Procter & Gamble (PG: NYSE) produces and supplies branded consumer packaged goods globally – operating through five key segments: beauty, grooming, health care, fabric & home care, and baby, feminine & family Care.

P&G was incorporated in 1905 and now employs a workforce exceeding 105,000. With approximately 20 manufacturing sites located in over 20 states in the United States as well as over 100 manufacturing sites in approximately 40 further countries P&G offers products under numerous popular brand names – such as Olay, Old Spice, Safeguard, Head & Shoulders, Pantene, Venus and Febreze.

Sales span approximately 180 territories – primarily through mass merchandisers, grocery stores, drug stores, department stores, e-commerce and pharmacies.

1. Market Activity

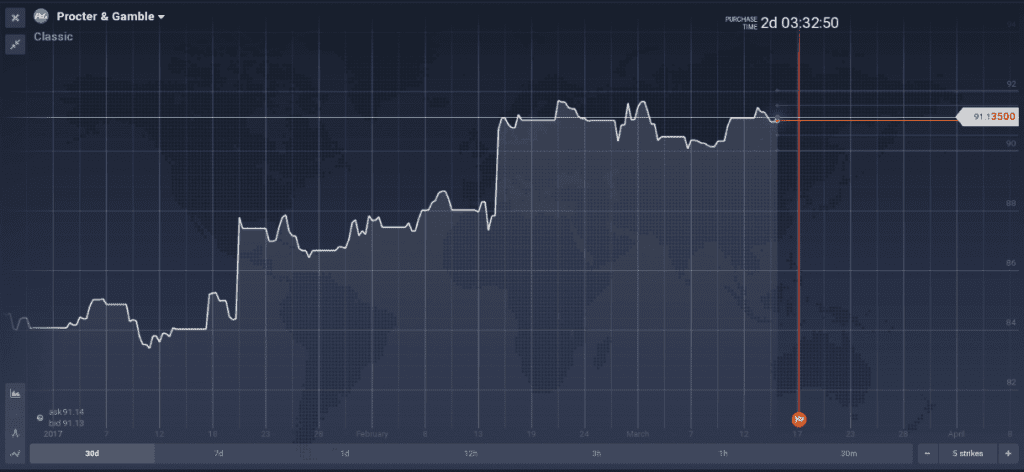

Procter & Gamble Co shares closed at 91.07USD last week, slumping -0.89% below a 52 week high of 91.89USD, achieved just 9 days earlier on March 1st 2017.*

Although the shares have experienced moderate volatility the overall trend has been upward – the shares are up 8.3 percent YTD and Markit data has indicated the stock has experienced low short selling activity consistently over the past two years.*

2. In good company

The consumer goods company has a market capitalization of 232.82billion USD as of March 2017 – of which 23.74% per cent of shares are held by the top 10 holders.*

The Vanguard group is the largest stakeholder with 6.94% and the third largest is Blackrock at 4.39%. Both of these institutional investors are known for successful stock picks – providing a positive indication of P&G future trajectory for the short term at the least.**

3. Dividends on the Up

In 2016, Procter & Gamble shares paid a dividend of 2.66 USD increasing 2.49% YoY and delivering a yield of 2.96% to shareholders.* The growth in dividends is particularly noteworthy as many companies in the Personal & Household Product segment paid no dividend at all in 2016.

Consensus analyst expectations forecast dividends of 2.71 USD for the upcoming fiscal year, an increase of 2.10% from 2016.**

4. Earnings Surprises

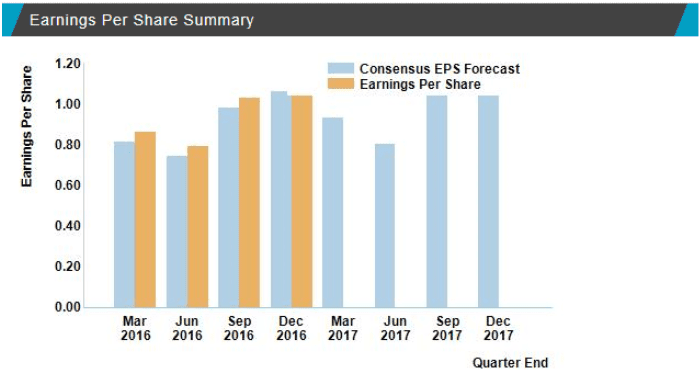

P&G earnings per share (excl extraordinary items) increased 23.09% YoY for the 2016 financial year.*

The company furthermore has a strong track record of delivering estimate beating earnings – with seven consistent quarter on quarter reports of positive earnings surprises since 2015.*

5. Turkish Expansion

In March 2017, P&G marked its 30th anniversary in the Turkish market with a 250 million lira (70USD million) investment in the production of baby and feminine care products at its Gebze factory.

This move is part of a plan to invest and expand the feminine care and baby products segment in Turkey and surrounding regions. P&G is incorporating elements of high-tech production to the factory as part of the investment whilst also supporting domestic production and female employment in the region as part of its ‘responsible and ethical investor’ outlook.

6. Baby Boom

The market for baby products is estimated to reach 121USD Billion by 2025 – driven by a combination of rising spending ability in developed countries with rising birth rates in emerging economies.**

P&G is positioning itself to capture increased market share in this growth area – focusing specifically on several product lines. In particular the PG flagship line Pampers is expected to see significant sales growth.**

* Past performance is not a reliable indicator of future performance.

** Forecasts are not reliable indicator of future performance.