HP Inc is a US based provider of technology solutions that became the legal structure of a corporate spin off from Hewlett-Packard on November 11th 2015. HP Inc is a provider of products, technologies, software, solutions and services to individual consumers, small- and medium-sized businesses, and enterprises.

This includes customers in the government as well as large public service organizations. Company segments include Personal Systems, Printing and Corporate Investments. The corporate Investments segment encompasses the operations of HP Labs and business incubation.

HP Inc (HPQ: NYSE) reports Q2 2017 earnings on May 24th 2017 after the closing bell. Let’s look at the five key facts to consider into the earnings announcement.

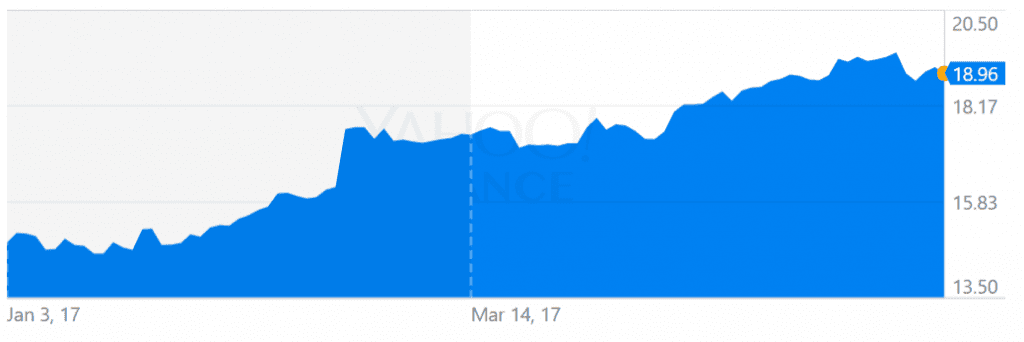

1) Shares Drifting Consistently higher

Up over 27% since the start of the year HP Inc shares have also drifted upward with moderate volatility over the past 12 months – delivering an impressive gain in share price of over 33% over the past year.*

2) Earnings Exceeding Expectations

On February 22nd 2017, the technology solutions provider reported Q1 2017 earnings of 0.38 per share, delivering a 5.56% year on year improvement.* For the previous quarter, HP Inc reported a positive earnings surprise of 2.7% – and the company has achieved an average positive earnings surprise of 3.6% over the past 4 quarters.*

The next earnings announcement is expected on May 24th 2017 and is forecast at 0.39USD per share – which would be marginally lower than the 0.41 USD reported for Q2 2016.**

3) Restructuring Delivers Growth

HP Inc (NYSE: HPQ) has been operating separately from Hewlett Packard Enterprise Company (NYSE:HPE ) since November 2015. This restructuring has created new opportunities for HP Inc by allowing the company to offer customized solutions through increased autonomy. Product innovation and differentiation have become key focuses of the business – leading to growth over the past year – whilst expanding the printing business to boost profits.*

4) PC Market Dynamics

The last three years saw a contraction in PC sales, however this trend saw a moderate reversal last year and consensus forecasts indicate there will be an additional uptick in PC demand this year. ** Given these market dynamics HP has managed to deliver growth and enhanced profits over the past four quarters. *

They have delivered consistent quarterly PC shipment growth over the past year and experienced a year on year 6.5% increase in PC shipments in Q1 2017 from Q1 2016 and furthermore improved market share to 19.5% from 17.9% over the same timeframe. * The spin-off from Hewlett Packard has led to increased focus on product innovation and enhanced pricing structures specifically in this segment.

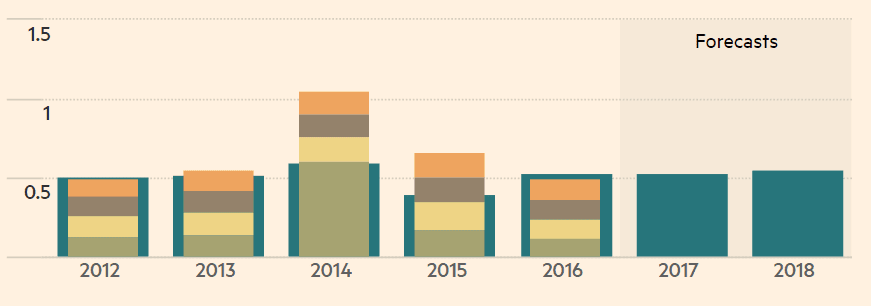

5) Dividend Outlook

For 2016, HP Inc delivered an annual dividend of 0.50 USD per share, improving over 26% year on year. * The forecasted dividend per share for the 2017 fiscal year is 0.53USD – representing expected dividend growth of 7.46% year on year.**

Given the new company structure the company has the fundamental and strategic advantages to maintain significant market share but they will need to remain agile to evolving market conditions.

The company will need to focus more specifically on cyber security, which has been thrown into the spotlight after the “WannaCry” hack – this area presents a lucrative growth opportunity for HP Inc going forward.

* Past performance is not a reliable indicator of future performance.

** Forecasts are not reliable indicator of future performance.