As you may or may not know gold is the world’s most traded precious metal. Gold (XAU) refers to the gold spot market price. Nowadays, gold is used vastly in the jewelry market and for investment purposes, it is regarded as a safe haven commodity. Gold was mostly extracted during post-war era and is sought after all over the world, typically bought for a premium over spot and sold at a discount to spot in physical exchanges.

The reason that gold is considered a safe haven, can be attributable to its intrinsic value. Meaning that it remains relatively stable during times of uncertainty and high volatility in the market and rarely experiences unpredictability.

For now, let us focus on the Australian dollar and how this currencies strength and value is dictated by the performance of its imports and exports.

Taking into consideration that the gold from Australia is essentially the ‘gold standard’ as it accounts for roughly 80% of gold in the market. If the price of gold increases, and Australia are world’s leading exporter of this commodity, the price of the Australian dollar is expected to increase also.

One might assume, if you hear about this commodity in the news, you are likely to hear about positive correlation to the Australian Dollar. But why?

There are many ways gold is correlated with numerous currency pairs, such as USD, AUD and CHF.

First allow me to explain correlation. When analyzing two variables, you will be given either one of two outcomes. Positive or Negative Correlation.

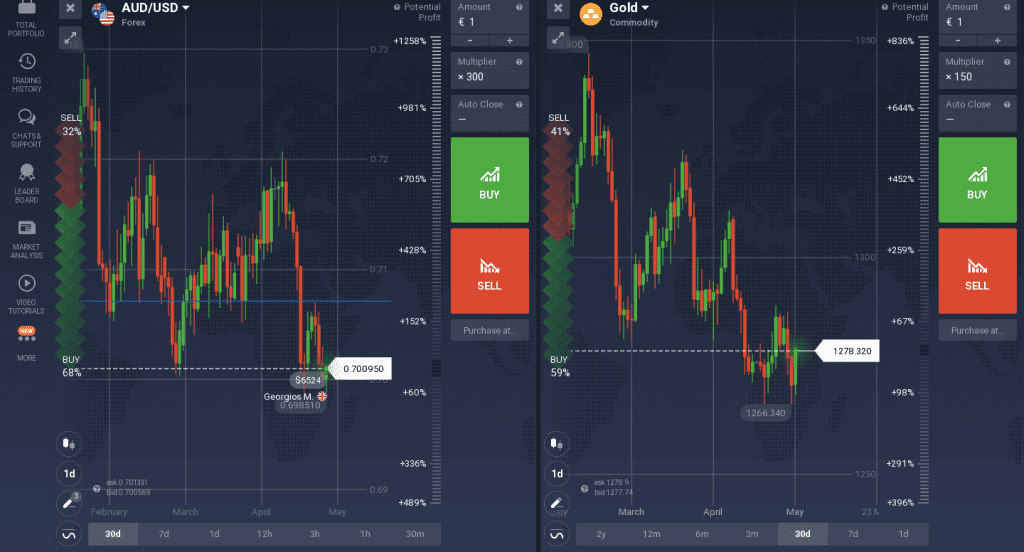

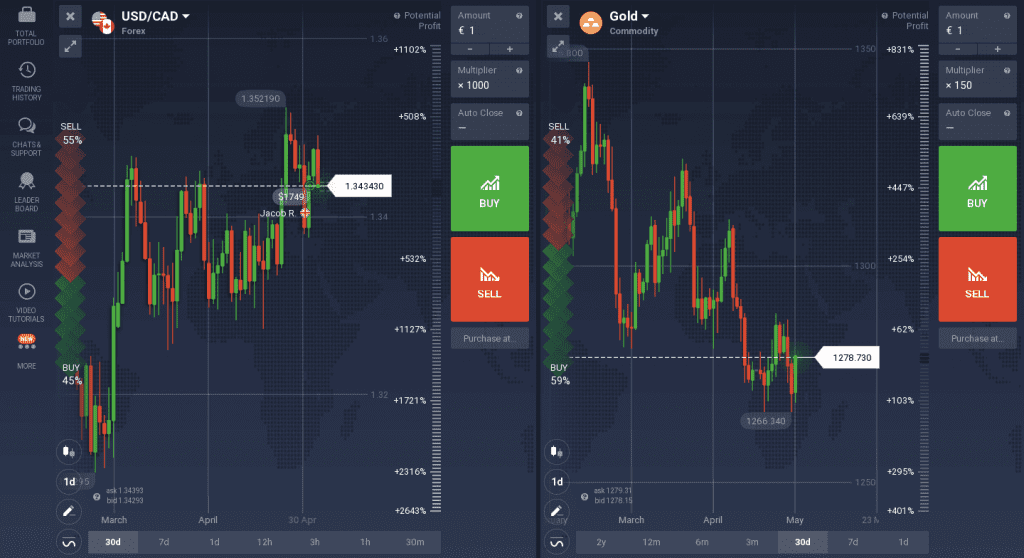

Positive correlation simply put, is when two variables have a parallel relationship moving in the same direction. In this case, as AUD increases in price, so will the price of gold.

However, with Negative correlation, this is when two variable have opposing reactions and do not follow each others pattern. They in fact deviate from one another, for example, gold and USD are considered to have a Negative correlation as they move in opposite directions.

If you would like to discuss any of the topics mentioned in this article, please do not hesitate to leave a message, or perhaps contact support to set up a training session or to request more information.

Information regarding past performance is not a reliable indicator of future performance.