New data from the UK points to accelerating growth within its borders. The data, business investment, grew faster than expected at 0.3% MoM and 2.6% YoY to set a new 6 month high. While a largely unwatched data points it is important for traders to note; this leading indicator is pointing to accelerating growth within the UK and supports the BoE plans to hike rates at the next meeting. Other data released yesterday concurs with the BoE’s sentiment as well although it did not beat the market’s expectations. The 4th quarter revision to GDP came in as expected at 1.4% and unchanged from the previous estimate.

The news was enough to get the pound moving in early Thursday trading although the moves were muted considering global economic strength; the pound can only gain so much strength when central banks other the the BoE are also turning hawkish. Data from the EU, centered in powerhouse nation Germany, shows continued improvement in labor with little change to inflation. Unemployment claims for the country fell a larger than expected -19,000 on top of a downward revision to the previous week’s decline. CPI, the most important data point in this mix, came in at an expansionary 0.4% but missed expectations and cooled a bit from the previous month.

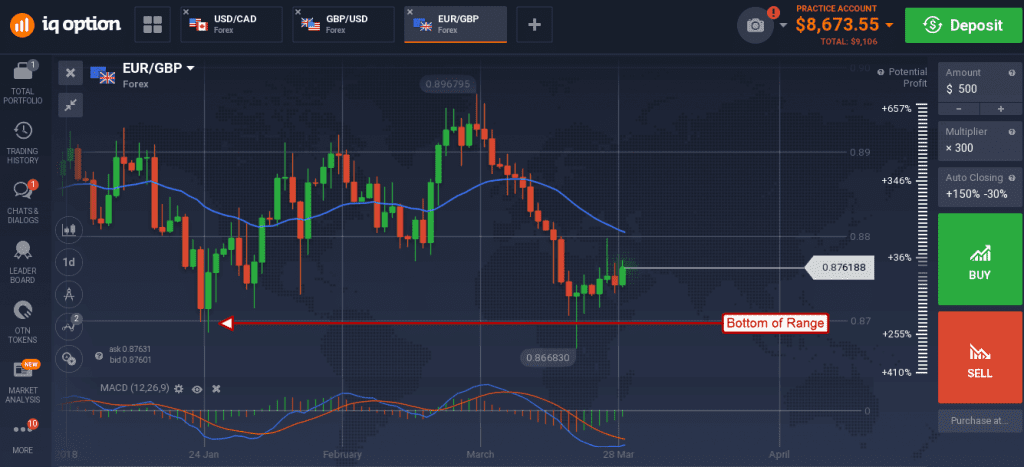

The EUR/GBP moved up on strength in Europe, but the gains were tempered by cool CPI and strength in the UK. The pair remains within the long-term trading range and may be moving higher. It has bounced from the lower range boundary with an eye on moving higher but resistance is apparent at the short term moving average. A break above the average would be bullish with target near 0.8900 and above.

US inflation data added its own spin to Thursday trading leaving the forex uncertain about the timing of another FOMC rate hike. Personal Income and Spending figures both came in a little better than expected and consistent with economic growth. Even the PCE price index accelerated to 1.8% YoY at the headline level and 1.6% YoY at the core but that was only as expected and still below the FOMC’s target rate.

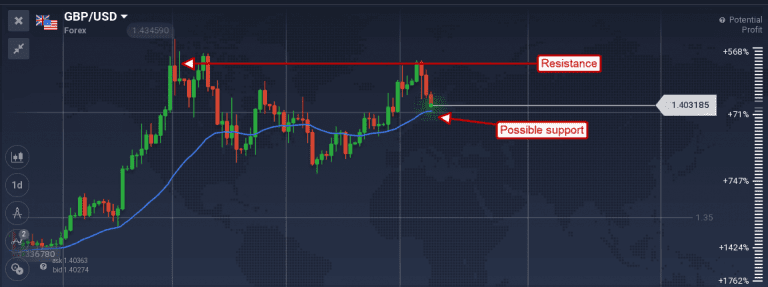

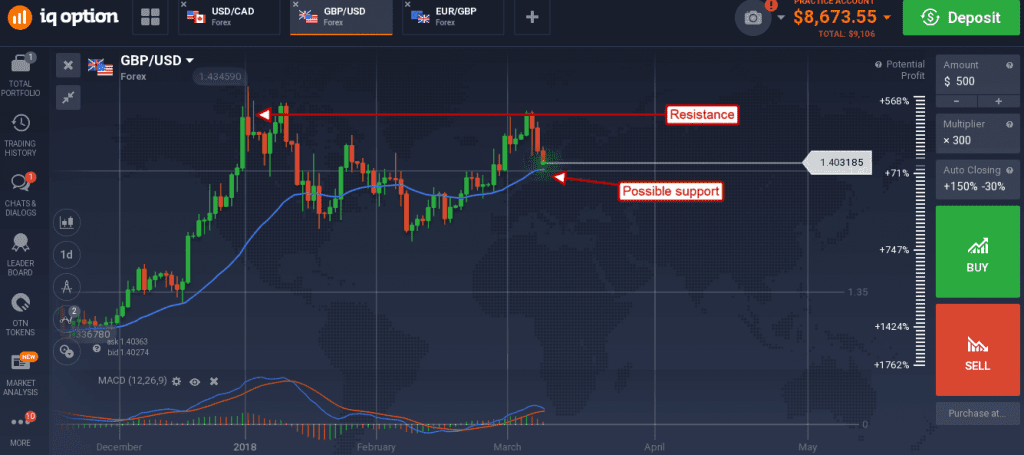

The GBP/USD gained strength on the news, continuing a move down from a resistance target, but the move does not look strong. Support is likely at the short term moving average and may be strong when reached. A break below 1.3990 would be bearish and likely take the pair down to 1.3800.

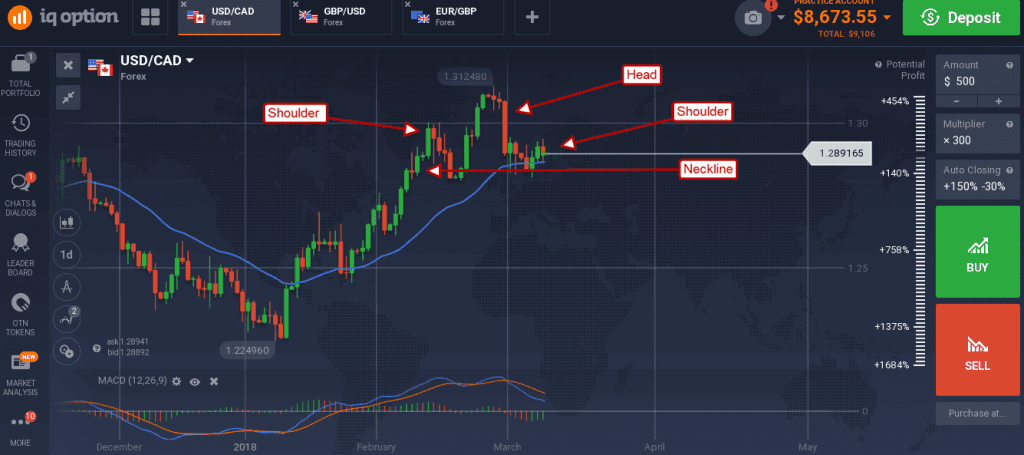

Canadian GDP came in a bit weaker than expected for January, but the loony was able to gain strength anyway. Easing trade tensions, an evident path to a renewed NAFTA agreement and general strength in the global economy providing the catalyst.

The USD/CAD moved down of the previous sessions high and looks like it may retest the short term moving average. The pair is in danger of reversal at this point as it is forming a head & shoulders.

A break below 1.2800 would confirm the move and bring targets near 1.2300 into play.