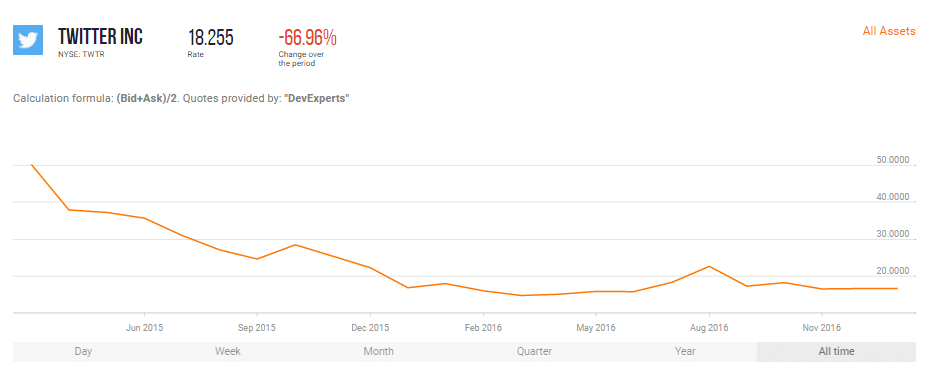

Although showing modest gains since the start of this year Twitter (NYSE:TWTR) continues to struggle with delivering growth.* The share price has been on a staggering, albeit volatile, downward trajectory since its IPO in 2013 and there is a number of both market and company indications that Twitter will stay bearish for the medium to long term.** Let’s take a look at five key reasons:

1) Disappointing Financials

The earnings reported from Twitter have been disappointing over the past two years. *2016 earnings failed to indicate strength of leadership or growth with revenues stalling.*

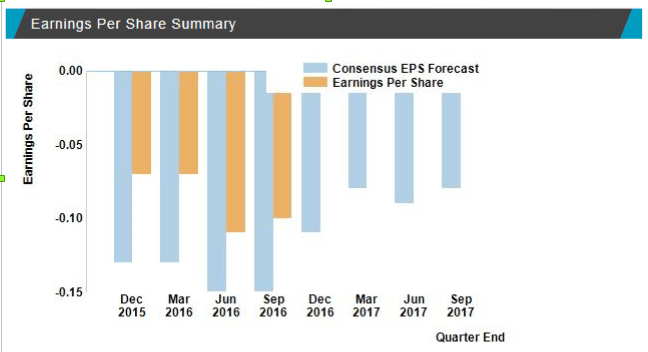

In the most recent reports (Q3 2016) Twitter reported a GAAP quarterly net loss of 103USD million.* In addition, worldwide GAAP revenue was up only 8%, compared with 58% and 114% for Q3 2015 and Q3 2014 respectively.* Even more of a bearish sign is the trajectory of earnings per share (EPS) for the company – which have consistently underperformed forecasts over the past few years.*

2) Lack of Strong Leadership

Twitter has suffered from entrenched internal turbulence for years. At Q3 2016 Twitter announced yet another restructuring and a 9% global reduction in headcount. There have been numerous changes in vital leadership roles and the high turnover in C-Suite executives is a sign of weak culture and operational framework.

With aggressive, hands on legacy leaders such as Mark Zuckerberg in their sector, Twitter needs a dramatic change in management in order to deliver sustainable growth. Until that time the outlook is bearish.

3) Tough Competition

The biggest challenge for Twitter is to remain relevant to users – fighting out the competition is vital. Competing for user engagement against social media power players like Facebook and LinkedIn has been an uphill struggle. With 317 million users Twitter trails behind the likes of Facebook (1.8 billion users).

Twitter hasn’t achieved the momentum to keep pace with its competitors and actually reported shrinking numbers in Q4 2015.* For Q3 2016 worldwide monthly average users (MAUs) were up 3% YoY.* However, is that really enough to drive growth at the company? – especially when we compare this against the 8% and 23% YoY growth in MAUs reported for Q3 2015 and Q3 2014 respectively.*

4) Struggling to Monetize

Another huge challenge for Twitter is closing the glaring gap between user engagement and revenue generation. The current CEO Jack Dorsey wants to capture higher ad revenues through boosting “live” video content – proven to generate higher revenues than text content.

However, Facebook and Snapchat (with more resources at hand) have also been aggressively pursuing this segment. Twitter will allocate over 9USD billion to video budgets in the U.S alone, however, if they do not successfully capture users in this segment the continued investment expenses will lead only to a deteriorating bottom line.**

5) Poor Value

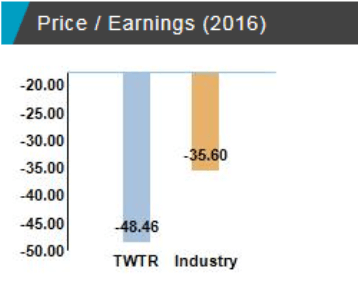

The price to earnings ratio for Twitter shares (trailing P/E of -21.16USD, forward P/E of 30.43USD) indicates worryingly poor value for investors as we can see from the comparison of P/E ratio performance against its industry peers in the figure below.*

Meanwhile Facebook shares offer investors a far superior forward P/E ratio of 19.71USD alongside numerous other strong growth indicators.*

Unfortunately for Twitter its main competitors are able to capitalize upon stronger user bases, financial foundations and market sentiment.

* Past performance is not a reliable indicator of future performance.

** Forecasts are not reliable indicator of future performance.