Staying strong for a century is a sizeable challenge – for example the only remaining stock in the Dow Jones Industrial Average from 100 years ago is General Electric. The changes in society over this time have been so significant that all the other index constituents have been rotated out of the index. Let’s look at 3 stocks which could last 100 years and still show signs of growth.

Please note that for now these assets are only available as binary options assets but we are working on CFDs on stocks and plan to introduce these by 2018.

Alphabet – Google (NASDAQ:GOOG)

Data is one of the most valuable commodities in the marketplace and this is forecast to continue for the foreseeable future – and to a growing degree year on year. Alphabet is the parent company to Google and both operate at the forefront of the data science and management industry. They are driving initiatives, products, operations and more in the artificial intelligence space – far outstripping its main competitors at this time. They can boast over 1 billion active users on their range of additional products – Play Store, Maps, Gmail, YouTube, Android, and Chrome and Google is the biggest search engine across the globe, with the exception of China.

What really makes Google a strong stock out there- term buy is the combination of the massive stable advertising based revenue stream combined with the pursuit of innovative new ventures – such as the self-driving car, Waymo. Although some of these endeavours will fail, a number will succeed in great measure – driving growth for shareholders.

McDonalds (MCD: NYQ)

This is not the first time McDonald’s has outperformed the market. The stock has decades of track record to demonstrate performance – showing an improvement and signalling opportunities over the long term. The success of the company has hinged on an ability to adapt to changes in society – for example, to meet changing demand for a more health conscious consumer base they adapted the menu and managed to protect market share. They have shown focus to evolve – making it a long-term hold. McDonalds has been outperforming the market for years based on solid fundamentals and a strategic vision to deliver year on year growth.

In addition, McDonalds has outperformed its direct competitors consistently over the years – as an example, global comparable stores annual sales growth was 6.6% in the last financial reporting, compared to KFC, with like for like sales growth of 3% and Pizza Hut with a 1% fall. The fast food restaurant giant has an approach that continually keeps services and products current, relevant and in demand. From partnerships with Disney and other media companies to menu adaptations across the globe to meet local tastes – the fast food giant maintains market share by meeting customer needs head on.

Amazon (NASDAQ:AMZN)

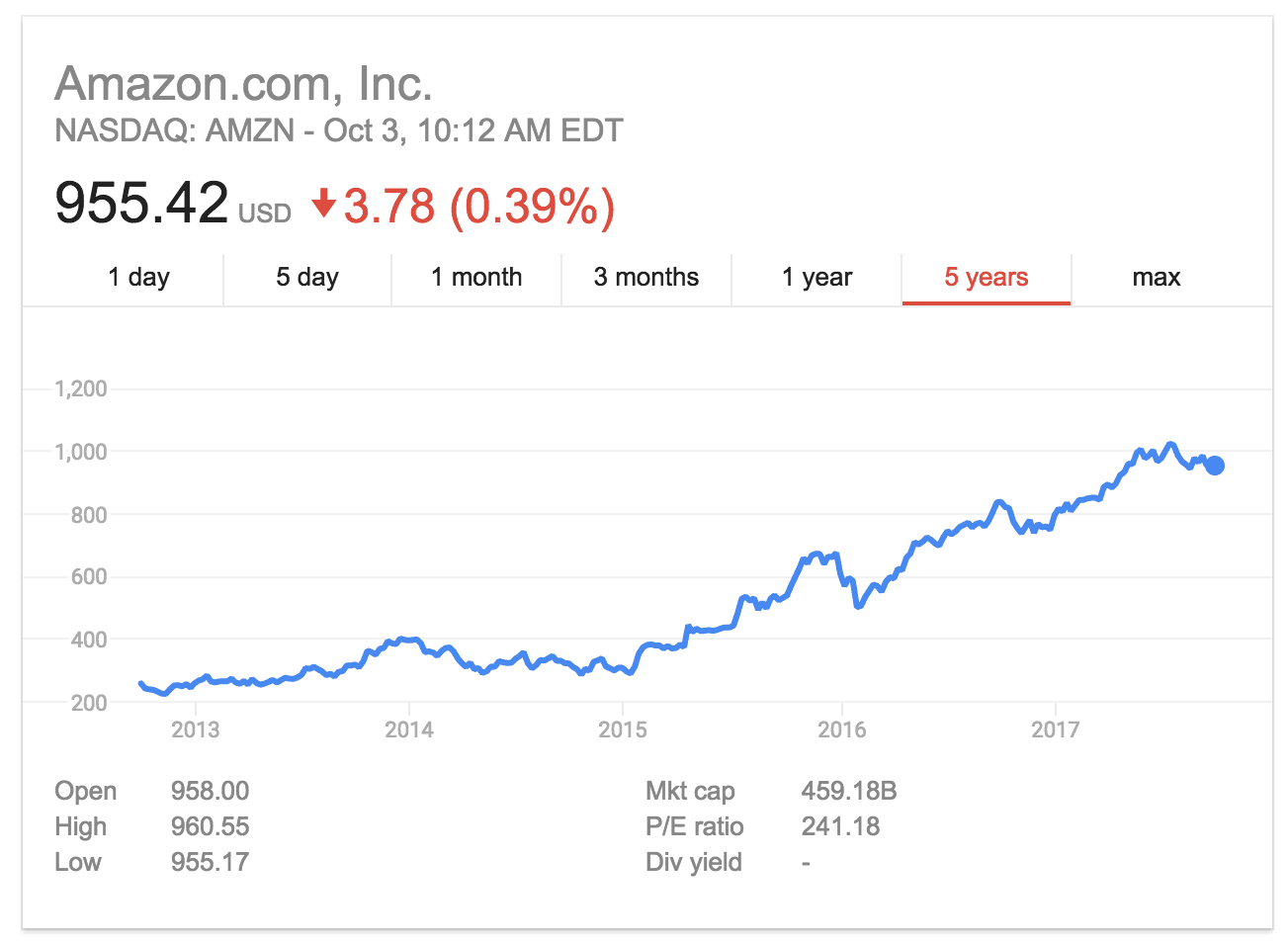

Amazon shares show multi-faceted signs of delivering decade on decade growth over the years to come. The e-commerce giant’s value has soared over the past twenty years – with the share price growing over 270% over the last five years alone. The company has grown consistently backed by solid fundamentals and an aggressive growth strategy and is still able to deliver revenue growth.

The company continues to deliver an expanded product range and wider geographic reach. The company has been at the cutting edge in cloud based services, with Amazon Web Services – driving revenues higher especially over the past two years. They are expanding further into groceries and automobiles. Crucially this continuing and successful drive to pursue new revenue streams is what makes the stock that strong.

Source: Google

Sources:

- http://corporate.mcdonalds.com/mcd/investors.html

- http://phx.corporate-ir.net/phoenix.zhtml%3Fc%3D97664%26p%3Dirol-irhome

- https://abc.xyz/investor/