A double shot of manufacturing PMI shows UK goods in demand. Headline manufacturing PMI data from Markit came in at 58.2, above the expected 56.5 and the previous 56.6. The gains are broad based across sub components and industy with noted strength in orders from the EU, the Americas and Middle East. The read is a 51 month high and gives little indication of Brexit hurting UK trade. Within the report data shows output, new orders, back logs and employment all expanding and accelerating. Orders for investment goods rose at the fastest pace since August 1994 and shows strong demand for equipment and materiel necessary for economic activity.

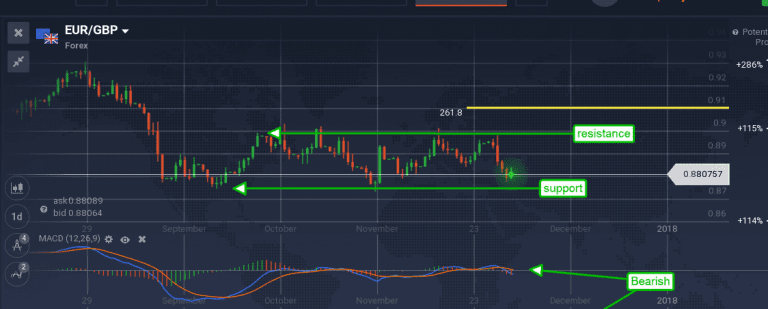

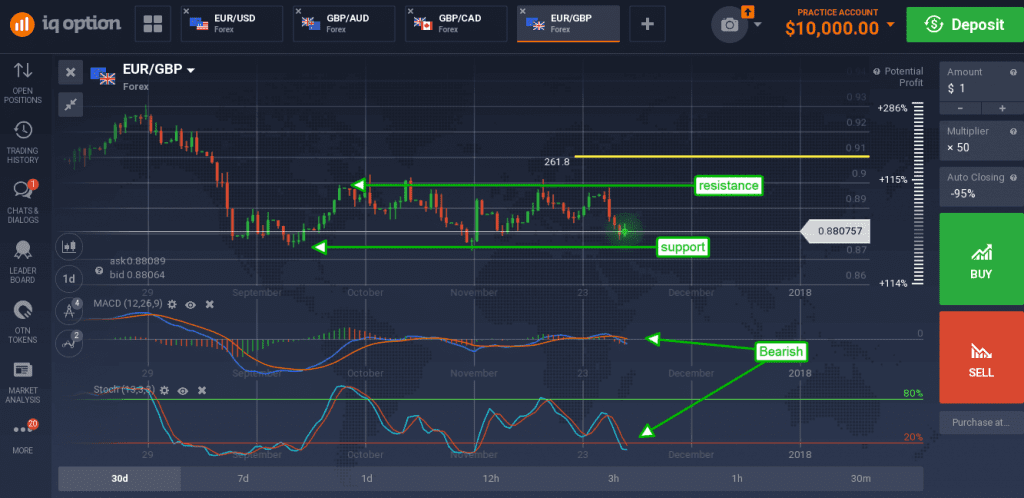

Market reaction was mixed but generally positive for the pound, if not bullish. The pound was able to firm against the euro, driving it down from early highs, and hold it down near support at the bottom of a near term trading range. The early highs were driven by German PMI but offset by the UK data and weaker than expected GDP from Italy. German PMI came in 62.5 and as expected, unchanged from the previous month, and not enough to spark a move in the currency. Italian GDP came in a tenth weaker than expected on the MoM and YoY comparison but still positive. Support for the EUR/GBP is near 0.8775, a break below there would be bearish. A bounce from support may be bullish but would face resistance at 0.8900.

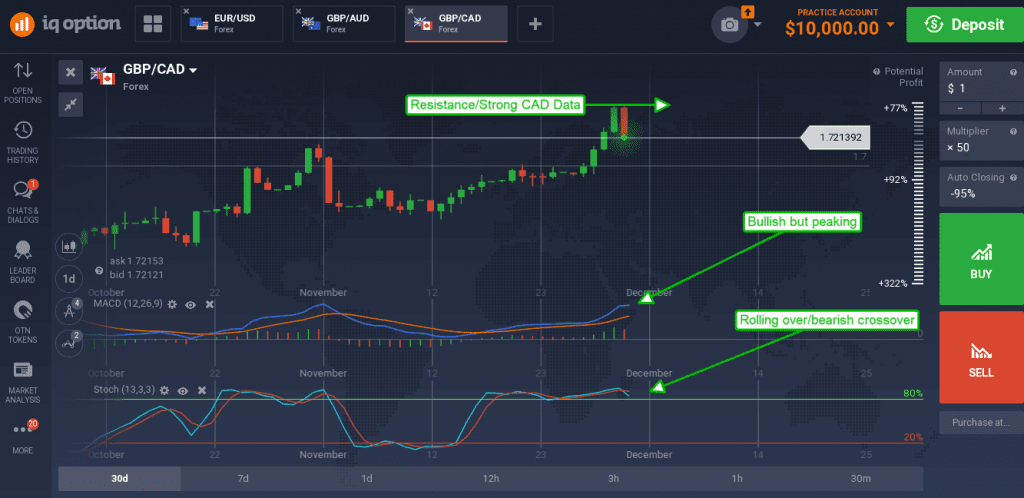

The pound was standing tall versus the Canadian dollar until better than expected data from that nation had traders flooding into the loonie. GDP rose 0.2% in November, hotter than the 0.1% expected, and up from the previous -0.10%. On a quarterly basis GDP rose 0.4% as expected with a minor negative revision to the previous read while the YoY figure came in strong at 1.7% and above expectations.

The gains are driven in part by labor which also saw big gains in the past month. Canadian employment figures show a gain of 79,000 new jobs versus an expected 10,000. The pair has now confirmed resistance at the 1.7400 level and is forming a dark cloud cover. Downside targets are 1.700 and 1.6800.

The pound weakened versus the Aussie Dollar but was able to find support near yesterday’s high. The pair has been trending upward for several months and showing bullish technicals. Both MACD and stochastic are bullish and in support of higher prices with only the merest hint of near term weakness.

MACD has held flat for the last two days while %K has moved lower in stochastic, both consistent with today’s decline, but both remain bullish and so am I. Current support is near 1.7800 with upside target near 1.8500.