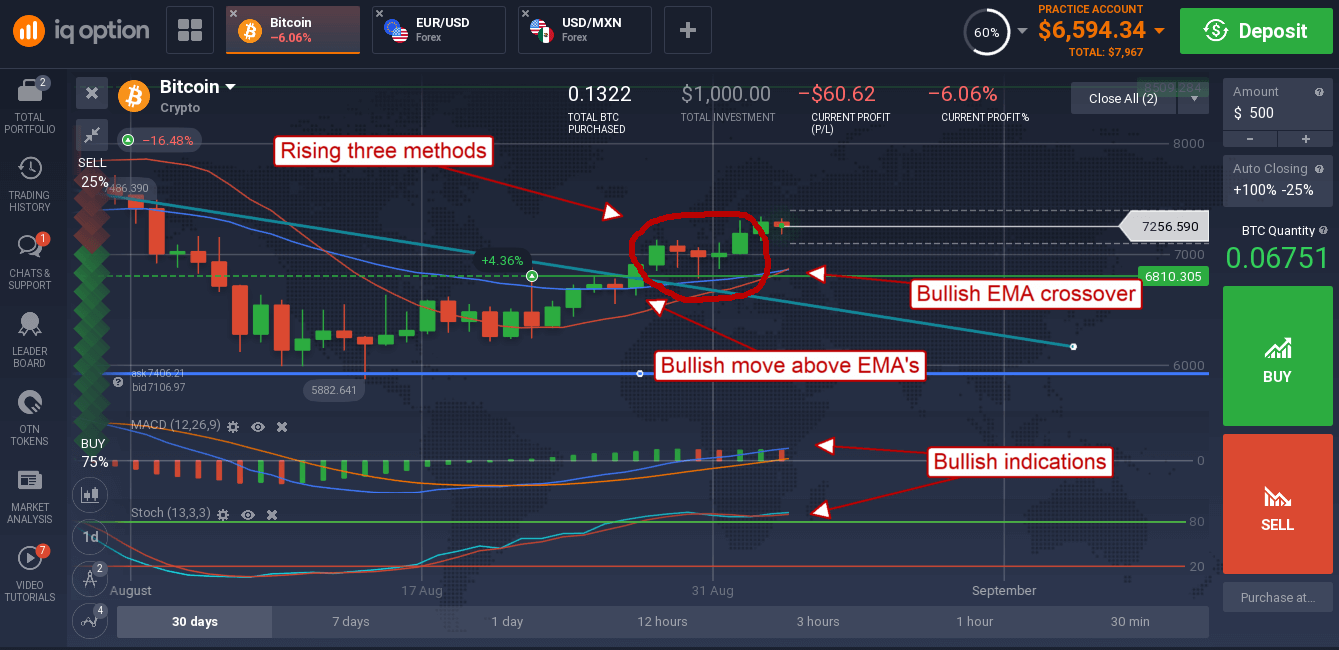

The Bitcoin market is flashing a sign to investors they can’t ignore. The world’s leading blockchain technology and reserve cryptocurrency has formed a textbook continuation signal that means one thing; BTC $8,000 is one the way and will be here soon. The signal is a Rising Three Methods, one of the more powerful continuation indicators provided by candlestick analysis because it is trend-following, includes a price consolidation and leads to high-probability price movements.

What is a Rising Three Methods? It’s a five (sometimes less) candlestick pattern that includes a medium/long green candle, 1-3 smaller spinning top candles (the consolidation) and a final medium/long green candle that breaks to a new high. Bitcoin not only created a Rising Three Methods, it created a textbook version pointing to one thing; a rise to $8,000.

The price projection for the Rising Three Methods is simple. Measure the distance, in prices, from the start of the rally to the continuation pattern. In this case the rally moves BTC from $6,000 to $7,000 which means a magnitude of $1,000. Add $1,000 to the point of break-out, close to $7,000, and you get a target of $8,000 which is likely to be reached within the next week to ten days providing no bearish news comes out to weigh prices down.

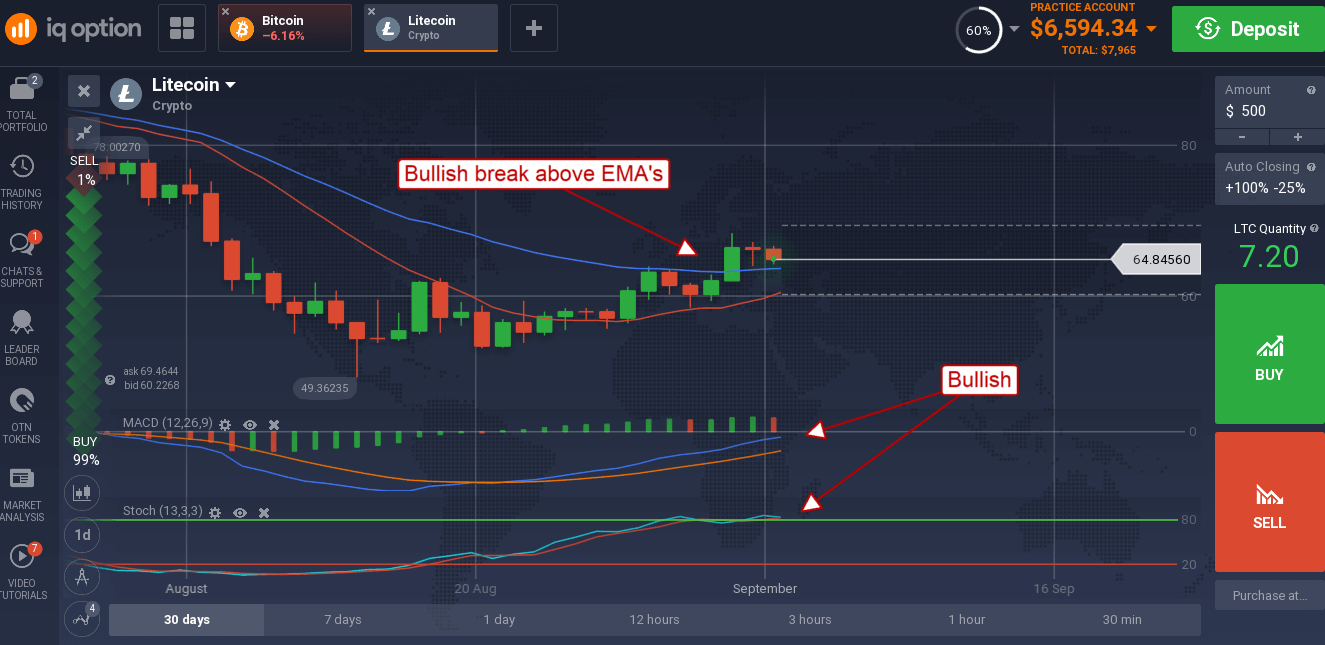

Litecoin, an early fork of the original BTC blockchain, is not far behind. The token is not yet forming a continuation pattern, but it has put in a bottom and recently risen above the short-term 30 day moving average. This isn’t a sign of major reversal, but it does indicate a shift in sentiment among the trading community, if not the LTC community at-large. Now that prices have moved above the 30-day EMA we can expect to see them drift higher over the next few weeks with a possible target as high $90.

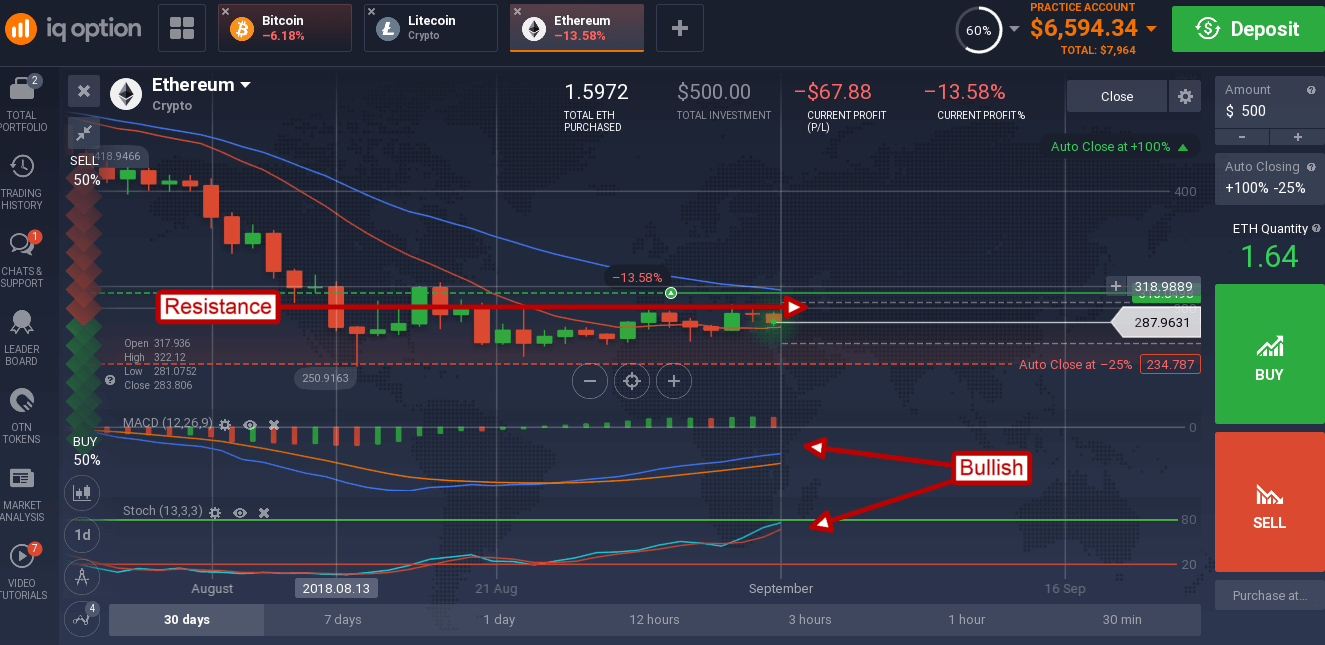

Ethereum is lagging the market and for one key reason; the Ethereum network is facing several catalysts that are keeping investors cautious. The catalysts include the Constantinople hard-fork (no new coins expected), Sharding, Casper and Plasma; all intended to increase efficiency, lower costs and improve scalability.

ETH is still trading below its 30-day EMA and having a hard time with the $300 resistance target. A move above this target would be a good sign for the bulls but would need to break above the short-term moving average for traders to get bullish on prices.