One of the most important risk management tools that most traders utilize on a daily basis is the take-profit/ stop-loss feature. A thorough understanding of these instruments is fundamental to any Forex trader. Take-profit and stop-loss are not unique to Forex, though, — on the IQ Option platform it is possible to set these levels for all CFD assets like Stocks, Forex, Cryptocurrencies and Commodities.

Today we will look at how to set stop-loss and take-profit correctly. Together, we will uncover the meaning of stop-loss and take-profit and see how they can be applied in practice.

What is take-profit and stop-loss?

The stop loss is the level at which a trader wishes for the position to close automatically. Take profit works similarly — setting this level means signaling to the broker that you wish your position closed at that certain level, once it is reached.

☝️

Stop loss is the level of acceptable loss that a trader is willing to bear in case the deal goes against their prediction. If the set level of loss is triggered, the deal will close automatically, preventing the possible loss of the full amount of the investment.

Pros and cons

It might not be completely clear why a trader needs to set these levels, instead of trading without them. Indeed, there are pros and cons to these tools, so let’s take a closer look at them.

| Pros: | Cons: |

|

|

Generally, stop loss and take profit levels are widely recognized as useful risk management features. It is up for every trader to decide whether they want to utilize them in their trading routine or not.

How to set stop-loss and take-profit levels?

In order to set stop-loss and take-profit, one may follow the steps:

- Choose the desired instrument for trading (Forex, Crypto, etc.)

- Set the desired investment amount and multiplier and click on the “Auto Close” button

- Set the take profit (“When profit is…”) and the stop loss (“When loss is…) values

- Once the necessary levels are set, a trader may open a position by clicking on “Buy” or “Sell”

- The auto close levels will be displayed on the chart for your visual convenience.

The sequence of steps can be seen in the following video:

Take-profit and stop-loss calculator

How to decide where exactly to place the take profit and stop loss orders?

Generally, traders decide on the levels that they are comfortable working with. The stop loss will largely depend on the investment amount and the total capital the trader is working with. Traders may utilize support and resistance levels as reference points.

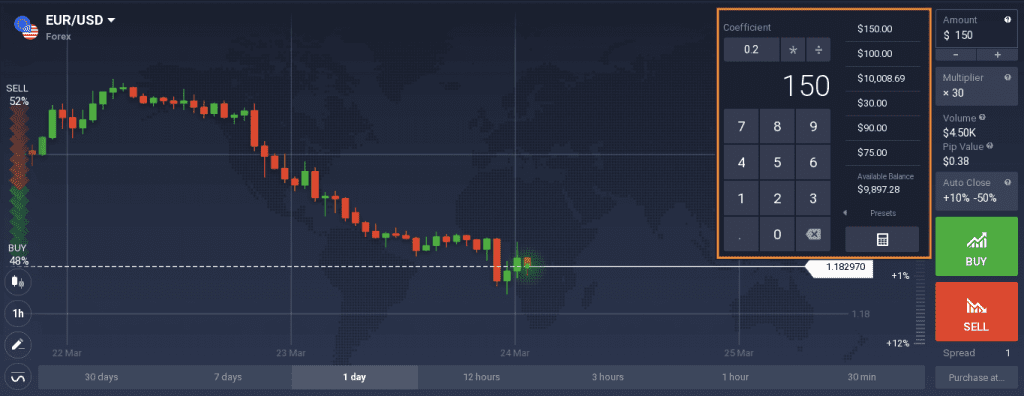

Another way to decide on the acceptable amount of loss is to use the calculator available in the traderoom. The calculator allows you to come up with an amount based on your investment, which might be convenient both for setting a stop loss and for certain trading approaches.

Additional features

Stop-loss vs trailing stop

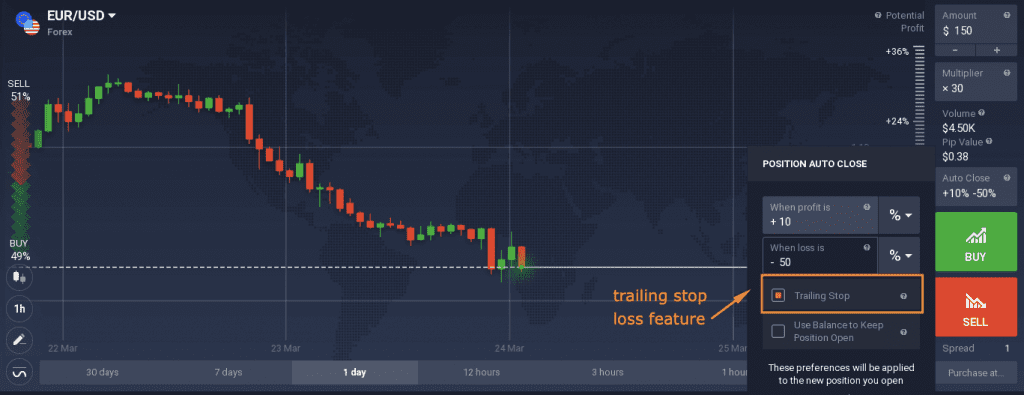

Experienced traders know that there is another interesting feature available to them on Forex and other CFD assets — trailing stop. What is the difference between a regular and trailing stop loss?

Once set, the stop loss order does not shift. Trailing stop will not shift either in case the asset is going against the trader’s prediction (not in favor of the trader). However, the big difference is that in case the price is moving in favor of the trader, trailing stop will follow the movement, shifting the same amount of pips from its initial position.

For example, for a long (“Buy”) position for every ten cents that the price rises, the trailing stop loss will also shift up ten cents. However, if the price falls ten cents, the stop loss will not move. This type of a stop loss is meant to preserve the trader from significant losses, while locking the possible positive outcomes.

Both trailing stop loss and regular stop loss have the potential to assist traders with money management. Based on their approach, traders can decide on the option that works best for them. Please keep in mind that this feature may not be available for margin accounts.

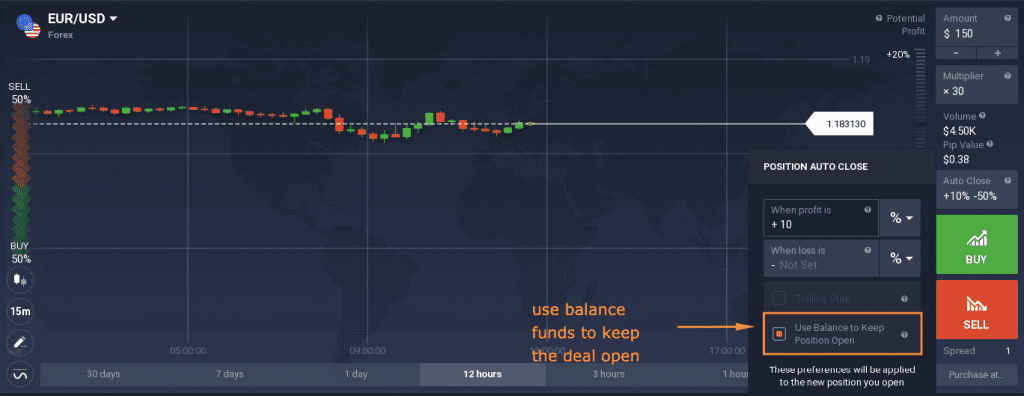

Use balance to keep position open

Another feature for risk management purposes is the “Use balance..” option. By enabling this feature, a trader allows the broker to deduct funds from the balance in order to keep the deal running in case it reaches the standard auto close level.

It is important to note that the funds get deducted only if the deal reaches the autoclose level. The balance is not used if the asset is moving in favor of the trader.

The funds deducted from the balance will be returned in case the price reverses its movement and goes in the trader’s favor. However, if the deal closes with a loss, the funds are not returned.

This option may be suitable for traders who wish to keep the deal running even if it is in a loss, but it is important to note that it might get quite risky and wipe out the balance completely. This feature requires supervision when used by novice traders.

The bottom line

When the take profit and stop loss features are explained, they are not hard to grasp. These levels might be useful for any trader who takes risk management seriously. The most important part of utilizing them is deciding on their placement since momentum plays a large role in trading.