The FOMC released its monthly Beige Book report and it says economic activity increased in all 12 regions. While bullish for the economy the news failed to move the dollar as data within the report did not signal strength beyond what has already been expected. According to the report growth is modest to moderate across the country with signs of tight and tightening labor markets throughout.

There is some economic effect from the recent round of hurricanes but it is mixed; where one region saw a decline, another saw an offsetting increase. Perhaps the most significant point of the release is the read-on inflation. Price pressure is reported as modest across all 12 regions, merely consistent with current inflationary trends and not enough to strengthen rate hike outlook or the dollar.

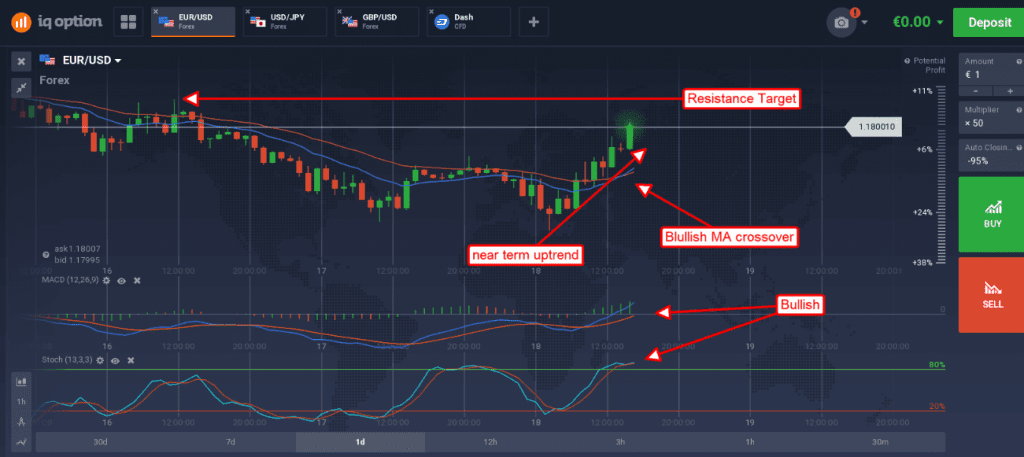

The EUR/USD began rising early this morning, moving up from support at an intraday bottom near 1.17400. The move was sparked by uncertainty over US tax reform and carried throughout the day as traders did not expect the Beige Book to strengthen the dollar. After the release the pair continued to move higher although gains may be muted as it approaches resistance. Longer term the pair will likely remain range bound until the next round of central bank meetings.

The ECB is next week and they are not expected to change rates. There is some expectation they will begin tapering bond purchases, if they meet or exceed market expectation it will bring the bank further into alignment with the FOMC and likely to strengthen the Euro. Tomorrow’s move will be influenced by US jobless claims data which is expected to show a continuation of ongoing labor market trends.

The pair is currently trending sideways within a narrowing trading range. The indicators are still mixed, consistent with an asset trending within a range, so the range may persist until the ECB meeting next Thursday. Tomorrow there may be support at 1.17400 but it is weak and may be broken should the labor data come in strong. If so next target is just below at 1.1700. A move up from today’s levels would be bullish for the pair with target near 1.18800.

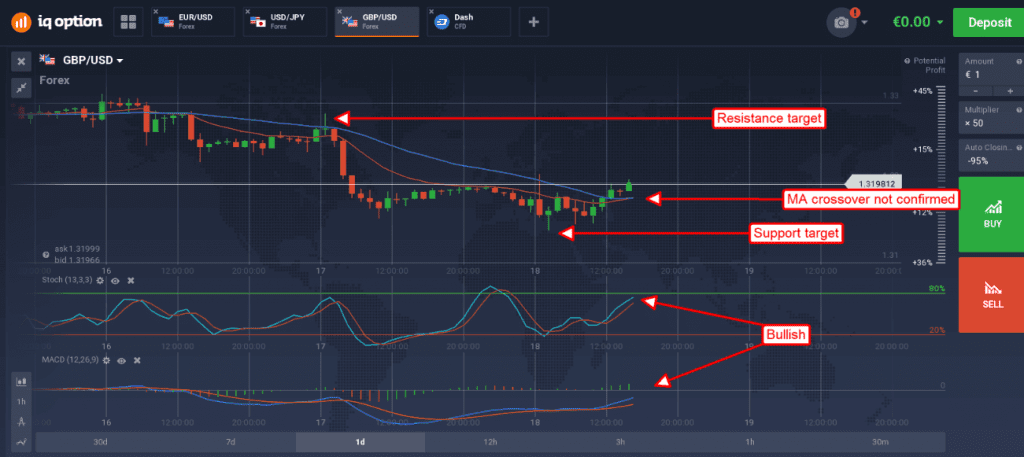

The Pound had been falling against the dollar but found support this morning following the release of UK labor data. The data shows steady unemployment and rising wage inflation. Unemployment was unchanged from the previous month at 4.3% while wages grew above expectations at 2.1% ex-bonus. The pound strengthened after this news and extended the early gains in the wake of the Beige Book release until hitting resistance. Resistance was hit just above the 1.3200 level and may cap gains until tomorrow’s round of economic releases.

UK retail sales are expected out at 8:30 AM GMT and not expected to strengthen the pound. Core YoY sales are projected to fall 0.4% to 2.4% from last year’s 2.8%. If so, or if worse, the pound is likely to move back to retest support. Support targets are at 1.3140 and then 1.3025 should the first target break. If the data is strong and pushes the pound higher upper target for resistance is near 1.3325. Longer term the pair is likely to remain range bound until the first week of November when the BOE and FOMC both meet.