Commodities trading is where everyday goods like oil, gold, and agricultural products become investment opportunities. It’s a dynamic market where prices are influenced by global events, supply and demand, and economic factors. So let’s break down how to trade commodities and make sense of the dynamics that affect this market.

What Are Commodities?

Commodities are the raw materials that make the world tick. Think of oil fueling your car, wheat in your bread, and gold in your wedding ring. These can be traded just like stocks or currencies. Trading them is all about predicting price moves — get these right, and you’ve got a potential profit.

What Are CFDs on Commodities?

CFDs (Contracts for Difference) are like betting on the price of a commodity without having to actually buy barrels of oil or store piles of wheat in your basement. Instead, you’re trading the price movement. This allows you to invest with a smaller amount of capital since you don’t own the underlying asset.

For instance, when trading commodities on IQ Option, you can go long or short, meaning you can profit whether prices rise or fall. No need to deal with exchanges like CME, ICE, or NYMEX — you simply speculate on the price difference.

Main Types of Commodities

Metals

Gold, silver, copper, and platinum are the big hitters here. Gold is a traditional safe haven in turbulent times, loved by investors as a hedge against inflation. But these days, its importance is boosted by tech’s growing demand for rare earth elements critical for smartphones, electric vehicle motors, batteries, etc.

If you want to know more, read the article on gold and silver trading.

Energy

Crude oil, natural gas, and gasoline are staples of energy commodities. With global oil reserves shrinking and the rise of renewables, energy markets are always in flux. Whether OPEC is making moves or solar tech is gaining ground, energy commodities are deeply linked to broader economic shifts.

To better understand how oil trading works, head to our article on Crude Oil Brent and Crude Oil WTI trading.

Agricultural Products

Corn, soybeans, wheat, and coffee make up the backbone of agricultural commodities. With global populations climbing and land for farming limited, these staples will likely see price gains as demand outpaces supply.

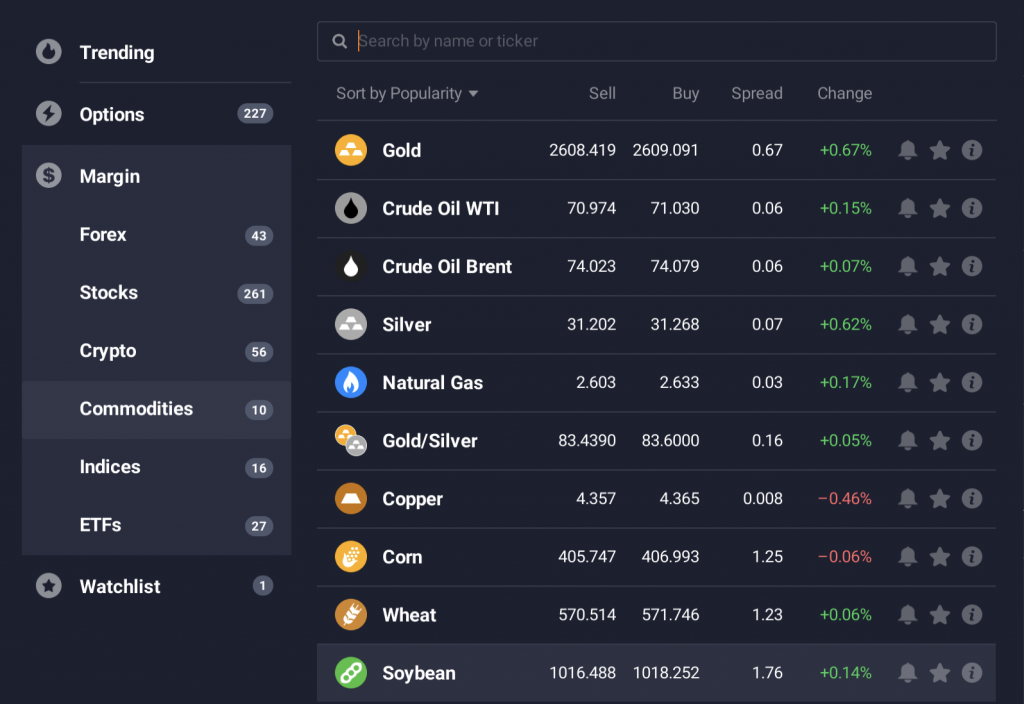

What Commodities Can You Trade on IQ Option?

On IQ Option, you’ll find a broad selection of commodities to trade, from oil to metals.

You can also trade gold options and even the gold/silver pair over the weekend via OTC trading. This is a great opportunity to take advantage of the market after hours trading opportunities. You can learn more about OTC trading in this material: A Guide for Weekend and Off-Hours Traders.

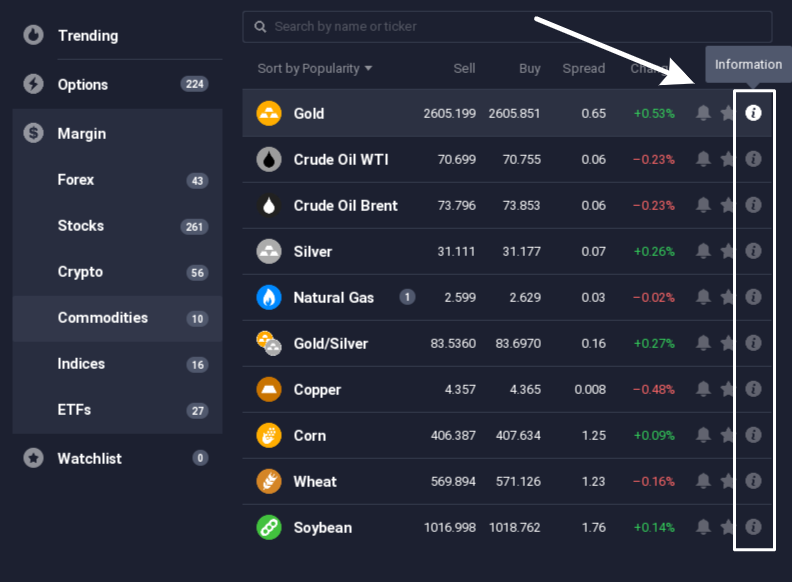

Wondering what time do commodities start trading on the IQ Option platform? Check the trading hours by clicking on the ‘Info’ tab to view specific trading conditions.

Here’s where you can check detailed information about specific assets and get additional insights to improve your strategy.

What Drives Commodity Prices?

To learn how to trade commodities successfully, you need to understand the factors that move prices.

| Costs Transport, storage, insurance — these logistics affect commodity pricing. | Currency fluctuations Most commodities are priced in U.S. dollars. When the dollar weakens, commodities become cheaper for other currencies, driving up demand. | Geopolitical instability Wars, unrest, sanctions — anything that disrupts the supply of a commodity will send prices soaring. |

| Global economic trends Booming economies boost demand for raw materials, while a recession does the opposite.. | Government policies Tariffs, subsidies, and environmental regulations can shape supply and demand, altering prices. | Inflation and interest rates Commodities are a common hedge against inflation. Higher inflation often means higher commodity prices. |

| Speculation Traders betting on future prices can shift current prices, even before real supply and demand catch up. | Tech advances New technologies can make it cheaper to extract and transport commodities, but they can also create new demand — just look at lithium for electric car batteries. | Weather events Droughts, hurricanes, floods — weather wreaks havoc, especially on agricultural and energy commodities |

Tools for Commodity Trading on IQ Option

To understand how to trade commodities successfully, you can start by learning market analysis. There are two main types of analysis: technical and fundamental. They use different tools, such as applying indicators and following market news. Let’s have a look at how you can use them in commodity trading on IQ Option.

1. Technical Indicators

IQ Option offers over 100 technical indicators to help you analyze commodity price charts. Some popular ones include Moving Averages, RSI, and MACD.

A standout is the Commodity Channel Index (CCI), which helps gauge the strength of a trend. Using CCI is very easy:

- Bullish trend: If the CCI line moves from 0 to closer to 100, it’s an uptrend.

- Bearish trend: If the CCI line drops from 0 to closer to -100, it’s a downtrend.

Action: Wait for 3-4 candles in the trend direction after a breakout to confirm the trend before trading.

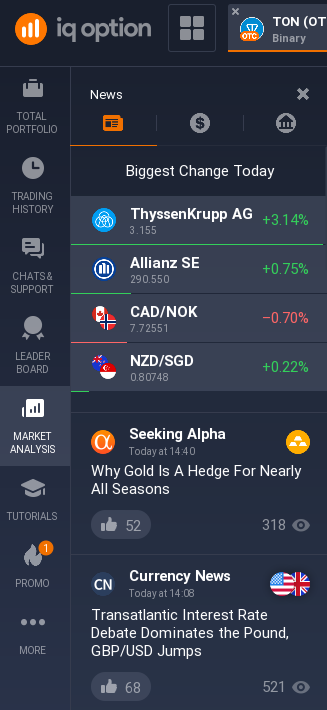

2. Newsfeed

Stay updated with global economic events using the IQ Option on-platform newsfeed. Look for the key reports like the U.S. Non-Farm Payrolls, CPI, and EIA reports on oil inventories — they can heavily influence commodity prices.

You can find the latest news in the ‘Market Analysis’ section of the IQ Option traderoom in the left menu.

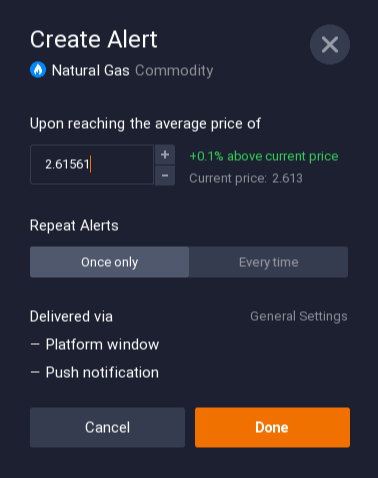

3. Price alerts

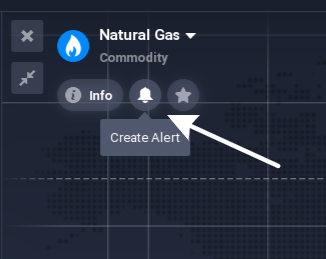

Set price alerts on IQ Option so you don’t need to monitor charts all day. You’ll get a notification when the price reaches your target level.

Then type in the price you’d like to be notified about. You’ll receive an alert via the platform or a push if the price reaches this new level.

Best Commodities for Trading

Choosing the right commodity depends on market conditions and your strategy. Gold and oil are favourites for their liquidity and volatility, while agricultural products like corn and soybeans can offer solid returns during certain seasons. Metals like silver and copper have become increasingly attractive with the rise of tech demand.

Conclusion

So, how to trade commodities on IQ Option? It’s all about understanding the forces behind commodity price shifts and using the right tools to make informed decisions. Whether you’re speculating on oil prices, watching the rise of tech metals, or betting on the future of agricultural demand, IQ Option gives you the platform and the tools to dive into the best commodities for trading.