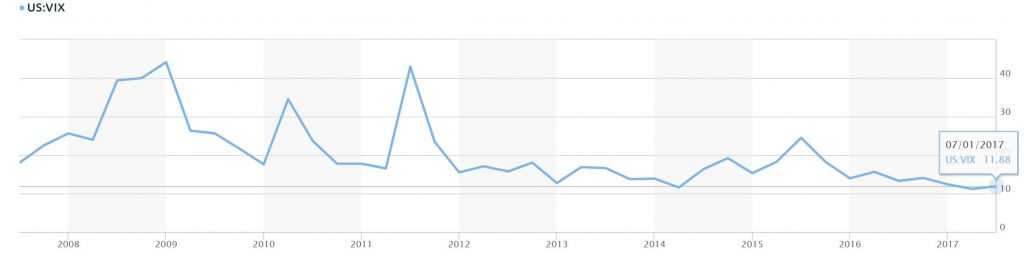

Volatility has been spotted approaching its record-low levels during the months following President Trump’s inauguration. But that is about to change, experts believe. We learn from history that long periods of market stability are usually followed by volatility spikes, and that they come when you least expect them.

Several events can trigger abrupt and rapid market movements. Most of them are apparently connected to the United States in one way or another.

North Korean threat, though less vocal in recent days, is still present. The peninsular communist dictatorship decided to ‘delay’ its plan to attack the U.S. territory of Guam with intercontinental ballistic missiles. However, nobody knows how long will it take for Kim Jong Un to change his mind once again. Full-scale nuclear conflict can dramatically change the landscape of the global financial market in a matter of minutes.

Financial and political insecurity back in the United States poses a serious threat to market certainty, as well. On September 29, the U.S. Treasury will run out of money, making the possibility of both a government shutdown and a default on the U.S. debt much more real. The Congress, therefore, will have to decide on two major pieces of legislation before the stated date in order to escape the disaster.

The so-called ‘Day of Rage’ is scheduled by the far-left political activists on the 4th of November. The event can initiate a series of attacks on important financial institutions and general businesses alike.

More than that, September and October are historically the most volatile time of the year. Most market crashes occur during these two months. Nine years have passed since the last financial panic and it can very well be possible that the new one is coming. The exchange rates of the national currencies, stocks and cryptocurrencies can be moved by the above-mentioned events.