Coca Cola (KO: NYQ) reports Q2 2017 earnings on July 26th 2017. The US based soft drinks giant was originally set up in 1886 and has made its name as a titan in the carbonated drinks segment. Let’s take a look at some key factors for Coca Cola shares moving into the Q3 2017.

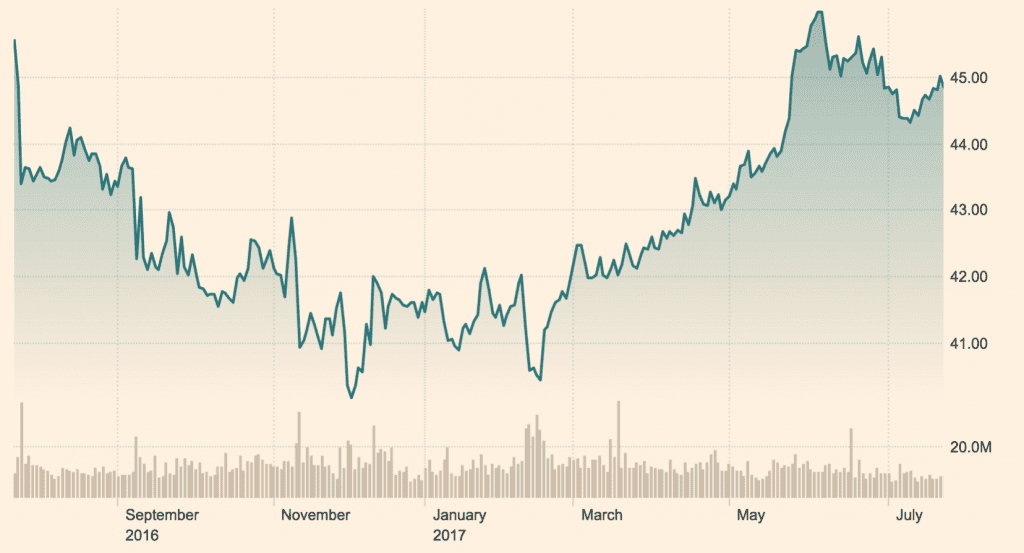

1) Share Price – Flat Performance

Over the past twelve months Coca Cola shares are down a little over 2% – down 2.12% and currently trading at 44.86USD. The share price had fallen significantly into the end of 2016 and has gained back this lost ground through the course of 2017 indicating potential high volatility for the remainder of 2017 and perhaps into 2018.

2) Financial Performance

Q2 2017 earnings are expected to be announced on July 26h 2017 and are forecast to be 0.43USD per share – representing a significant contraction year on year in EPS for the quarter as compared to the 0.60USD reported for Q2 2016. Coca-Cola’s Q1 2017 revenues fell 11% year on year. This was attributed to currency effects combined with structural costs. Q2 earnings are likely to be negatively impacted by a further fall in revenues stemming from aggressive restructuring in addition to acquisitions and divestitures.

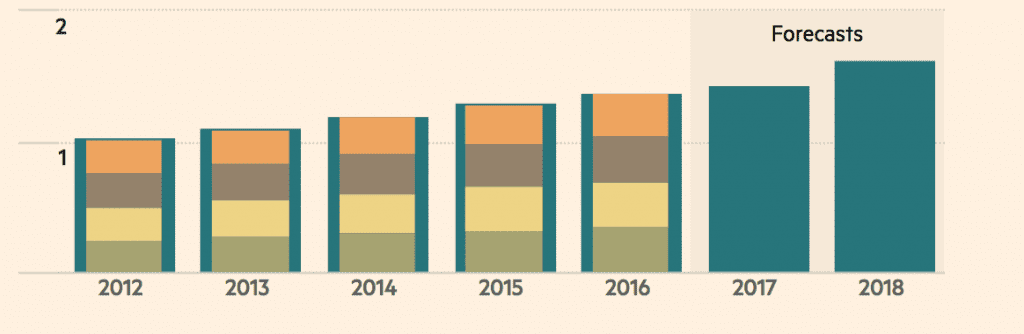

3) Dividends – Weaker Outlook

Coca Cola reported a dividend of 1.38 USD for the 2016 financial year, achieving an 6.56% increase over the previous year. The forecast for the 2017 financial year dividend is 1.43 USD – representing a year on year improvement in dividends of 3.77%.

Source: https://markets.ft.com/

4) Refranchising

The international drinks company has been undergoing significant business restructuring – specifically focussing on refranchising bottling operations across various locations across the globe.

By 2017 year end Coca Cola plans to refranchise two-thirds of its Northern US bottling territories. Further to this they are aiming to refranchise a large portion of the remaining territories by the end of this decade – as part of an overarching plan to restructure the company to achieve a less capital-intensive distribution network. In the meantime, this will hurt bottom line through reduced revenues and higher costs.

5) Healthy Alternatives

Coca Cola has been diversifying into the healthier drinks segment – adding more focus to flavoured water, bottled water, and dairy products as part of this strategy. This is intended to drive new channels of growth. As part of this vision Coca-Cola launched the Gold Peak brand in Q1 2017 – a range of ready-to-drink tea lattes and coffees. The success of this range will be revealed in this quarter’s earnings.

For the long term, the outlook is positive for Coca Cola shares. The company is positioning itself to meet evolving consumer preferences and capture a more diverse segment of market share. Over the short term this involves significant investment and as such may hurt bottom line and share price over this transition investment horizon.

Sources:

- http://www.coca-colacompany.com/investors/stock-history

- http://www.coca-colacompany.com/press-center/press-releases/the-coca-cola-company-reports-first-quarter-2017-results

- http://www.nasdaq.com/aspx/stock-report.aspx?symbol=KO&selected=KO