Since the Gold Rush prospectors have mined 20 million ounces of gold from the Yukon. But they haven’t been able to find the original source—the multi-billion-dollar bedrock. Until now. A famous geologist armed with the latest in drone tech and robo-drills is certain he’s just found it. This is the Mother Lode of Klondike gold that countless prospectors have been trying to get at for over a century. It makes the 20 million ounces that have been collected on the surface of the seem like gold dust. A mere flash in the pan. This is no longer a story of men with pick axes trying in vain to find the mega source that’s it’s all come from.

Now it’s a story of amazing technology that’s enraptured everyone on the Discovery Channel, a Canadian billionaire whose touch turns everything to gold, and a legendary geologist of gold-discovery fame. The famous geologist is Peter Tallman. The company is Klondike Gold, and their latest gold discoveries are the stuff of legend. Not only are they sitting on massive acreage in one of the Gold Rush’s most pre-eminent venues, but they are also positioned in an area that has geology similar to the California Motherlode Belt, where 220 million ounces was discovered. And the timing is urgent. What Tallman has already discovered could be enough to make Klondike Gold a prime takeover target. Volatile news for the gold market!

Elon Musk backs call for global ban on killer robots

Elon Musk is among a group of 116 founders of robotics and artificial intelligence companies who are calling on the UN to ban autonomous weapons. “Lethal autonomous weapons threaten to become the third revolution in warfare. Once developed, they will permit armed conflict to be fought at a scale greater than ever, and at timescales faster than humans can comprehend,” the experts warn in an open letter released Monday. “These can be weapons of terror, weapons that despots and terrorists use against innocent populations, and weapons hacked to behave in undesirable ways,” the letter says. Its signatories are from companies spread across North America, Europe, Africa and Asia.

Unlike other potential manifestations of AI, which still remain in the realm of science fiction, autonomous weapons systems are on the cusp of development right now and have a very real potential to cause significant harm to innocent people along with global instability,” said an expert. More than a dozen countries — including the United States, China, Israel, South Korea, Russia and Britain — are currently developing autonomous weapons systems, according to Human Rights Watch. Musk has been warning of the perils of artificial intelligence for years, saying it’s “potentially more dangerous than nukes.” As tensions spiked over North Korea this month, he weighed in, saying AI poses “vastly more risk” than Kim Jong Un’s regime.

FED and ECB Leads Head to Jackson Hole Amid Inflation Unease

As the world’s top central bankers gather in Wyoming this week, their relief about a stronger global economy will be tempered by a growing unease that inflation remains inexplicably low. Federal Reserve Chair Janet Yellen and European Central Bank President Mario Draghi will be among the officials addressing this year’s installment of the annual conference hosted by the Kansas City Fed. The summit, held at a Jackson Hole mountain retreat, comes as central banks in advanced economies creep toward the policy exit after years of unprecedented easing, even with outlooks are clouded by stubbornly tepid inflation.

Prices have been slow to pick up despite solid growth and falling unemployment, suggesting that the long-observed relationship between inflation and labor-market slack might have frayed. That puzzle will likely surface as the conference debates this year’s theme of “Fostering a Dynamic Global Economy” against the backdrop of the Grand Teton mountains. “Inflation has been the big question mark, both here and abroad,” said the head of U.S. economics at Bank of America.

Draghi’s remarks will focus on the theme of the conference, an ECB spokesman said, responding to speculation over whether the Italian might choose to send a policy signal on the central bank’s bond-buying program. Advanced economies face common challenges that range from rising asset valuations to the uneven effects of globalization that galvanized the populism behind Brexit and the election of Donald Trump. It’s a lot easier to solve these problems with faster growth. Still, inflation may be the most pressing riddle facing central banks, which are failing to meet their price mandates.

MiFID Mess

With the start of Europe’s MiFID II rules less than 5 months away, banks and asset managers are scrambling to prepare for a regulatory overhaul that risks doing more harm than good to the finance industry. Aimed at making markets fairer and more transparent, the European Union’s revised Markets in Financial Instruments Directive impacts everything from how firms trade to how research is distributed.

Yet practitioners are concerned that the hundreds of pages of rules conceal problems that regulators never fully considered. “The bubble of MiFID II feels painful. It’s a bit like Britain all of a sudden changing to driving on the right-hand side. It will create disruption but eventually people will adapt.” an Expert said.

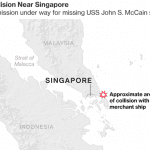

US Warship collides

Ten sailors are missing and five were injured after a U.S. warship collided with a petroleum tanker near Singapore on Monday, the second crash involving an American naval vessel in Asia in a matter of months. Search-and-rescue efforts are underway after the USS John S. McCain collided with the Alnic MC, the U.S. Navy said.

Ten sailors are missing and five were injured after a U.S. warship collided with a petroleum tanker near Singapore on Monday, the second crash involving an American naval vessel in Asia in a matter of months. Search-and-rescue efforts are underway after the USS John S. McCain collided with the Alnic MC, the U.S. Navy said.

The Navy is examining the extent of the damage and injuries, with initial reports suggesting the guided-missile destroyer suffered damage to her port side. “Thoughts & prayers are w/ our @USNavy sailors about the #USSJohnSMcCain where search & rescue efforts are underway,” President Donald Trump said on Twitter. Earlier, in response to a shouted question on the incident, he said “that’s too bad.”

Important economic events

Monday

1.30 pm – US Chicago Fed national activity index (July): expected to remain unchanged at 0.1. Markets to watch: US indices, USD crosses