When the market is in a downturn, some traders decide to pause trading and just wait out the storm. But others might see bear markets as an opportunity to try new trading methods. One of the most popular is short selling stocks. In this article, we will dive into the world of short selling stocks to see how it works and why it may be preferred when the market is down.

What is Short Selling?

When it comes to trading, generally there are two ways to go: either open a long or a short position. With the former, traders expect prices to rise and hope to benefit from the movement. With short selling, it is the opposite. When traders go short, it means they have some reason to believe that the asset’s price might be declining.

Short Selling Stocks Explained in Simple Terms

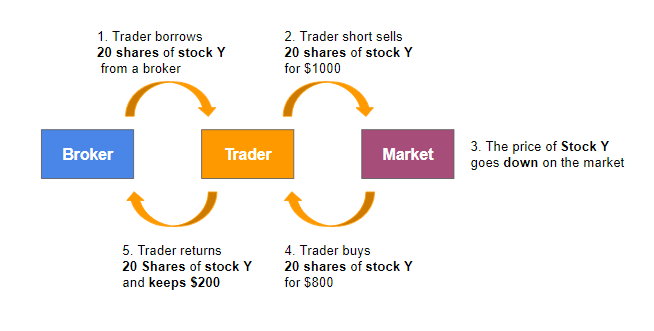

Generally, when someone opens a long position, they buy assets. However, short selling in trading involves going short on assets they actually do not own. So they borrow them from a broker. They expect the price to drop, so they may be able to return these assets and keep the difference. Short selling is available on various assets, stocks being one of the most popular options. To understand the concept of short selling on stocks, have a look at the example below.

However, with CFDs – Contract for Difference – there is no need to buy or sell assets themselves. Instead, traders focus on trying to predict the direction of price movement. In case of short selling, the answer is “down”. If your prediction is correct, you may receive a positive outcome.

If you are interested in learning more about this approach and how it works, check out this video tutorial with examples from the IQ Option traderoom.

Why Try Short Selling?

Investors and traders may have a number of reasons to turn to short selling. Here are the most common ones.

Try to Benefit From a Falling Market

Normally, traders attempt to buy assets at a lower price and then sell at a higher one. But with a bear market, when prices are dropping across the board, this is not possible.

Short selling offers an alternative: to first sell assets at a higher price and then buy them back when price declines. This way, there is no need to wait for the market to recover: it may be a chance to have a positive outcome while it is still down.

Besides, a volatile market causes bigger price fluctuations. This might provide more short-term trading opportunities than a stable market can offer. However, volatility may bring along additional risks. So make sure to consider them before making your move.

Here is an example of asset price fluctuations that may have been a part of short selling stocks approach. You may notice that the price of Airbus SE stock had significant swings over a course of one day. If a trader were to correctly predict this movement, he or she might have been able to short sell this stock and get a positive trading result.

Hedging

Short selling may also be used as a hedging tool to protect capital from short-term market volatility. To achieve that, traders might open a position in the opposite direction (short) to the one they already have (long). This way, if the price continues to decline, they may use the profit from the short position to manage losses from the long one.

Short Selling Stocks: Pros and Cons

Let us now outline the main advantages of short selling on stocks and the potential risks.

Pros

Smaller Investment

One of the most important benefits of short selling stocks is an opportunity to trade the price difference. There is no need to buy the asset itself, which often requires a smaller investment. For instance, if you decide to short sell stocks on IQ Option, you’ll be able to make deals starting from $1.

Leverage

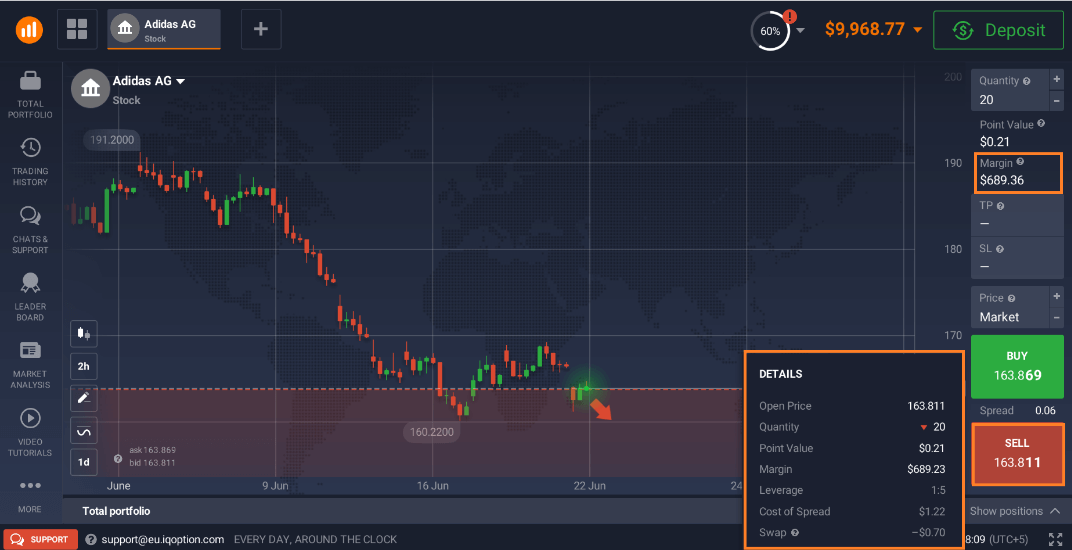

Trading CFDs often involves having a margin account, where traders may use leverage to open larger positions. The main concept of margin trading is the ability to trade with funds larger than the initial deposit. This may give traders a chance to get higher returns on their investments. However, it is important to keep in mind that using leverage may also lead to bigger losses. So you should weigh the risks before applying it for your deals. To learn more about margin trading, check out this article: Margin Trading: How Does It Work?

When trading with margin, it is important to carefully monitor the margin levels. If an asset’s price suddenly goes up, you might have to add more funds to your account, thus putting more of your capital at risk. This may be required to maintain the open position.

To keep track of your trades and never miss the right time to exit a deal, you may apply Stop-Loss and Take-Profit levels for your deals.

Availability

When the market is declining, short selling is on the rise. So there may be many traders out there looking to short a limited number of assets. Some might not be available to a regular trader. However, with short selling stocks with CFDs this problem does not exist: as you do not purchase any assets, it is very hard to run out of them.

Cons

Short selling is not risk-free: there are a few important things to consider before acting.

Potentially High Losses

When someone buys an asset (open a long position), the lowest value it could get to is 0. For instance, if someone bought some stock for $100, the biggest loss that may occur is $100. It would not be possible for the stock price to drop lower. However, with short selling in trading, the losses might potentially continue. There is no limit on how high the price may go: it can keep rising for a long period of time.

Some brokers provide risk management tools that traders may use to manage losses. As an example, on IQ Option, if a losing CFD position reaches -50%, it will automatically close.

Short selling stocks may offer interesting opportunities but also high risks, especially when using leverage. It may significantly increase the profits, but it also makes the trades riskier and might lead to bigger losses. So make sure to assess the margin and leverage rates before pushing the “Sell” button in the traderoom.

Bottom Line

Short selling may provide a chance to trade on a falling market. When short selling stocks with CFDs, this approach may offer interesting trading opportunities and potentially higher returns. However, it carries several risks too, so every trader should consider them to make an informed decision. Risk management tools, such as Stop-Loss and Take-Profit, might be useful to manage potential losses.