When it comes to trading, there is a lot to know, and one of the important topics is the trading time. What time is best? And during what time can you trade at all? When you are just starting, this is one of the topics that take a bit more time to learn about. Experienced traders do not hesitate to investigate the market and the asset they are about to trade before investing in it.

Of course, there is a difference among the instruments on the platform. Some markets are open 24\7. It means that you can trade them all week long without any limitations. It is convenient to trade markets that are open all day every day, like the crypto market. You can place deals there at any moment, including the weekends, too. Moreover, it is possible to close the deal whenever you like, without the need to wait.

However, with CFD assets, it is a bit different. Stocks are traded according to the market hours. Let us look at it a bit more closely and learn everything there is about trading time of stocks.

Market hours

When the time comes to trade a certain CFD asset, you may open the traderoom and suddenly notice that the asset is closed. Why does it happen?

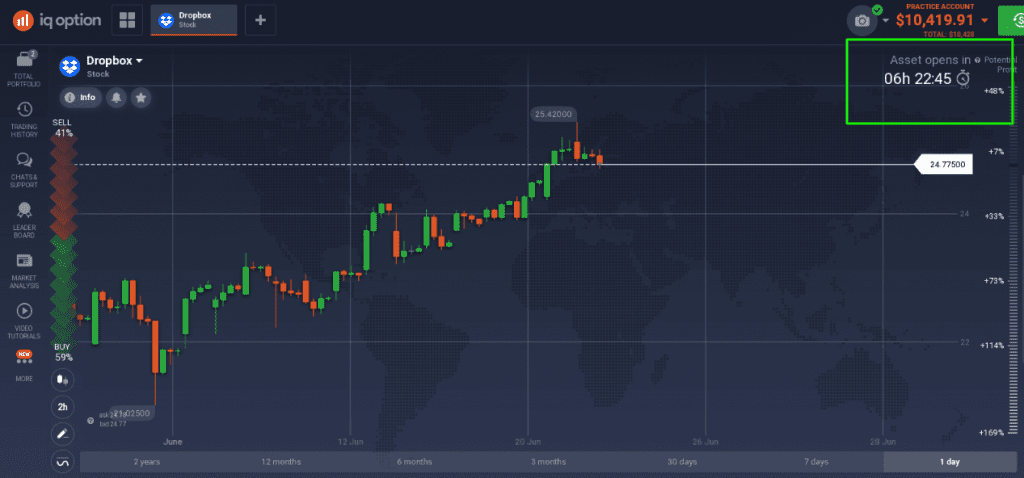

Each asset has its own trading time at which the market is open. If the market for a certain stock is closed, you will see the time left until opening in the traderoom:

This timeframe shows exactly how much time is left until you can trade the asset again. If you have an already open position on this asset, you will see it in your portfolio, however, it is not possible to close such deal until the market opens. You cannot sell or buy an asset that is not traded at the moment. However, as soon as this time is up, you are welcome to open new deals or close the ones you already have, if you wish so.

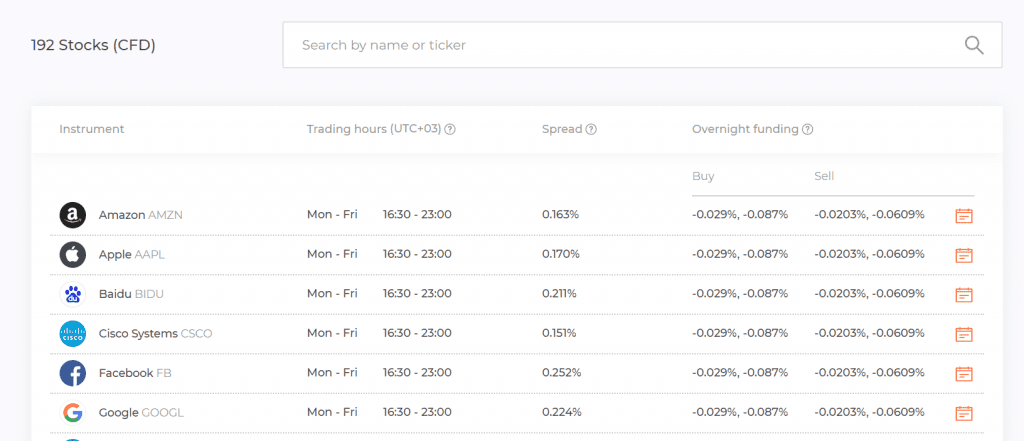

Besides checking in the traderoom, it is always possible to check the schedules, as they are available on the website. Let us have a closer look at the schedule.

Here you may find the information about trading time as well as overnight fees and spread.

Note that the schedule is according to the UTC +3 timezone. The schedule allows you to plan your trading strategy beforehand and take the trading time of assets into consideration.

You may decide how long you wish you leave your deals open for, count the overnight fees you will be charged and calculate the risks. If you prefer trading stocks, plan your trading in accordance to the market so that you are never caught off guard. However, if you notice that the asset is closed, but you still wish to trade it, there are options for you that we will talk about next.

After market trading

While the stock market is open at certain hours during business days, the value of the stock is still changing and fluctuating all the time. It happens as there is a certain company or business behind each stock. The company releases news and announces changes and it will immediately influence the intrinsic value of the stock. Some companies report earnings before the market opens or after it closes. Traders and investors want to access the market when the intrinsic value is changing and that is how the pre-market hours trading and after market trading are born.

Pre-market trading takes place approximately an hour before the stock market opens and the after hours are usually 2-3 hours after the market closes.

It is needless to say that it is specifically important to closely follow the news of a certain company which stocks you are trading. Even minor announcements can significantly influence the market, and that it is why it could be useful to focus the attention on 2-3 assets, rather then trading dozens of them without taking time to learn about the business.

As the trading type of IQ Option platform is CFD (contract for difference), traders invest making an expectation about price change and benefit from a correct prediction or lose if the prediction was incorrect. While the market is closed, it is not possible to trade the asset. However, there is a possibility to schedule a deal for it to open automatically once the market opens. Let us have a closer look at the way it works.

“Market-on-open” feature

After the market closes, the after market trading takes place. How can traders of IQ Option benefit from it?

It is possible to schedule your deals exactly how you want them to open. There are two ways to place orders even when the market is closed. The first one is placing a “Market-on-open” order. It means that the deal will be opened once the market for this certain stock opens.

Let us look at an example:

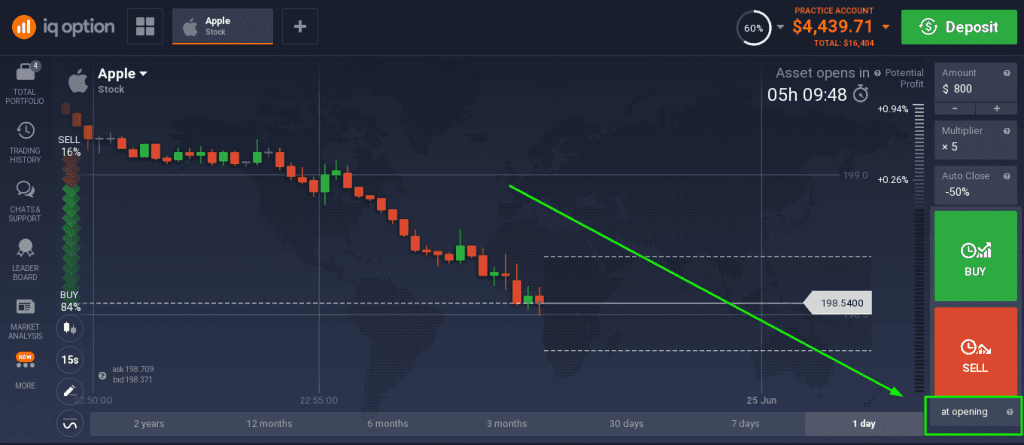

The market for Apple will open approximately in 5 hours. Let us imagine that you are about to place a market-on-open order:

- By evaluating the stock’s previous performance and the news releases you need to decide whether the price of the asset will continue dropping or reverse and start rising once the market opens.

- Click “Buy” if you think that the price will rise or “Sell” if you estimate further decreasing of the price. Make sure that you have set it “at opening”.

- Once you have clicked “Buy” or “Sell”, a deferred order will be created. It will be triggered and executed as soon as the market opens.

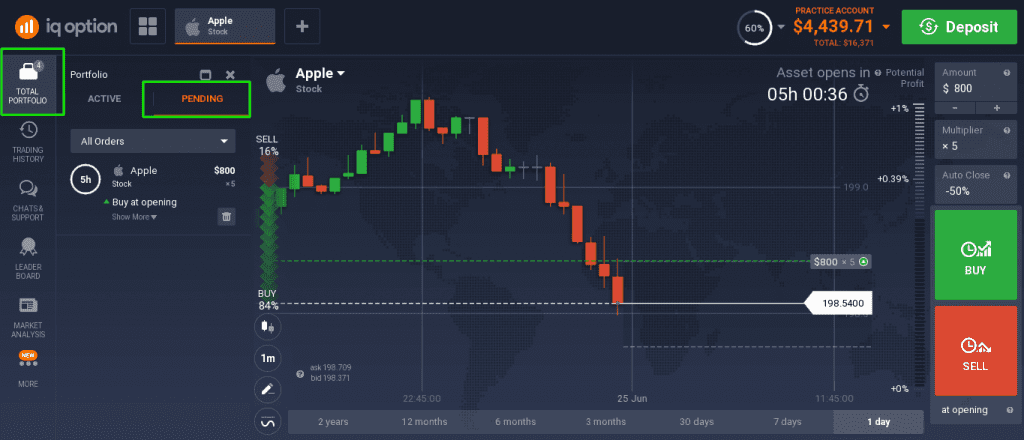

- You can easily check all of your pending orders in the total portfolio.

This feature is useful for traders that want to enter deals immediately once the market opens. It is an extremely useful possibility, however, it can also be quite risky, as there are no quotes up until the moment of the market opening. Moreover, assets that are not traded during weekends can open at a drastically different price on Monday. Therefore all decisions are made according to your knowledge of the market. Once the market opens, it can also take time for the price to settle so your prediction has to be well-weighted.

“Purchase at..” feature

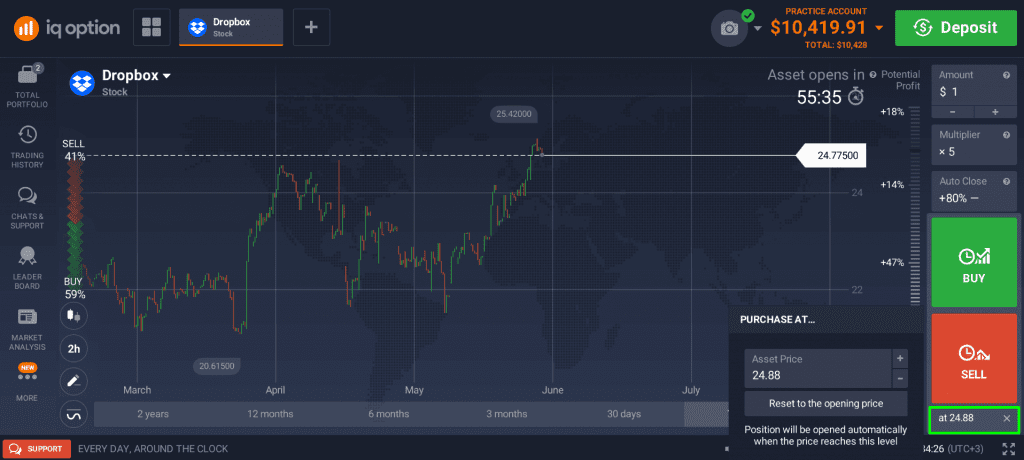

Our platform offers traders high flexibility, so the “market-on-open” feature is not the only one that can be used. Deferred orders are quite handy when it comes to after market trading. If you estimate a certain change in price and you wish to enter deals exactly at established levels, you can set the quote when opening a pending order. Let us see how it can be used.

To create a pending order that will be executed when the price reaches a certain quote, simply click on the “at opening” button and change the price to a certain level.

The pending order will be triggered and the deal will be opened as soon as the market opens and the price reaches your set level. This feature is useful as it allows you to control what level your deal will be opened at exactly.

How to evaluate stocks

As there are many possibilities for traders to place deals even when the market is closed, it is important to understand the asset that you are trading and gather as much data as possible before opening deals. On the platform you can find a useful feature that keeps all crucial data in one place.

When the market is closed, you have more time to make your decisions and it is wise to pay more attention to the information about the asset you invest in. On the platform you can use the “Market Analysis” tab to read about different assets, but you can also focus on the one that you are about to trade.

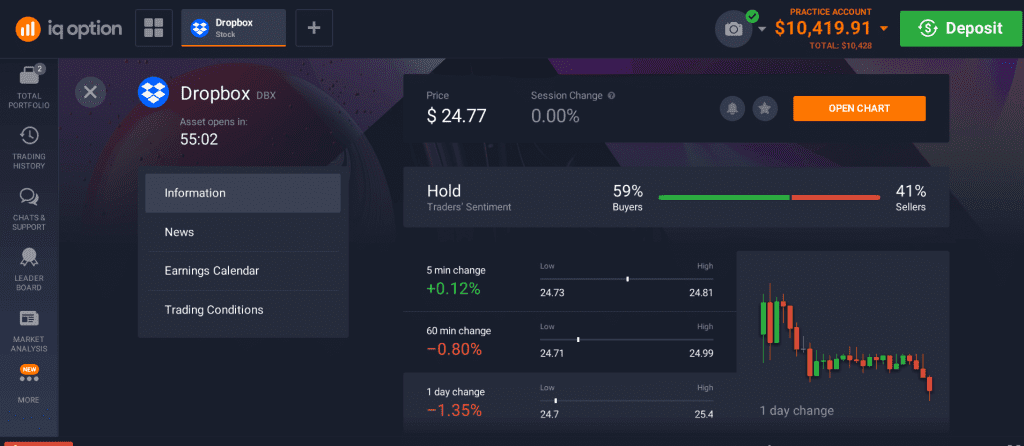

To see all the useful data in one place, click on the “Info” button near the asset name.

In the tab you will find everything you need to know in order to make an educated decision.

Here you will see the trader’s sentiment which reflects the percentage of traders choosing one or another direction, as well as market news about the specific stock you have chosen, earnings calendar and trading conditions. The trading schedule can also be found there, for your convenience.

Trading stocks can be rewarding, however, there is a lot to take into consideration before you start. You may use the practice account to see how the overnight fees are applied and test different investment amounts. Moreover, the practice account is a good place to exercise placing deferred orders during the after market hours.