The IQ Option trading platform has so much to offer, it is easy to oversee or forget about certain features that will elevate your trading level if used correctly. Today we are talking about Take Profit/Stop Loss, Market-on-Open and Trailing Stop Loss — three features that both novice and professional traders can put to good use.

1) Take Profit / Stop Loss

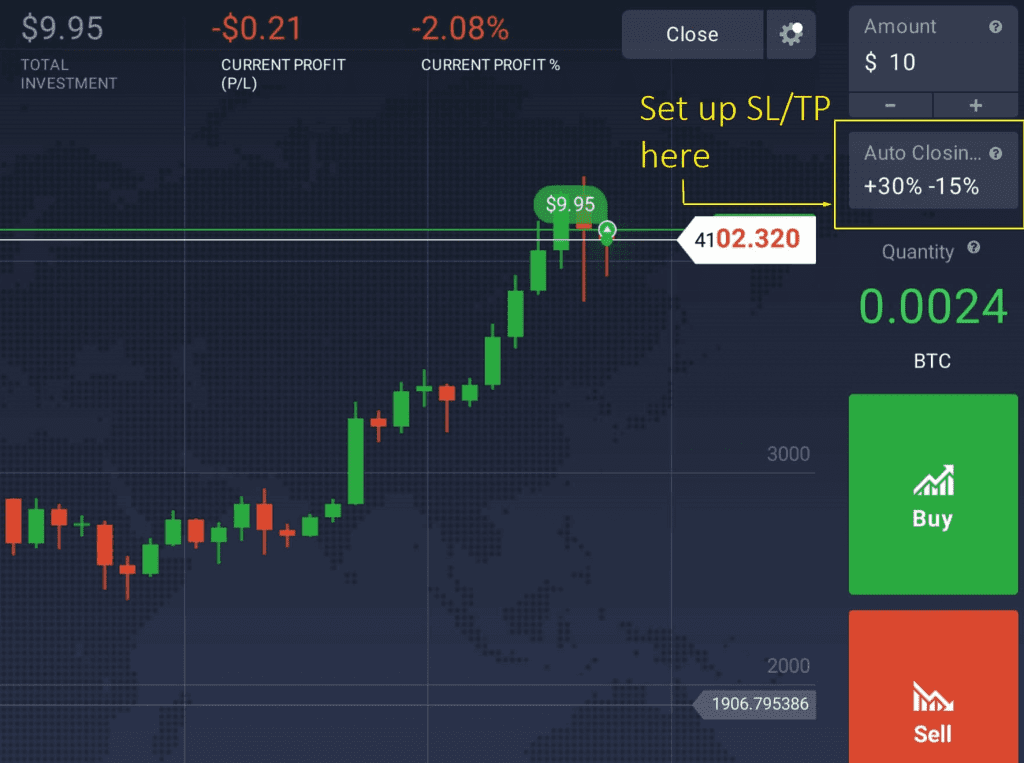

While the other two features are not essential, this one is vital for everyone trading on longer time intervals. Take profit / stop loss is an order that will automatically close the deal once the price of the underlying asset reaches a certain predetermined level. It can be used to both lock in profit and manage losses. In other words, the feature can be used to exit the market in good time and with no intervention from your side.

When using take profit/stop loss you want to balance the values so that you collect the maximum payout possible and don’t lose too much. In reality, it is hard to reach a perfect balance. But remember that practice makes perfect. Keep experimenting with the values in order to reach the right balance.

2) Market-on-Open

This feature will let you open buy and sell orders even when the market is closed. Of course, it can only be applied to assets that are not traded 24/7, namely Forex and contracts for difference. Currency pairs (the underlying asset in the Forex market) are not traded on weekends. CFDs are not traded on weekends and during the night. The thing is even as all trading activities stop, the asset price can still change, sometimes significantly. This is the opportunity a lot of traders would like to utilize, hoping for a sudden increase or decrease in prices once the market opens.

This feature should be used differently for different assets, as it can be used only one time per week for a major currency pair and several times per week for an exotic currency pair/single company. As long as there are no major announcements made by the national central banks on weekends, only sudden political and macroeconomic events have the potential to affect the exchange rate of national currencies. For publicly traded companies the number of events that can influence the stock price is higher.

3) Trailing Stop Loss

Trailing stop loss is very close in its functionality and underlying mechanics to the regular stop loss / take profit feature. However, it works a little bit differently. This difference makes it a very special tool that can significantly boost your trading results if applied correctly.

When not using trailing stop loss, the negative threshold is calculated as a percentage of the opening price and can go as low as −95% (sometimes even lower). When the trend is in your favor, the deal will not be closed until the current price goes below the opening price. Trailing stop loss will automatically move your stop loss threshold up (in case of a BUY option) or down (in case of a SELL option). In other words, the deal will close when it has already generated a certain level of payout, but the trend is about to reverse.