Big deal in arms business | Tech Stocks downs | Toys R Us Files Chapter 11

S&P 500 and Dow All-Time Highs

U.S. equity market opened the week on a positive note, sending both the S&P 500 and the Dow to new all-time highs. The tech-heavy Nasdaq touched a new intraday high on Monday, but failed to carve out a new record close following a technology sell off in the late afternoon. Small caps outperformed, pushing the Russell 2000 higher by 0.7%.

After climbing to a new record high at the start of Monday’s session, the stock market began trending sideways, protecting its modest opening gain. The heavily-weighted financial sector underpinned the broader market during this time and continued to exert a positive influence through the closing bell. However, the top-weighted technology sector took control of the broader market in the afternoon following the sector’s sharp drop into negative territory.

After climbing to a new record high at the start of Monday’s session, the stock market began trending sideways, protecting its modest opening gain. The heavily-weighted financial sector underpinned the broader market during this time and continued to exert a positive influence through the closing bell. However, the top-weighted technology sector took control of the broader market in the afternoon following the sector’s sharp drop into negative territory.

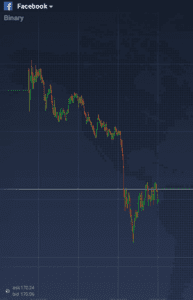

Without a catalyst, the tech sector exchanged a gain of 0.3% for a loss of 0.3% in less than an hour with mega-cap names like Apple, Facebook, Alphabet and Microsoft leading the retreat. Likewise, the S&P 500 slipped to its lowest mark of the day, fully retracing its gain of 0.3%.

However, the tech group managed to bounce back a bit in the late afternoon to finish just a tick below its unchanged mark. Chipmakers helped keep the sector’s loss in check, putting together yet another positive performance. The PHLX Semiconductor Index climbed 1.2% to settle in the green for the sixth-consecutive session. NVIDIA led the semiconductor rally – climbing 4.1% to a new all-time high–after Bank of America/Merrill Lynch raised its target price to $210 from $185 on Monday morning. The industrial sector benefited from the positive performances of several influential Dow components, including Boeing and Caterpillar, which climbed 1.6% and 2.0%, respectively. UBS upgraded CAT shares to ‘Buy’ from ‘Neutral’ on Monday morning.

As for Boeing, it rallied alongside aerospace and defense peer Northrop Grumman which climbed 3.4% after announcing its intent to acquire Orbital for $7.8 billion, or $134.50 per share, in cash. Including the assumption of debt, the total cost will be $9.2 billion.

In the bond market, Treasuries sold off in a curve-steepening trade. The yield on the benchmark 10-yr Treasury note climbed three basis points to 2.23% while the 2-yr yield advanced just one basis point to 1.39%. Meanwhile, the U.S. Dollar Index (91.81, +0.16) climbed 0.2%.

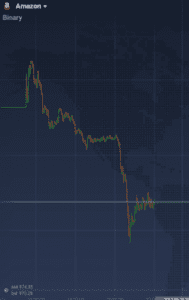

Toys ‘R’ Us Files For Bankruptcy, Crushed by Online Competition

Toys “R” Us filed for bankruptcy as the retailer, loaded with debt in a buyout more than a decade ago, failed to keep consumers from abandoning its stores for the lower prices and convenience of online shopping. The company listed debt and assets of more than $1 billion each in Chapter 11 documents Monday in U.S. Bankruptcy Court in Richmond, Virginia. Prior to filing, the chain secured more than $3 billion in financing from lenders including a JPMorgan Chase & Co.-led bank syndicate and certain existing lenders to fund operations while it restructures, according to a company statement. The funding is subject to court approval. The company didn’t announce plans to close stores, and said its locations across the globe would continue normal operations.

“Like any retailer, decisions about any future store closings – and openings – will continue to be made based on what makes the best sense for the business,” Michael Freitag, a spokesman for Toys “R” Us, said in an email. The bankruptcy filing is the latest blow to a brick-and-mortar retail industry reeling from store closures, sluggish mall traffic and the threat of Amazon. Much of the toy merchant’s debt is the legacy of a $7.5 billion leveraged buyout in 2005 in which Bain Capital, KKR & Co. and Vornado Realty Trust loaded the company with debt to take it private. Since then, the Wayne, New Jersey-based chain has struggled to dig itself out. Time to go long on Amazon?

“Like any retailer, decisions about any future store closings – and openings – will continue to be made based on what makes the best sense for the business,” Michael Freitag, a spokesman for Toys “R” Us, said in an email. The bankruptcy filing is the latest blow to a brick-and-mortar retail industry reeling from store closures, sluggish mall traffic and the threat of Amazon. Much of the toy merchant’s debt is the legacy of a $7.5 billion leveraged buyout in 2005 in which Bain Capital, KKR & Co. and Vornado Realty Trust loaded the company with debt to take it private. Since then, the Wayne, New Jersey-based chain has struggled to dig itself out. Time to go long on Amazon?

Northrop Grumman to Buy Missile Maker Orbital for $7.8 billion

Northrop Grumman said on Monday it would buy Orbital for about $7.8 billion in a deal that gives it greater access to lucrative government contracts and expands its arsenal of missile defense systems and space rockets. The all-cash transaction is the biggest in the defense sector in two years and comes as North Korea’s missile and nuclear weapons threats grow, heightening tensions with the United States and its allies. “Clearly, as we watch what’s happening around our globe, the rather rapid advance of some of our potential adversaries is quite concerning,” Northrop Chief Executive Wes Bush said on a call with analysts. Although Northrop already has a significant presence in payloads, it has not had launcher capability, an area that Orbital brings for both space and missile defense, Vertical Research Partners analyst Robert Stallard said on Monday. Orbital has contracts with NASA and the U.S. Army. The Dulles, Virginia-based company is one of the two firms hired by NASA to fly cargo to the International Space Station under an initial contract worth up to $3.1 billion.

Northrop Grumman said on Monday it would buy Orbital for about $7.8 billion in a deal that gives it greater access to lucrative government contracts and expands its arsenal of missile defense systems and space rockets. The all-cash transaction is the biggest in the defense sector in two years and comes as North Korea’s missile and nuclear weapons threats grow, heightening tensions with the United States and its allies. “Clearly, as we watch what’s happening around our globe, the rather rapid advance of some of our potential adversaries is quite concerning,” Northrop Chief Executive Wes Bush said on a call with analysts. Although Northrop already has a significant presence in payloads, it has not had launcher capability, an area that Orbital brings for both space and missile defense, Vertical Research Partners analyst Robert Stallard said on Monday. Orbital has contracts with NASA and the U.S. Army. The Dulles, Virginia-based company is one of the two firms hired by NASA to fly cargo to the International Space Station under an initial contract worth up to $3.1 billion.

Northrop’s purchase of Orbital would help sharpen its focus on small space systems, launch vehicles, missiles and munitions. The deal also comes ahead of planned upgrades of U.S. ballistic systems, which are expected to drive demand for missiles, potentially benefiting companies such as Northrop.

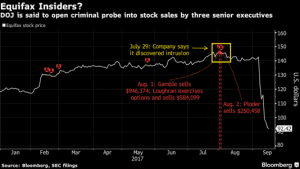

Equifax Stock Sales Are the Focus of U.S. Criminal Probe

The U.S. Justice Department has opened a criminal investigation into whether top officials at Equifax violated insider trading laws when they sold stock before the company disclosed that it had been hacked, according to people familiar with the investigation. U.S. prosecutors in Atlanta, who the people said are looking into the share sales, said in a statement they are examining the breach and theft of people’s personal information in conjunction with the Federal Bureau of Investigation. The Securities and Exchange Commission is working with prosecutors on the investigation into stock sales, according to another person familiar with the matter. The federal probes add a serious challenge to Equifax as lawmakers, state attorneys’ general and regulators scrutinize the breach that may have compromised the privacy of 143 million U.S. consumers. Equifax shares were little changed. The shares have fallen 35 percent since the breach was disclosed after market close in New York on Sept. 7.

The U.S. Justice Department has opened a criminal investigation into whether top officials at Equifax violated insider trading laws when they sold stock before the company disclosed that it had been hacked, according to people familiar with the investigation. U.S. prosecutors in Atlanta, who the people said are looking into the share sales, said in a statement they are examining the breach and theft of people’s personal information in conjunction with the Federal Bureau of Investigation. The Securities and Exchange Commission is working with prosecutors on the investigation into stock sales, according to another person familiar with the matter. The federal probes add a serious challenge to Equifax as lawmakers, state attorneys’ general and regulators scrutinize the breach that may have compromised the privacy of 143 million U.S. consumers. Equifax shares were little changed. The shares have fallen 35 percent since the breach was disclosed after market close in New York on Sept. 7.

Investigators are looking at the stock sales by Equifax’s chief financial officer, John Gamble; its president of U.S. information solutions, Joseph Loughran; and its president of workforce solutions, Rodolfo Ploder, said two of the people, who asked not to be named because the probe is confidential.

The company and the executives didn’t immediately respond to requests for comment.