Working for IQ Option, I tend to hear a multitude of different financial questions from my clients on a daily basis. The nature of these questions is often concerned with making some kind of choice or decision in trading:

‘Is there any hope for Ripple?’, ‘What is the best trading strategy?’, ‘Will Apple ever recover?’.

If you even somewhat glanced at the title, then you know where I am headed with this. The question of ‘Am I ready to trade?’ is often glossed over as traders who have already invested their funds onto a trading platform are typically too battle-ready to consider Step 1; is this really the right time to trade? Am I actually ready?

If you were to ask me this question, my answer would vary depending on whether you have two minutes or twenty for a chat. The short version would probably be something akin to ‘I have absolutely no idea… ’.

And now for the long answer;

There are MANY different factors to consider when trading. Let’s first tackle the subject of making an investment in general. Now in order to prevent a financial catastrophe, trading with funds that you cannot afford to lose is most definitely a big mistake. As a common rule, it’s best not to invest money that will cause you heartache when it’s gone. In other words, don’t buy it if you can’t afford to replace it. I heard a smart man once say that if you’re going to buy a new car, make sure you could afford to buy another the day after, in case your drunk uncle steals it from you and drives it off a cliff. Sure, insurance… But the point here is to not mess with something that you can’t afford to lose. This is important. If you hadn’t already considered this, then please do. It might feel like I am repeating myself at this point but consider the fact that I have seen first-hand what happens to those who don’t adhere to this simple rule and I’ll tell you this much; it is not a pretty sight.

Now let’s consider Part Deux: Choosing your asset. So, let’s say that you actually are in a position to invest. Let us assume that you are using an amount that you have carefully saved on the side to be used for this purpose. Let us also assume that you aren’t hiding this from your partner/family and that they too are aware of the risk that you are undertaking that might not only affect your own life, but theirs as well. In a nutshell, let’s say you are ready.

‘Here’s the good thing; the hard part is done. Deciding whether it’s the right time to invest is over, and the rest is effortless.’

Said no one ever…

If you have had any experience with trading in the past, then you probably already know that the above quote is an absolute lie. No, the hard part is not over, it is only beginning. Now comes the analysis. What tools shall we use for investing? There are so many; where to even begin?

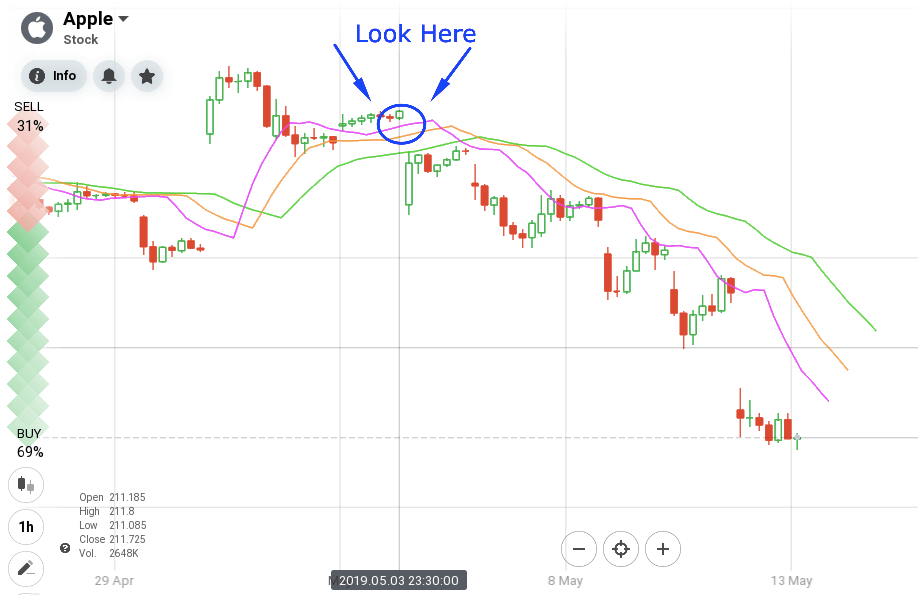

Many traders like to use technical indicators and there is nothing wrong with that. Technical Indicators can be useful for making trades, but certainly not always as there are some limitations. Let’s discuss them by looking at this screenshot of Apple with the Alligator indicator attached.

Take a look at that candle stick before the downtrend began. That was the last 1-hour candle stick before the weekend. Once Monday came in, the price had already adjusted lower which led to the bearish movement that you see before you. So, why am I showing you this? I must be trying to make a point here right? Well, yes let me get to it.

If you understand how the Alligator indicator works then you can immediately notice the downtrend that is being indicated. The technical analysts will argue that this is why indicators are the best way to analyse the market; they show you the trend and you take a trade on it. Now this is where it gets divisive. On the other end of the spectrum are the purists; the ones who don’t believe in technical analysis and support the decision to invest through fundamental analysis. And this kind of trader would probably make the following point.

Yes. Sure. There is a bearish movement. I see it. Your indicator sees it. We agree on this. Do you understand, however, why there is a bearish movement?

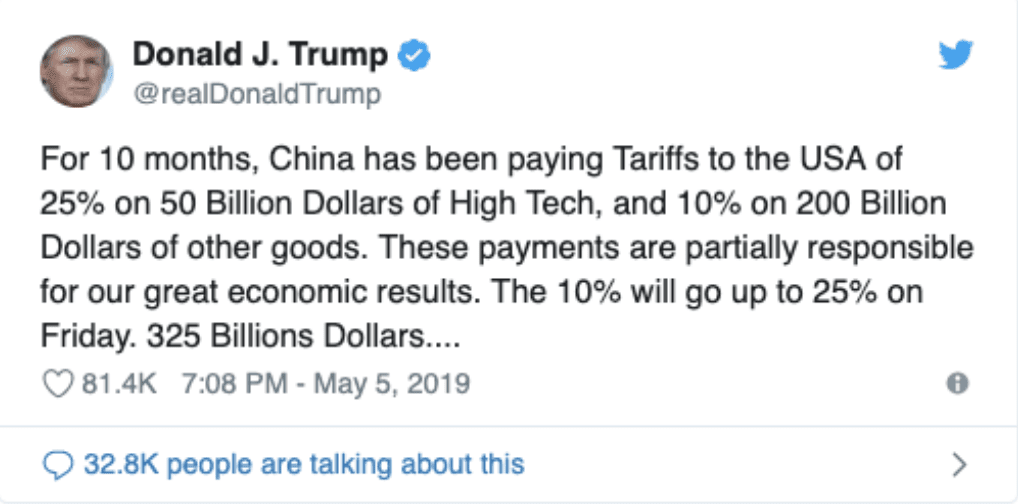

Well the Alligator can read trends, but it can’t read the news. It doesn’t understand economics, and it surely can’t fathom policy. Let’s go back to that candle I circled (surely you didn’t think I was done with that?) and think about what happened there. If you look at the bottom of the screenshot you will see that the candle stick dates the 3rd of May. Meaning that the next one is on Monday the 6th of May. So what happened on that weekend? Well, President Donald Trump tweeted something interesting.

In a nutshell, tariffs on imports from China are going up. Did you know that Apple imports a large amount of raw materials from China and thus its revenue has a 20% exposure to China? That explains things doesn’t it.

So where do we go from here? I could probably show you a million different examples such as this but I won’t bore you with that. Here’s what I will say; be cautious and use EVERYTHING that you can. There are many tools at your disposal, use them all. Being cautious and aware is the name of the game so make sure to follow the news. If a recent event gives you reason to take on an asset then sure, do it, but don’t ignore everything else. If it is a stock, read the financial statements, make sure it is the right decision. Maybe you’ve taken the trade but your Alligator is indicating the emergence of a new trend… Well, it might be time to get out and not let yourself get too greedy.

It takes a lot of work before deciding if you are ready to trade and if you can take one thing away from this article, I guess that should be caution. Think about it and take your time. Don’t rush it, don’t be season 8 of Game of Thrones.