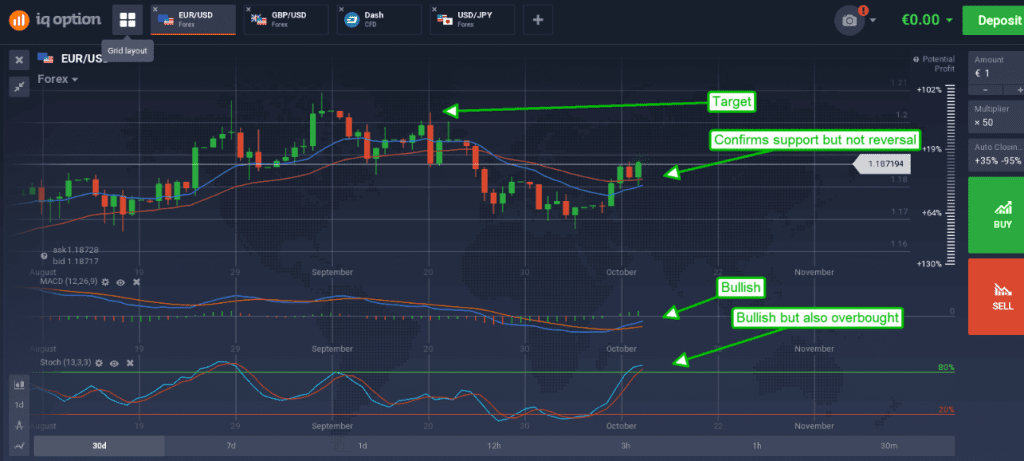

The EUR/USD gained more than 50 pips in the immediate wake of the announcements and likely to go higher into the near term. The hourly chart shows the pair confirming new support at 1.1800 with bullish indications. Both MACD and stochastic are showing bullish crossover and pointing higher suggesting higher prices are on the way. The only caveat is that the moving average crossover is yet to confirm but this looks likely in the next couple of days. Upper target is 1.1950 in the near term and then at the current high near 1.2100 if the first target is broken.

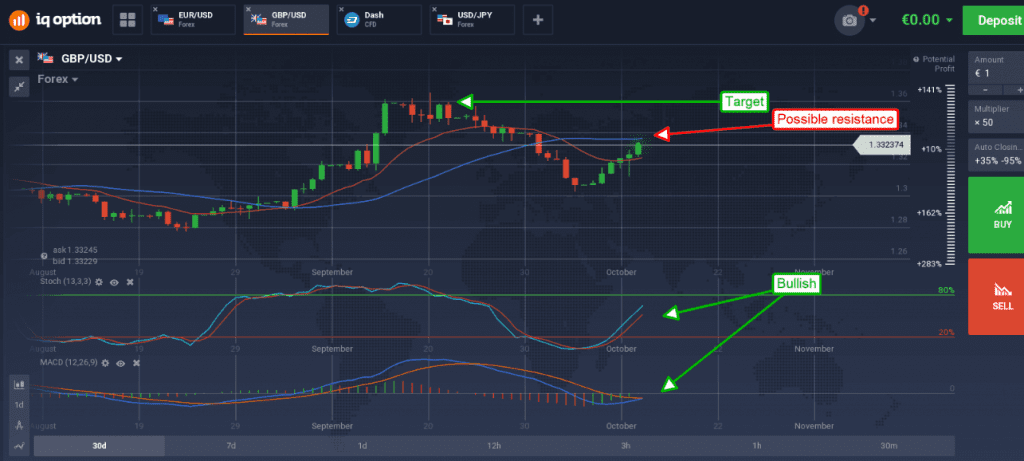

The GBP/USD moved up to test resistance at 1.3200. The move is confirmed by the indicators; MACD and stochastic are both pointing higher following bullish crossovers and the moving average pair is widening within a bullish up trend. A break above resistance will confirm continuation of the move with an upper target near 1.3400 and then 1.3600.

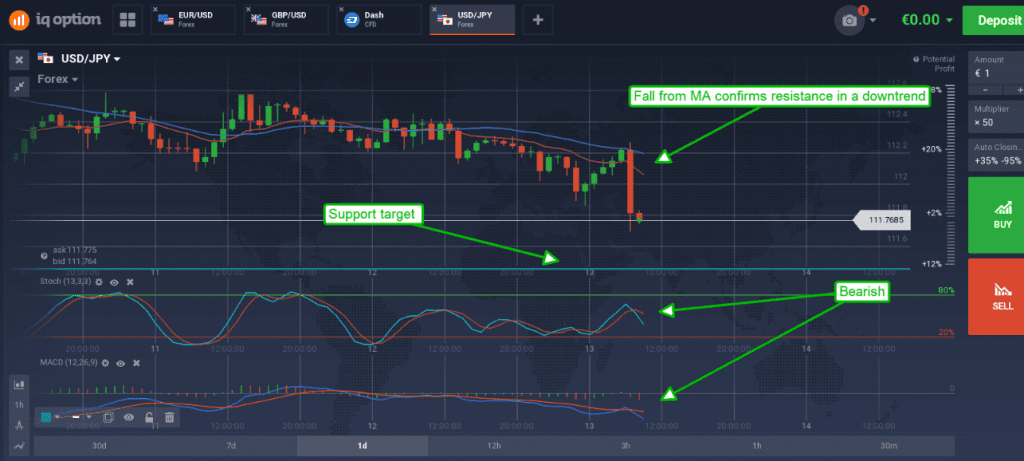

The USD/JPY is also on the move and heading down to test a near term support level at 111.455. The MACD and stochastic indicators both confirm the move with bearish crossovers, the caveat here is that bullish momentum remains strong in the longer term, stochastic is approaching oversold levels near support and the moving averages have yet to confirm.

A break below this support target would be bearish and possibly take the pair as low as 108.00 in the near to short term.