Equities gained even higher ground for the second day in a row on Tuesday, but conviction was much more subdued than it was on Monday when the major averages rose over 1.0% apiece. The S&P 500 climbed 0.3% to notch its second record-high close of the week, while the Nasdaq and the Dow each managed to notch their first. Small caps outperformed, sending the Russell 2000 higher by 0.6%.

The biggest event of the day was Apple’s annual product unveiling, in which the tech giant showed off three new iPhones, including the iPhone 8, the iPhone 8 Plus, and the high-end iPhone X–which CEO Tim Cook called “the biggest leap forward since the original iPhone.” Apple also introduced a new 4K Apple TV and its Apple Watch Series 3, which is the first series to include LTE-capability, allowing users to make phone calls and stream music without hauling a phone.

On the whole, the product event provided little new information as many of the details had been leaked to the public beforehand. Nonetheless, Apple shares were volatile following the event’s afternoon kick off, first surging from their flat line to a new session high and then dropping sharply to a new session low. In the end, Apple shares finished lower by 0.4%.

Unsurprisingly, the top-weighted technology sector–and the broader market to some degree–mimicked Apple’s volatility as the company is the largest component by market cap within the sector. The tech group ended Tuesday’s session a tick above its flat, but held a gain of 0.4% at its best mark of the day and a loss of 0.4% at its worst. Conversely, the influential financial space proved to be pillar of strength on, settling comfortably above the broader market for the second time this week.

The sector benefited from a curve-steepening trade within the Treasury market, which sold off once again as investors dialled up their appetite for riskier assets–like equities. The yield on the benchmark 10-yr Treasury note climbed five basis points to 2.17%, hitting its best level in over a week, while the 2-yr yield ticked up just two basis points to 1.33%. Like financials, the lightly-weighted telecom services space comfortably outperformed the broader market, but the remaining advancers finished with more modest gains, ranging from 0.1% to 0.8%.

The consumer discretionary sector settled in the middle of said range (+0.4%), overcoming a disappointing performance from McDonald’s which tumbled 3.2% on the heels of some cautious commentary. At the opposite end of the sector standings, the rate-sensitive utilities and real estate sectors struggled amid the increase in interest rates. The two groups were the only sectors to finish Tuesday in the red, registering sizable losses of 1.8% and 1.2%, respectively.

JP’s Dimon Slams Bitcoin as a ‘Fraud’

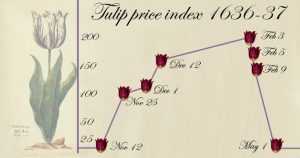

JP Morgan CEO Jamie Dimon said he would fire any employee trading bitcoin for being “stupid.” The cryptocurrency “won’t end well,” he told an investor conference in New York on Tuesday, predicting it will eventually blow up. “It’s a fraud” and “worse than tulip bulbs“. If a JPMorgan trader began trading in bitcoin, he said, “I’d fire them in a second. For two reasons: It’s against our rules, and they’re stupid. And both are dangerous.”

JP Morgan CEO Jamie Dimon said he would fire any employee trading bitcoin for being “stupid.” The cryptocurrency “won’t end well,” he told an investor conference in New York on Tuesday, predicting it will eventually blow up. “It’s a fraud” and “worse than tulip bulbs“. If a JPMorgan trader began trading in bitcoin, he said, “I’d fire them in a second. For two reasons: It’s against our rules, and they’re stupid. And both are dangerous.”

Bitcoin has soared in recent months, spurred by greater acceptance of the blockchain technology that underpins the exchange method and optimism that faster transaction times will encourage broader use of the cryptocurrency. Prices have climbed more than four-fold this year — a run that has drawn debate over whether that’s a bubble. Bitcoin initially slipped after Dimon’s remarks. It was down as much as 2.7 percent before recovering.

Last week, it slumped after reports that China plans to ban trading of virtual currencies on domestic exchanges, dealing another blow to the $150 billion cryptocurrency market. Tulips are a reference to the mania that swept Holland in the 17th century, with speculators driving up prices of virtually worthless tulip bulbs to exorbitant levels. That didn’t end well.

In bitcoin’s case, Dimon said he’s skeptical authorities will allow a currency to exist without state oversight, especially if something goes wrong. “Someone’s going to get killed and then the government’s going to come down,” he said. “You just saw in China, governments like to control their money supply.” Dimon differentiated between the bitcoin currency and the underlying blockchain technology, which he said can be useful. Still, he said banks’ application of blockchain “won’t be overnight.”

Foxconn $3 billion incentive deal comes closer to reality

A $3 billion state incentive package for electronics maker Foxconn, the largest ever of its kind, moved much closer to becoming reality Tuesday by passing the state Senate. The bill passed on a 20-13 vote with two senators breaking party lines. Republican Sen. Rob Cowles of Allouez voted “no,” while Democrat Bob Wirch of Kenosha, near where Foxconn may locate, voted “yes.”

Senate Republicans had moved more cautiously than their Assembly counterparts on the Foxconn measure. Its passage returns the bill to the Assembly for what likely will be a swift approval on Thursday. The bill then would head to its champion, Gov. Scott Walker, for a signature. The city of Kenosha announced Tuesday that it’s dropping out of the running for the proposed $10 billion Foxconn campus, which would build liquid crystal display, or LCD, screens.

The mayor wrote a letter saying the bill could leave the city “unable to support and/or absorb the development of the project.” That appears to tip the Foxconn sweepstakes in favor of Racine County, also believed to be vying for the facility. Sites in western Kenosha County also may still be in the running.

WhatsApp co-founder to leave company

Brian Acton, co-founder of WhatsApp, now owned by Facebook will leave the messaging service company to start a new foundation, he said in a Facebook post on Tuesday. Acton spent eight years with WhatsApp, which Facebook bought in 2014 for $19 billion in cash and stock. A Stanford alumnus, Acton co-founded WhatsApp with Ukrainian immigrant Jan Koum in 2009. The duo worked at Yahoo before starting WhatsApp.

Amazon’s Rapid Rise Put Online Giant on EU’s Tax Hit List

Amazon is in the EU’s cross hairs because its rapid expansion may have been fuelled by tax measures that slashed its costs, according to the EU official spearheading a state-aid probe into the online giant. Gert-Jan Koopman, whose department at the European Commission was responsible for slapping Apple Inc. with a 13 billion-euro tax repayment order last year, told a Brussels conference that the EU is targeting methods that are a menace to fair competition. “We are concerned that a company that is essentially in the position to lower its tax base, and as a business model is penetrating markets and scaling up, can do so more rapidly than some of its competitors,” Koopman said when asked about the EU’s investigation into Amazon.

Amazon is in the EU’s cross hairs because its rapid expansion may have been fuelled by tax measures that slashed its costs, according to the EU official spearheading a state-aid probe into the online giant. Gert-Jan Koopman, whose department at the European Commission was responsible for slapping Apple Inc. with a 13 billion-euro tax repayment order last year, told a Brussels conference that the EU is targeting methods that are a menace to fair competition. “We are concerned that a company that is essentially in the position to lower its tax base, and as a business model is penetrating markets and scaling up, can do so more rapidly than some of its competitors,” Koopman said when asked about the EU’s investigation into Amazon.

He pointed to an “internal form of financing which allowed it to expand very significantly.” Amazon and burger chain McDonald’s Corp. are tipped to be the next in line as the EU clamps down on tax deals it deems to be unfair. Both are under investigation for their fiscal arrangements with Luxembourg, which has gained a reputation for doling out special deals to big firms in the Grand-Duchy. At stake in the EU’s probes are billions of euros that multinational companies have squirreled away in tax havens, out of the reach of authorities in the countries where they make most of their sales.

Faced with some 300 companies to look at, the EU can prioritize cases that may harm competition more widely, said Koopman. Further pressure on Amazon?

Important events today:

9.30 am – UK unemployment data: August claimant count forecast to rise 8800 from a 4200 fall in July, while the July unemployment rate remains at 4.2%. Average hourly earnings expected to rise 2.1%, in line with the previous month. Market to watch: GBP crosses

1.30 pm – US PPI (August): factory-gate inflation expected to fall 0.1% MoM. Market to watch: USD crosses

3.30 pm – US EIA crude inventories (w/e 9 September): last week’s reading showed an increase of 4.6 million barrels. Markets to watch: Brent, WTI