A key fed official says the US should keep its growing debt load in mind as it plans to increase government spending.

The US Should Watch Its Debt Before “Things Get Out of Hand”

Loretta Mester, president of the Federal Reserve Bank of Cleveland, says the US needs to watch its growing debt pile. In her view the country’s national debt load is on the verge of “getting out of hand”. According to data from GAO, the General Accounting Office, the US national public debt is already sitting at 75% and expected to double over the next 30 years as government spending continues to grow. The International Monetary Fund says the US is the only advanced economy in which debt-to-GDP is expected to grow in the next 5 years.

“I think we have to be taking into account the health of U.S. economy, in terms of are we on a sustained fiscal path?” Mester replied. “And I do think that’s something we should be thinking of now as we go forward, and not waiting till things get too far out of hand.”

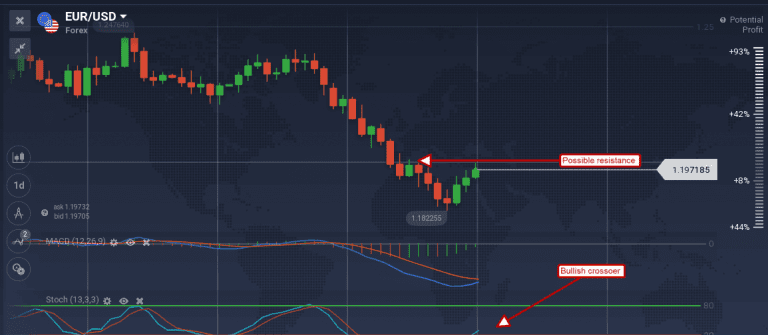

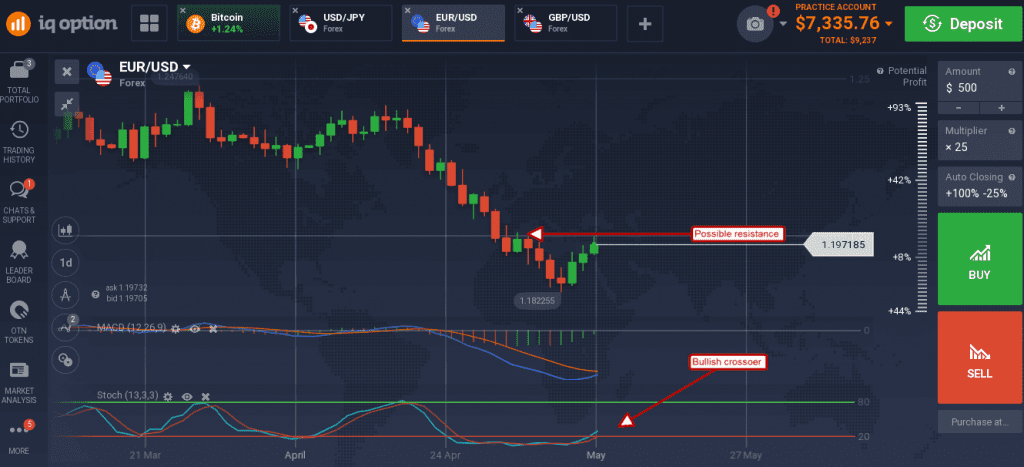

What affect did this have on the dollar? Not very much. The world’s reserve currency continued to fall versus a basket of world currencies on inflation data and interest rate expectations. The USD/EUR moved up to test for resistance at the 1.2000 level, extending a bounce that formed last week. The pair appears to be in full reversal but that is not confirmed in the charts yet. The indicators are both consistent with reversal, but momentum has not shifted to the upside. A move above 1.2000 would be bullish and likely take the pair up to the 1.2100 level near term.

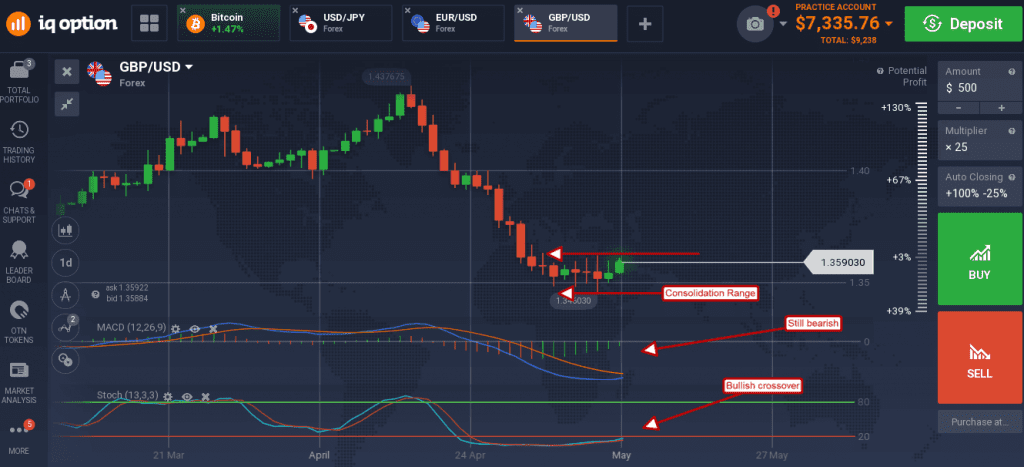

The USD lost some ground to the British pound as well. The GBP/USD moved up to test resistance at the top of its near-term consolidation range just above 1.36000. The indicators are suggestive of reversal with stochastic forming a bullish crossover and MACD not far behind, but the move is not confirmed. A move in prices above 1.36000 with a close at the new high would be bullish. This week there is a load of US data, but none will give much indication about inflation while in the UK economic news will be dominated by employment data later in the week.

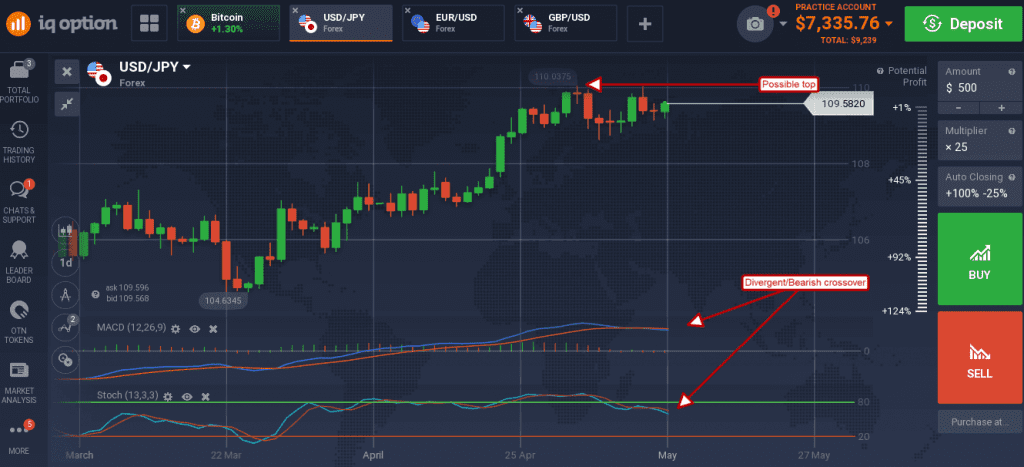

The dollar was able to make up some ground versus the Japanese yen, but the gain was small and left the pair trending within a near-term price pattern that is beginning to take on the look of a double top. The top is forming at 110.00 and has been touched twice. The pair has retreated from the tops but not yet broken support although that looks likely.

Both MACD and stochastic have diverged from the high and formed bearish crossovers which suggest lower prices are on the way. A break below support at 108.70 would be bearish. Later this week Japanese GDP figures are due out; a hot number could help send this pair down to stronger support levels.