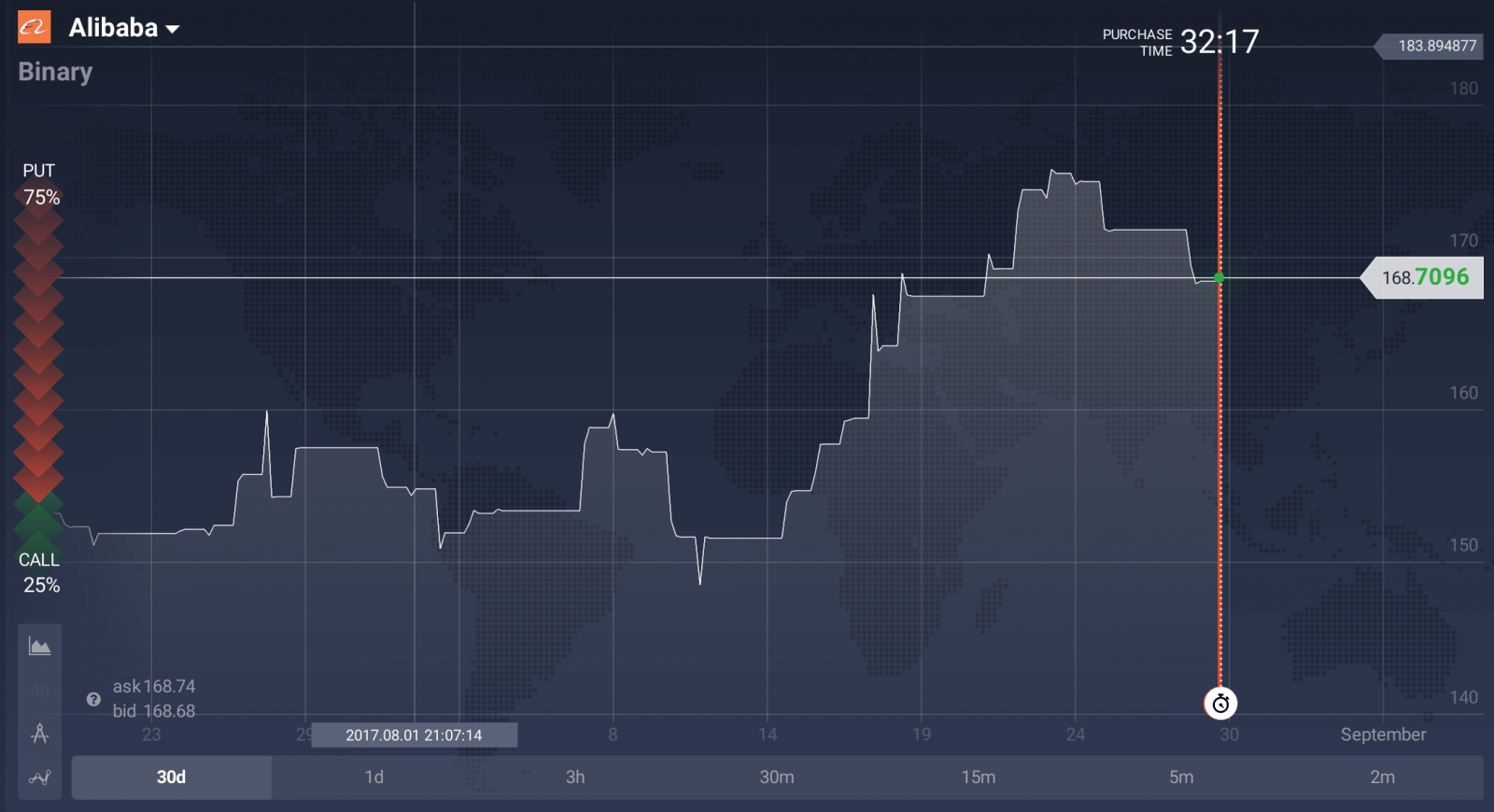

Alibaba (BABA:NYQ) is trading slightly below 170USD per share (reached on Aug 25th) – the highest highs of all time. The China based global e-commerce powerhouse reported another outstanding set of earnings on August 17th, 2017. This stellar financial performance combined with a number of additional factors is indicating continued strong growth to investors – and has sent the share price soaring to all-time highs.

1) Revenue Rocketing

One of the biggest drivers of positive sentiment in the stock is the rapid revenue growth – Alibaba’s management has reiterated full-year guidance for revenue growth at an impressive 47% approximation.

2) Retail Rising

The company’s core segment – retail operations – has continued to expand at breakneck pace, predominantly driven by expansion in the domestic Chinese market, which recently reported an increase of 57% in year on year revenues to reach 5.4USD billion. Meanwhile, international retail sales leaped a huge 136% higher to reach 440USD million.

3) International Expansion

Alibaba is aggressively pursuing international growth. By holding a retail conference in Detroit during the first quarter of this year the company was able to interact with American sellers and manufacturers. This was an opportunity to demonstrate the value of the Alibaba platform to a larger market share – specifically showing US producers how to market their goods in China.

Alibaba is scheduled to host a similar event in Canada this September. In addition, Alibaba has been securing partnerships in Russia as well as a 1USD billion investment in an e-commerce platform based in Singapore – further elements to their international expansion plans.

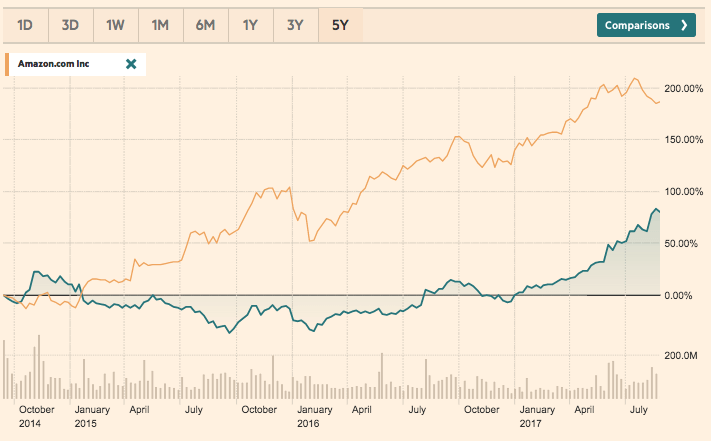

4) Alibaba vs Amazon

With a market capitalisation closing in on 420USD billion, Alibaba may soon overtake Amazon as the world’s most valuable online retailer.

Amazon stock has also had a stellar performance this year – up over 25% YTD. However, Alibaba, benefits from a home advantage – serving a domestic Chinese population of over 1.3billion people. Alibaba now also owns a number of Chinese e-commerce sites such Taobao and Tmall – consolidating the foothold it has in Chinese retail even further.

5) Diversification

The consistent and stable revenue generation of the retail segment has been the key to Alibaba’s success – creating the liquidity and opportunity to diversify and explore other high-growth opportunities concurrently. Alibaba has expanded into e-commerce support solutions and has been especially successful in cloud services to date.

Most recently, revenues in cloud services doubled from the previous quarter – to reach 400USD million. In addition, as part of a strategy to diversify revenue generation, Alibaba now owns the YouTube-like video site Youku Tudou as well as the South China Morning Post newspaper – both highly valuable assets in today’s media-centric marketplace.

6) Attractive Valuations

At these levels Alibaba is trading at valuations similar to start-up stocks. However, start-up stocks tend to have short track records and pose investors high risk. Alibaba, on the other hand, has a long track record of delivering year on year growth, from which to accurately assess risk. In addition, Alibaba have the luxury of a bulge bracket balance sheet to drive growth – helping support a far superior risk-reward ratio at these valuation levels compared to start-ups.

Sources:

- http://www.alibabagroup.com

- https://markets.ft.com

- http://money.cnn.com