The forex markets were a bit muted on Monday as traders gear up for a week filled with economic data. The data is diverse, coming from several countries, but generally focused on one thing; inflation. There are some key reads on retail sales, industrial activity and housing but they will only be important if they indicate a major change in economics, good or bad.

Monday’s calendar was light, data from the US dominated and was, in general, a bit on the light side. Retail sales jumped by 0.6% and better than expected but that figure was tempered by cool core sales growth of only 0.2%. On the manufacturing side the Empire State Manufacturing Index fell more than expected to 15.80 showing manufacturing has slowed more than expected within the NY Federal Reserve Region. Housing data was similarly weak, the home builders index falling 1 point to a 6-month low as tariffs drive up costs.

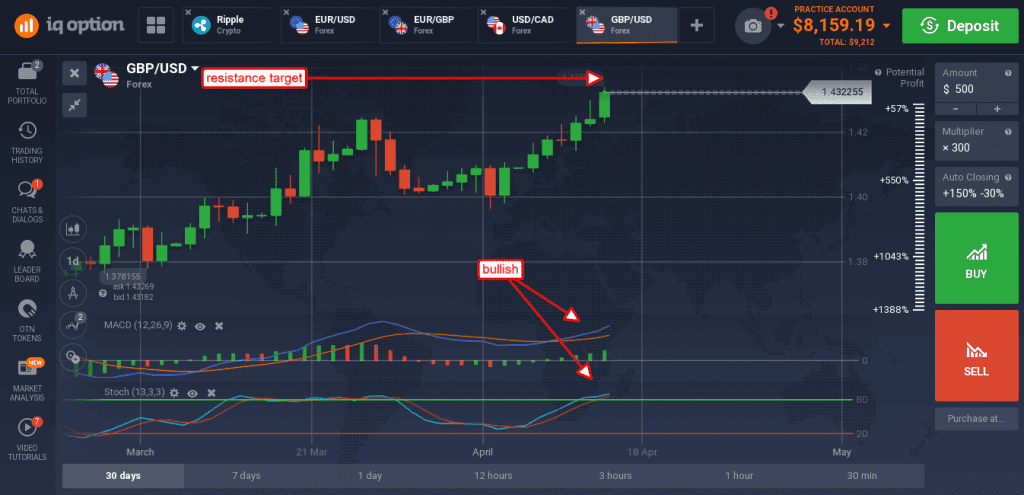

Data due from the UK this week includes average hourly earnings on Tuesday, CPI and PPI on Wednesday and then retail sales on Thursday, all of which are expected to reveal ongoing improvement with the UK and support the BoE’s plan to hike rates on May 10th. The GBP/USD moved up on today’s light US data and expectations for this week’s UK data. The pair is now testing resistance at 1.4350 that, if broken, could lead to a longer term move up to 1.5000.

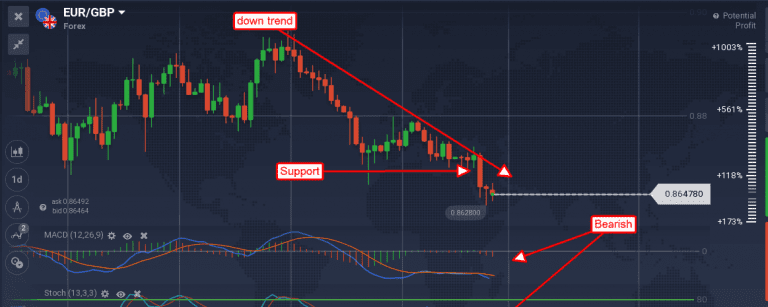

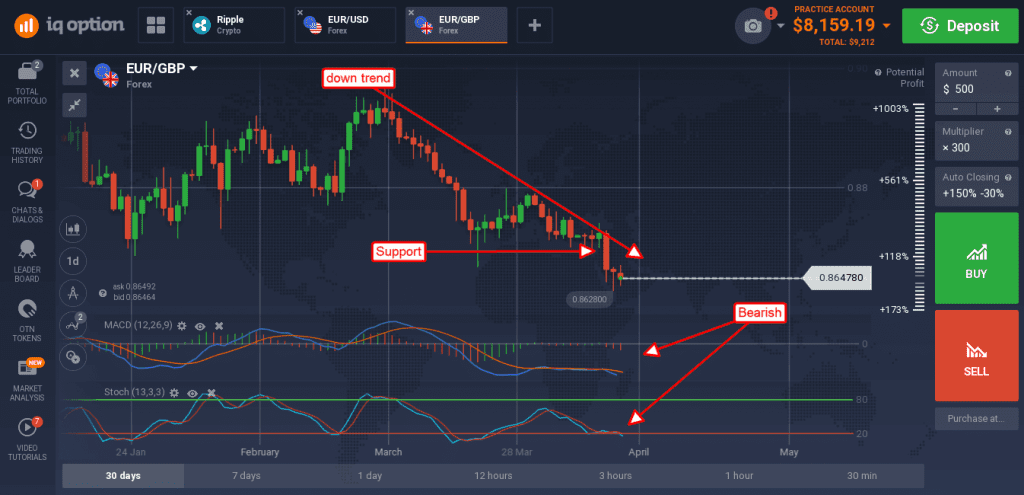

Data due from the EU includes economic business sentiment on Tuesday, CPI on Wednesday and German PPI on Friday, data that will foreshadow next week’s EU PPI. The data is also expected to show continued expansion within the EU and support outlook for EU tightening sometime next year. The EUR/GBP fell on today’s news and looks like it could continue falling if the EU data is not strong. Support at 0.8700 has already been broken and the indicators are bearish, so a deeper fall looks likely, the first target is 0.8600.

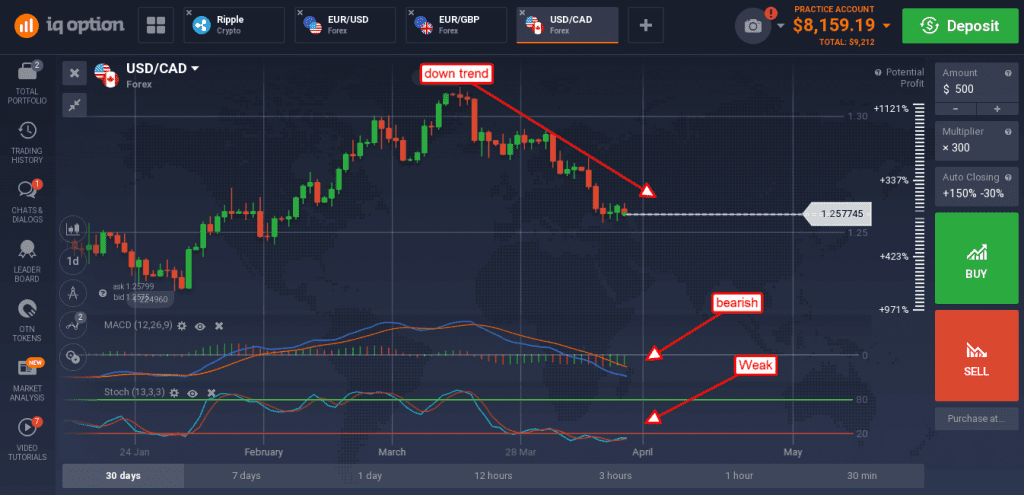

More data is due from the US including building permits and the Philly Fed. Building permits is of interest as they may be impacted by tariffs on Canadian lumber as builder sentiment is. Along with this data is a policy statement from the BOC on Wednesday that could sent the USD/CAD moving.

The pair is in a near term consolidation within a down trend and looking like it will continue lower. The 1.2300 level looks like an easy target and may be exceeded if US data is light and Canadian is strong.