Stop-loss and take-profit (SL and TP) management is one of the most important concepts of Forex. Deep understanding of the underlying principles and mechanics is essential to professional FX trading.

So what is SL and TP in forex trading? Stop-loss (SL) is an order that you send to your Forex broker to close the position automatically. Take-profit (TP) works in much the same way, letting you lock profit in forex trading when a certain price level is reached. SL and TP in forex trading is, therefore, used to exit the market. Preferably, in the right way and at the right moment. Several strategies exist, making the decision process harder but also providing the trader with additional opportunities.

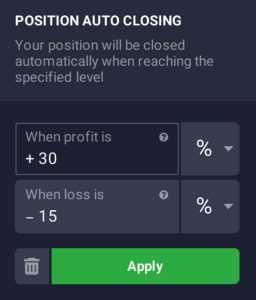

Opening IQ Option stop-loss orders

What is an SL in Forex trading, and why would anyone use it? By opening a stop-loss (SL) order, you determine the amount of money you are willing to risk in a case of each particular deal.

IQ Option trading platform calculates the said amount as a percentage of your initial investment.

Cutting off losses at the right moment is a skill all traders have to learn sooner or later should they want to reach a certain degree of success. Professional traders do believe it is wise to adjust SL to market conditions, not only the amount of money you are ready to sacrifice. Taking technical analysis into consideration can also be practical. And remember, the majority of traders agree: it is vital to know when to get out of trade even before opening a position.

There are three major ways to determine optimal SL in Forex points:

- Percentage Stop. Determine the SL position based on the amount of capital you are willing to risk at each particular moment. SL in this case will heavily depend on your total capital and the amount of money invested. Remember that experts advocate allocating not more than 2% of your trading capital to a single deal.

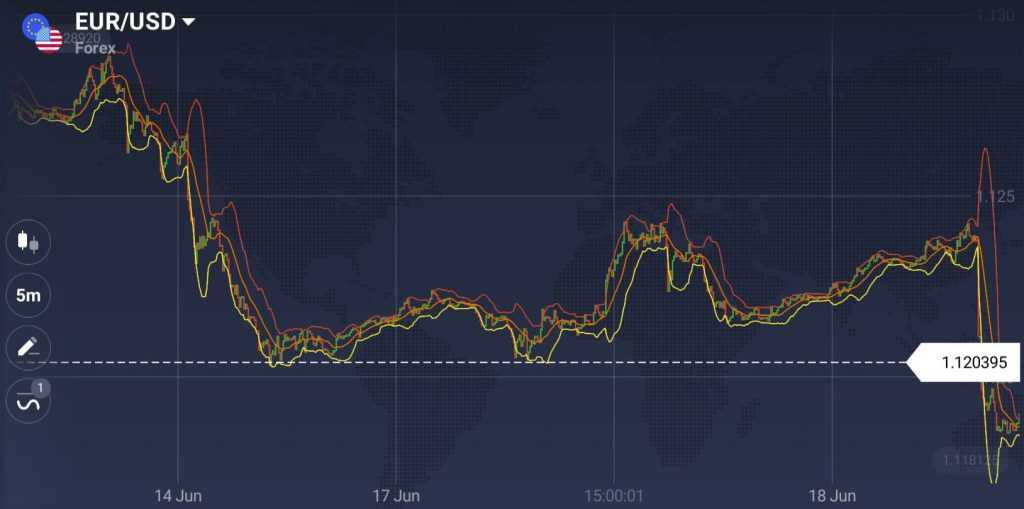

- Chart Stop. This method is more technical analysis-oriented than the others. It turns out, support and resistance levels can also help us determine optimal SL and TP points. Setting stop-loss beyond support/resistance levels is one way to do it. When the market trades beyond these areas, there is a good chance the trend will continue working against you. It is time to take what’s left of your investment.

- Volatility Stop. Volatility is something traders don’t want to miss. It can differ dramatically from asset to asset, thus making a tremendous impact on trading results. Knowing how much a currency pair or a stock can move will help greatly in determining optimal SL points. Volatile assets may require higher risk tolerance and therefore greater stop-loss levels.

It might be a good idea to shape your own SL and TP system, combining different approaches. It should be based on your trading strategy and market conditions.

By using SL and TP in trading you do not accept an obligation to wait until the predetermined price level is reached. Feel free to close a deal should the market demonstrate unfavorable price action. But at the same time do not let your emotions intervene. Have you ever noticed how devastating emotional trading can get? The same happens when you place a stop-loss order and don’t give your trading strategy enough time to validate itself.

SL is not simply the exit point, a good forex stop-loss is set to become an “invalidation point” of your current trading idea. In other words, it should prove the chosen strategy does not work. Otherwise it may be a good idea to wait.

Opening take-profit orders on IQ Option

What is take-profit in forex trading? SL and TP in forex work in pretty much the same way but their levels are determined differently. SL signals serve the purpose of minimizing the expenses of an unsuccessful trade, while TP orders provide traders with an opportunity to take the money at the peak of the deal.

How to take profit in forex trading? Taking profit at the right time is as important as setting optimal SL signals. Market always fluctuates and what seems like a positive trend can turn into a downturn in a matter of seconds. Some would say it is always better to take respectable payouts now than to wait and risk losing your potential payouts. Note that not letting your payout grow high enough and closing the deal prematurely is not good either, as it would eat up a portion of the potential payout. Waiting for too long can be equally detrimental.

The art of take-profit orders is to pick the right moment and close the deal right before the trend is about to reverse. Technical analysis tools may be of great help in determining the reversal points. You may choose between Bollinger Bands, Relative Strength Index or Average Directional Index. These indicators work best for the purposes of SL and TP management.

Certain traders might recommend using a 1:2 risk/reward ratio. In such a case, even if the number of losses is equal to the number of successful deals you would still be generating payout in the long run. Consider finding an optimal risk/reward ratio, that would suit your personal strategy and remember there are no universal rules that would work for each asset and every trader.

Things to remember about SL and TP in forex trading

Keep in mind that SL and TP in forex trading is just yet another tool in your rich portfolio. Trading skills are not limited to correct usage of indicators and stop-loss/take-profit orders. Don’t let any automated system trade for you. Rather rely on it in order to get better control of your deals and emotions. It may take some time to learn the basics of setting IQ Option stop-loss and take-profit orders. But when it is done, you are left with another must-have trading skill.