Bollinger-Bänder sind ein Indikator der technischen Analyse, der sich durch die Vorhersage des zukünftigen Verhaltens eines Kurscharts auszeichnet.

Was sind Bollinger-Bänder?

Bollinger-Bänder bestehen aus einem gleitenden Durchschnitt und zwei zugehörigen Bändern. Die Bänder werden anhand der Standardabweichung vom gleitenden Durchschnitt berechnet. Kurz gesagt – je höher die Kursvolatilität, desto weiter sind die Bänder vom gleitenden Durchschnitt entfernt.

Oder mit anderen Worten – je größer die Standardabweichung, desto größer ist der Kursbereich des Basiswertes für den gegebenen Zeitraum. Zu ermitteln, wie weit ein Kurs von seinem Durchschnittswert abweichen kann, ist hilfreich für die Prognose der zukünftigen Kursbewegungen.

Wie funktioniert das?

Wie oben bereits beschrieben besteht der Indikator aus drei Linien: dem exponentiellen gleitendem Durchschnitt (EMA) und den zwei Kursbereichen über und unter ihm. Die Kursbereiche erweitern sich bei hoher Volatilität und ziehen sich bei einem ruhigen Markt zusammen.

Für Anleger ist die Volatilität genauso wichtig wie Richtung und Ausgeprägtheit des Trends. Schwankende Märkte bieten zusätzliche Handelsmöglichkeiten.

Wenn Sie die Bollinger-Bänder beim Handeln einsetzen möchten, ist es wichtig zu verstehen, dass sie auf einer einfachen Idee beruhen: wenn das Kursniveau zu sehr steigt/fällt, ist zu erwarten, dass es zurückschwingt. Auf Zeiträume mit geringer Volatilität folgen gewöhnlich ernsthafte Marktbewegungen – auch das kann mithilfe der Bollinger-Bänder vorhergesagt werden. All das können Händler nutzen, um den optimalen Zeitpunkt für den Einstieg zu bestimmen.

Wie erfolgt die Einrichtung?

Bollinger-Bänder können bei IQ Option sehr einfach eingerichtet werden.

1. Klicken Sie auf die Schaltfläche „Indikatoren“ in der unteren linken Ecke des Bildschirms und wählen Sie „Bollinger-Bänder“ aus der Liste der verfügbaren Indikatoren aus.

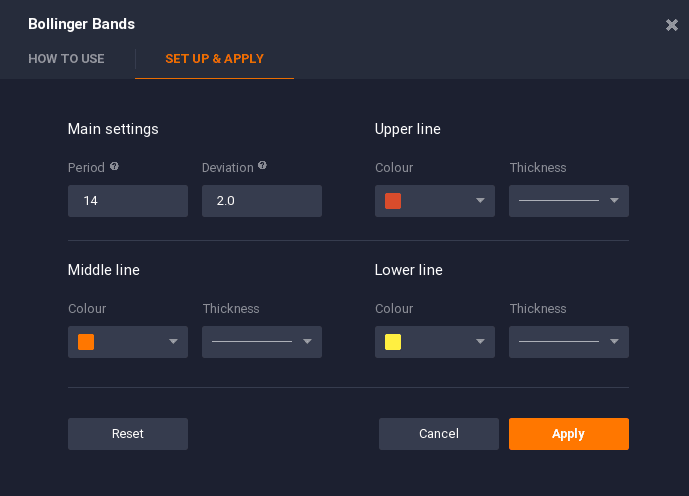

2. Klicken Sie dann „Anwenden“, wenn Sie mit den empfohlenen Einstellungen arbeiten wollen. Sonst wechseln Sie zum Tab „Einrichten & Anwenden“ und passen dort den Zeitraum und die Standardabweichung an.

3. Jetzt kann der Indikator verwendet werden!

Wie wird er im Handel verwendet?

Um die Bollinger-Bänder im Tagesgeschäft effektiv zu nutzen, ist es wichtig, die Haupteigenschaften der Kursvolatilität und deren Anwendung auf den Handel zu verstehen.

Als Faustregel gilt, dass Zeiträume geringer Volatilität sich mit Perioden hoher Volatilität abwechseln. Bei einem Abwärtstrend schwankt der Kurs gewöhnlich zwischen dem unteren Band und der Durchschnittslinie. Bei einem Aufwärtstrend dagegen liegt der Kurs in dem Bereich zwischen dem oberen Band und der mittleren Linie.

Je länger der Markt ruhig ist, desto höher sind die Chancen für eine bevorstehende Vergrößerung der Volatilität. Bollinger-Bänder sind gut geeignet dafür, diese Momente zu lokalisieren. Mit diesem Indikator ist der Händler in der Lage, zukünftige Veränderungen der Volatilität vorherzusagen und überkaufte/überverkaufte Positionen zu bestimmen, wodurch er Geschäfte zum günstigsten Zeitpunkt eröffnen kann. Jedoch ist es wichtig, daran zu denken, dass kein Indikator zu 100 % genau arbeitet. Alle Indikatoren können falsche Signale vermitteln.

Wenn ein Vermögenswert den „normalen“ Kursbereich verlässt, stoppt die Mehrzahl der risikoscheuen Händler das Eröffnen neuer Geschäfte und wartet darauf, dass sich der Markt stabilisiert.

Spezielle Eigenschaften

Squeeze (Verengung)

Eine Situation, in der sich die Kursbänder einander annähern, wird Squeeze genannt. Solche Zeiträume weisen auf aktuell niedrige Volatilität und das Potential für hohe Volatilität in der nahen Zukunft hin. Der Indikator kann allerdings dem Händler keine Informationen darüber geben, zu welchem Zeitpunkt genau die Volatilität ansteigen wird. Die meisten Händler sind während eines Squeezes nicht aktiv.

Ausbrüche

Etwa 90 % der Kursaktionen finden innerhalb der Bänder statt. Die Ereignisse, die in den verbleibenden 10 % der Zeit passieren, heißen Ausbrüche. Ein Ausbruch ist ein Ereignis, bei dem der Kurs den „normalen“ Kursbereich verlässt. Das sollte nicht als Handelssignal interpretiert werden, da ein Ausbruch keine Hinweise über die zukünftige Entwicklung und Stärke des Trends gibt.

Kombiniere und gewinne

Bollinger-Bänder können gut die aktuelle Volatilität verdeutlichen und mitunter anstehende Marktänderungen vorhersagen, aber sie sind kein universelles Handelswerkzeug. Gemäß Mr. Bollinger persönlich sollte dieser Indikator mit anderen Indikatoren kombiniert werden, um das Prognosepotential und die Effektivität zu verbessern.

Zusammenfassung

Bollinger-Bänder sind es wert, sich mit ihnen zu befassen und sie im realen Handelsgeschäft zu nutzen. Sie sind nicht nur nützlich, sondern können auch rechtzeitige Kauf- oder Verkaufssignale liefern, solange die Mehrheit der Händler noch im Unklaren über die zukünftige Entwicklung ist.